Gold Stocks Testing Last Ditch Support

Commodities / Gold and Silver Stocks 2018 Jul 27, 2018 - 03:25 PM GMTBy: Jordan_Roy_Byrne

Although precious metals have not rebounded too strongly yet, the long awaited summer rally could be underway (at least in Gold). Gold is oversold and its sentiment is overly bearish. But it is holding important support in the low $1200s. Silver has begun to rally after breaking down from a triangle consolidation. The gold stocks held up well during recent carnage in the metals but are struggling around very important support levels. The nature of their potential rebound is important as they try and maintain current support.

Although precious metals have not rebounded too strongly yet, the long awaited summer rally could be underway (at least in Gold). Gold is oversold and its sentiment is overly bearish. But it is holding important support in the low $1200s. Silver has begun to rally after breaking down from a triangle consolidation. The gold stocks held up well during recent carnage in the metals but are struggling around very important support levels. The nature of their potential rebound is important as they try and maintain current support.

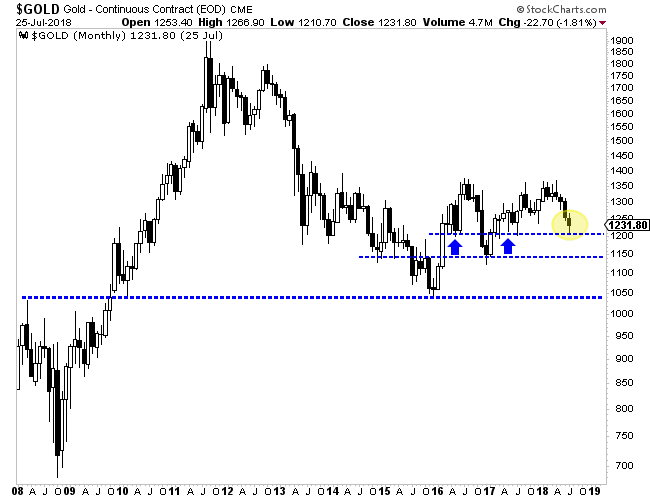

In recent days Gold has bounced from strong monthly support at $1200-$1210/oz. As the chart shows, that level was monthly support in early 2016 as well as the middle of 2017. It is the key support level between Gold and roughly $1140/oz. Look for this support to hold at least into September.

On the sentiment front, last week Gold’s net speculative position hit 13.9% (as a percentage of open interest) which is a year low. Friday’s report may show a reading close to 10%. Within the context of a downtrend, this is the kind of sentiment (sub 15%) that can be deemed as extreme. Pair that with the strong monthly support at $1200-$1210 and its likely Gold holds this level for at least a few months.

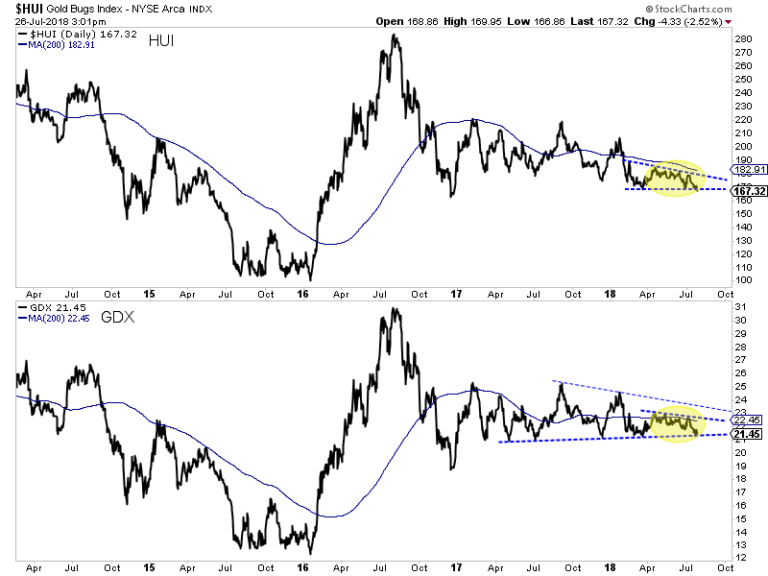

Turning to the gold stocks, while they have held up well in recent months, the technicals suggest some potential trouble if they do not rebound soon.

The HUI Gold Bugs Index which contains only gold miners (no royalty companies) is losing key support within a descending triangle pattern. The pattern projects to a downside target of 149. Upon a close below 163 (which is less than 3% away from current levels), the HUI would hit a 2.5-year low and not have good support until 140.

GDX, meanwhile is showing less weakness but is vulnerable to a decline if it loses support at $21. If that break comes to fruition then GDX has a measured downside target of roughly $16.50-$17.00.

HUI & GDX Daily Line

Even though the miners have struggled and Gold has not rallied much in recent days, the path of least resistance for the remainder of the summer should be higher. Gold should continue to hold support in the low $1200s and eventually rally back to $1260 perhaps. While the gold stocks are struggling to hold above support, I’m not sure there is enough selling pressure at the moment to drive them lower.

To follow our guidance and learn our favorite juniors, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.