The Changing Face of Payments: Online & Mobile Payments

Personal_Finance / Mobile Technology Aug 03, 2018 - 04:32 PM GMTBy: Steve_Marks

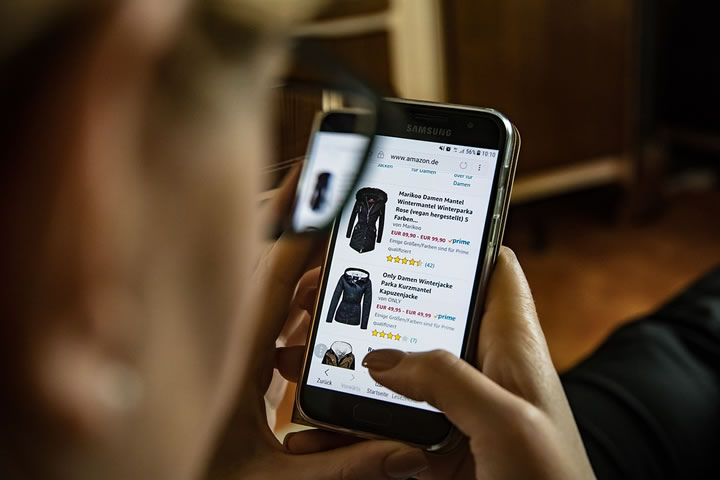

Back in the day, it used to be the case that cash was the only mainstream way to pay for pretty much every transaction. When cheques and bank cards became popular, they were considered to be cutting-edge payment forms that were about to change the world. Now, both of these payment methods are becoming increasingly obsolete. This is evident in the UK as more people use online payment and baking methods. One popular example of this is e-tailer payment methods. Popular examples of these include Amazon’s Amazon Pay and Apple’s Apple Pay. Originally envisioned as an extension of both Apple and Amazon, both payment methods can now be used elsewhere. Meaning that traditional payment methods like debit and credit cards are being used less and less. Another reason for this is the growth of online shopping. In the UK it is estimated that over 70% of households use online shopping. This follows the trend of increased internet usage.

Online payments are now ruling the roost – and from speed to convenience, there are plenty of reasons why this has occurred. Here are just some of the ways that online payments have grown and developed.

Easier and faster

The major benefit for most users of online payment systems, of course, is the speed and convenience that it offers. Many major systems, such as PayPal, are now integrated into online storefronts across the internet, so all it takes to pay is just one click or tap. Balances can be viewed on smartphones and laptops in seconds, while there’s no need to call the bank if you want to arrange a cash transfer to a friend or family member. For businesses, these time-saving methods save vital staff resources – which means that the staff member who may previously have had to visit the bank every day can now do something more productive.

Versatile

One of the major additional benefits of online payment systems, meanwhile, is how versatile they are in an age of unrivalled online choice. The internet is full of products and services, many of which aren’t available at in-person stores – so by shifting your personal finance focus to online rather than physical money, you’ll automatically be making it easier for yourself to pay for everything that the internet offers. Whether you make a deposit in your online casino wallet using Interac payments or simply settle an online shopping bill via PayPal, your trusty online payment system will deliver a versatility that cash simply can’t match.

Secure

When it comes to the internet, there have always been concerns over the security of financial transactions. With many people worried about the ways that data shared over the web can be hacked or otherwise maliciously accessed, online payment systems have to be robust in order to prevent problems. Thanks to developments such as two-factor authentication and end-to-end encryption, however, it’s now harder than ever for malicious eyes to find your payment data. In fact, in many ways, it’s safer to place your cash in a secure and reputable online payment processor than it is to have it in your wallet!

It’s no exaggeration to say that online payment systems truly have changed the world. From the way that they can provide speedy settlements, to the versatility that they offer in the age of online choice, there is all sort of benefits to these innovations. While there are still some important considerations – such as security – to take into account, it’s clear that online payment systems are robust enough now to take over as the primary way to pay for a whole host of transactions.

By Steve Marks

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.