Are You Ready For Inflation?

Economics / Inflation Aug 02, 2018 - 05:22 PM GMTBy: Graham_Summers

The market is sensing a major turn.

The market is sensing a major turn.

As I’ve noted before, the currency markets are the largest, most liquid markets on the planet. As such they sense changes first.

With that in mind, consider that the “inflation” currencies are showing a major turn in the $USD.

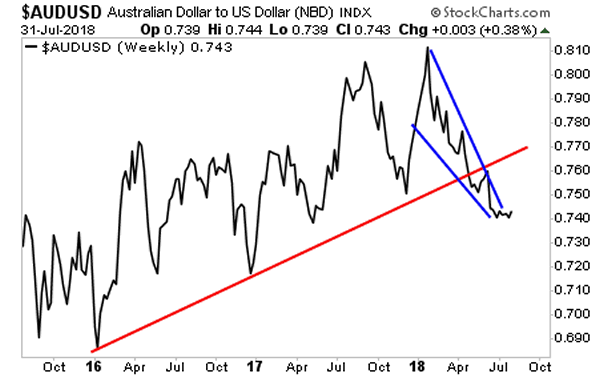

First and foremost, the Australian Dollar: $USD pair looks to have bottomed. We have a clear bullish falling wedge formation being broken to the upside. We should expect a retest of former support (red line) at the very least.

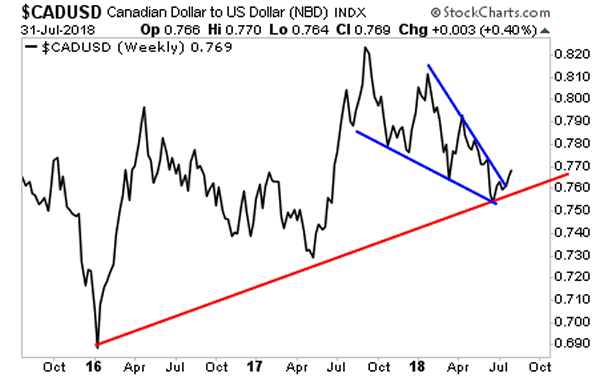

Next up is the Canada Dollar: $USD pair (another inflationary currency pair). Here again we have a bullish falling wedge pattern breaking out to the upside. Even better, we HELD support (red line) here.

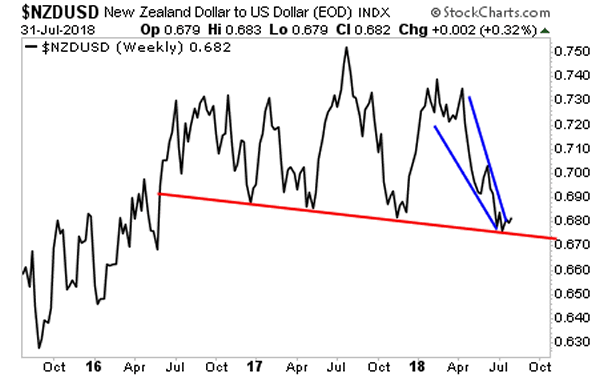

And finally, we have the New Zealand Dollar: $USD pair, where we have yet another bullish falling wedge pattern breaking out to the upside with support (red line) being held.

One of this alone is significant. But all three taken together STRONGLY indicate that the $USD is prepared to roll over.

Again, we’re talking about the MOST sensitive markets on the planet signaling in three different ways that an inflationary move/ weak $USD is about to hit.

This tells us, the Fed is about to “walk back” its tightening schedule. And those who are prepared for this, will see MAJOR gains.

This is THE BIG MONEY trend today. Already the financial system is showing signs of it. And smart investors will use it to generate literal fortunes.

We just published a Special Investment Report concerning a FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.