The Trillion Dollar Stock Question

Stock-Markets / Stock Markets 2018 Jul 29, 2018 - 09:19 AM GMTBy: Doug_Wakefield

How many people do you know who are billionaires? Unless you are a billionaire, probably not too many. How many people do you know who run companies worth a trillion dollars?

How many people do you know who are billionaires? Unless you are a billionaire, probably not too many. How many people do you know who run companies worth a trillion dollars?

Currently none, but that could change in August.

The last full week of July has presented us with three possible candidates for the trillion-dollar circle; the pinnacle of stock market mountain.

First up, Google, who leaped over $50 billion in market cap on July 23rd after releasing its earnings. That day its stock market value reached $875 billion for the first time. (1)

Next up is Amazon. After another blockbuster Prime Day on July 16th, the stock reached $1858. According to Reuters, the stock market value of the company broke through $900 billion, reaching $902b. Climbing to a current high of $1889 today after releasing its earnings yesterday, the company edged even closer to that $1 trillion mark. (2)

Last on our current list of top contenders for the $1 trillion mark is Apple. At $195, reached for the first time on July 26th, the stock market value of the company stands around $950 billion. (3)

Yet not every big tech celebrity has leaped on earnings. While one can jump $50 billion in a day, another can make history, getting caught in an avalanche of selling, losing over $100 billion in a day.

Facebook just had the worst day in stock market history, CNN, 7/26/18

Last week, Netflix dropped over $50/share the day after releasing its latest earnings on July 16th. (4)

Should traders who loaded up on the NYSE’s new FANG+ options, launched a little over a month ago on June 11th, be concerned because the index contains only 10 stocks, three of them being Netflix, Tesla, and Facebook? (5)

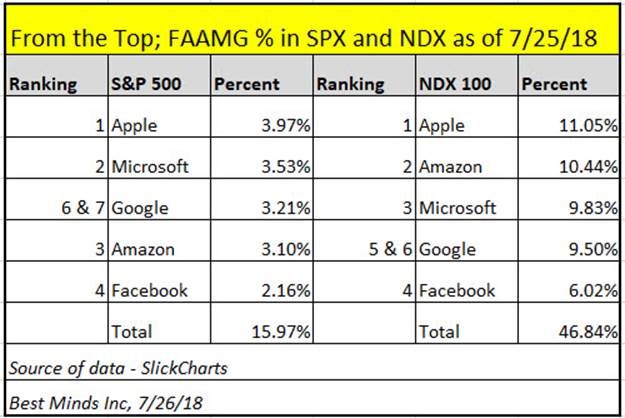

Are the millions of investors holding an active or index fund tracking the S&P 500 or NASDAQ 100 thinking how this type of “negative adjustment” might impact their own investment goals when the next bear sets in?

When we came over the top in 2000, Microsoft, Intel, and Cisco were dominate stocks in the NASDAQ 100. Between their 2000 highs and 2002 lows, they fell 65%, 80%, and 90% respectively.

When we came over the top in 2007, Apple, Google, and Microsoft were dominate names in the NASDAQ 100. Between their 2007 highs and 2008/2009 lows, they fell 61%, 67%, and 59% respectively.

Google, Amazon, and Apple investors could pop the cork in celebration if this first in history trillion-dollar milestone happens soon. However, these recent swift drops and the many warnings of severe weather ahead warn us that reaching a summit is not a time to sit back and relax.

“The popular wisdom of the time had it that if an investor stuck to index funds, he reduced risk by spreading his money around. What the received wisdom ignored was the price of the index. When the S&P 500 is driven by highfliers, an investor who buys the index is, by definition, buying high.” Bull: A History of the Boom, 1982-1999, Maggie Mahar, 2003, pg 209

Sources:

- Alphabet crawls closer to 1 trillion after reporting earnings that beat expectations, Trading Nation, 7/23/18

- Amazon.com’s stock market value hits $900 billion, threatens Apple, Reuters, 7/18/18

- In a race to a $1 trillion valuation, analysts are still betting on Apple over Amazon, Quartz, 7/19/18

- Netflix stock slammed after earnings, as subscriber growth and revenue fall short, MarketWatch, 7/17/18

- NYSE to Launch FANG+ Options on June 11, Offers Efficient Hedging and Exposure to Basket to Key Tech Stocks, NASDAQ Press Release, 5/23/18

What questions are you asking right now with so much history taking place every month? What US stock market record could be broken in August? What other trillion-dollar level could be broken in the next month or two?

We will come over this top like the previous cheap money mountain that peaked 11 years ago. What changes are you discussing with others and what actions are you taking?

Sign up today to The Investor’s Mind’s ongoing commentary.

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.