How High Will The Market Rally Before The Economic Collapse Begins?

Stock-Markets / Stock Markets 2018 Aug 02, 2018 - 10:33 AM GMTBy: Avi_Gilburt

Last week, I wrote an article about how I view the potential effects of an economic collapse on American society. Unfortunately, many of our readers took it as an opportunity to post their perspectives on Trump and the democrats.

Last week, I wrote an article about how I view the potential effects of an economic collapse on American society. Unfortunately, many of our readers took it as an opportunity to post their perspectives on Trump and the democrats.

Yes, I know the country is exceptionally divided. However, I brought this issue to light not because I see one party as being the savior for this country over the other. Rather, I brought this issue to light to show you that we are on a path of history repeating itself, as we have forgotten the lessons learned from the pain of the past.

We all have to recognize that the United States took a big step down that slippery slope of socialism with the passage of The New Deal. Since then, it does not matter which party has been in power, as we have extended those socialistic policies when the masses thought it was “needed.” Thus, each generation since The New Deal has seen expanding socialistic policies. While you can argue whether you approve or disapprove of this progression, to ignore that we are on this path is foolish.

Moreover, the reaction to the financial market shock experienced during the Great Recession has shown us that our government is willing to go further down the path of socialistic policies. So, I really do not have much doubt in my mind that this will be the go-to answer when we get into bigger trouble in the 2030’s no matter who is in power.

But, I digress. The main point of this update is a follow up on my last article to explain the potential that the market still has overhead before we top out in the coming years.

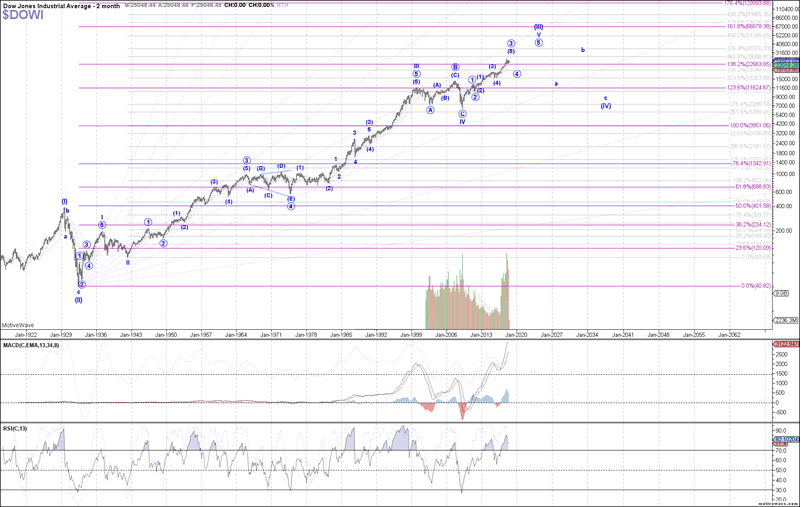

As you have seen from our very long-term perspective in this chart, which covers over 100 years of time, we still think there is upside left in this market in the coming years. However, before we are going to set up for that final run in the early 2020’s, I still think we will see a 20-30% correction begin in 2019.

But, once that 20-30% correction completes, our expectation is that the DOW can reach at least 35,000 on the rally into the mid-2020’s, with a potential blow off top taking us as high as the 66,000 region. In fact, the 66,000 region is the ideal target on the larger degree structure.

While that is quite a large range, much will depend on how that rally takes shape after we complete the expected 20-30% correction. So, it is a bit premature to be able to hone in on the exact target region upon which to focus. But, as noted, our minimal expectation at this time is the 35,000 region, whereas the ideal target has been 66,000.

So, as you can see, based upon our analysis which has kept us on the correct side of this market for many years, we still believe that this bull market has further to run. However, we are expecting a sizeable correction to begin in 2019 before that last leg of this bull market which began at the 2009 lows takes hold. And, after this last leg into the mid-2020’s completes, then we will likely begin a 10-20 year bear market which can take the DOW back towards the 10,000 region.

See expandable chart on the Dow.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

© 2018 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.