Rising Inflation is Not Bearish for Stocks

Stock-Markets / Stock Markets 2018 Jul 13, 2018 - 01:57 PM GMTBy: Troy_Bombardia

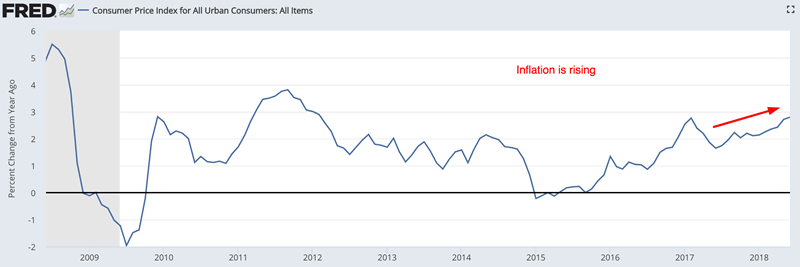

Inflation is on the rise. Yesterday’s CPI reading saw inflation rise 2.8% year-over-year.

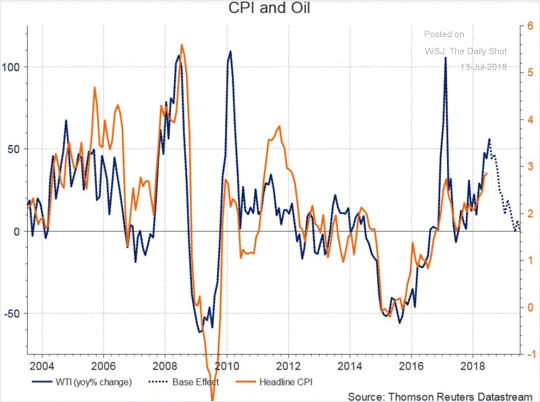

Rising inflation is mostly a function of a rising year-over-year change in oil

Bearish investors and traders are afraid that rising inflation will kill the bull market in stocks. I disagree.

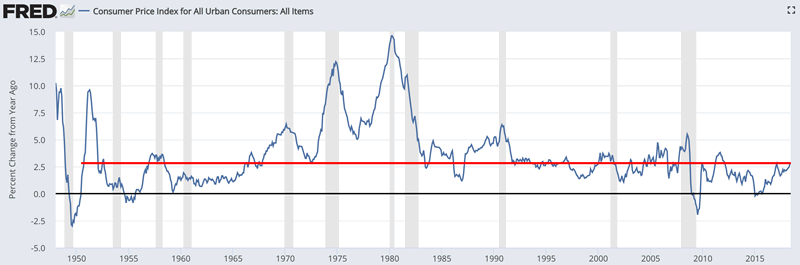

- Inflation is not high right now.

- History shows that rising inflation is not consistently bearish for the stock market. Stagflation is bearish, not inflation. Rising inflation is normal when the economy is growing. There are no significant signs of economic deterioration (stagflation) right now.

Here’s an overview of inflation.

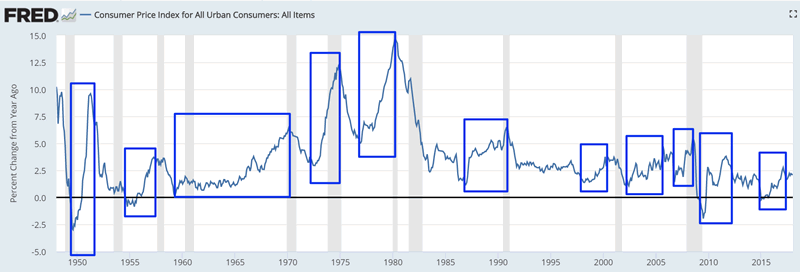

Here are periods of prolonged rising inflation.

This is what happens to the stock market when inflation goes up.

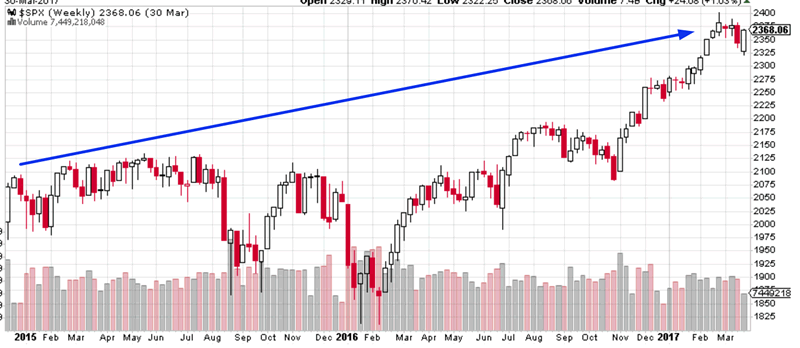

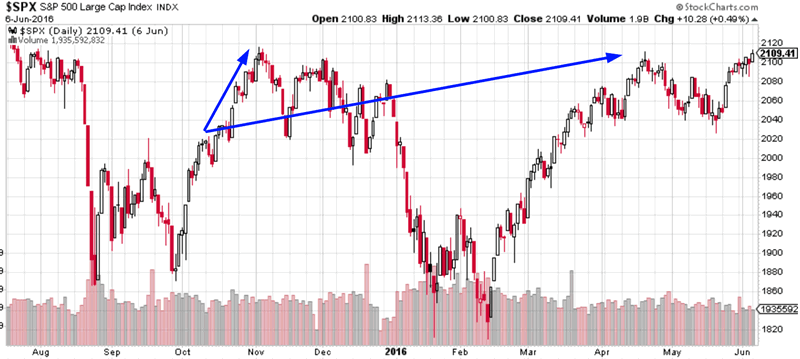

January 2015 – February 2017

The S&P 500 went higher while inflation went up, even though there was a “big correction” along the way.

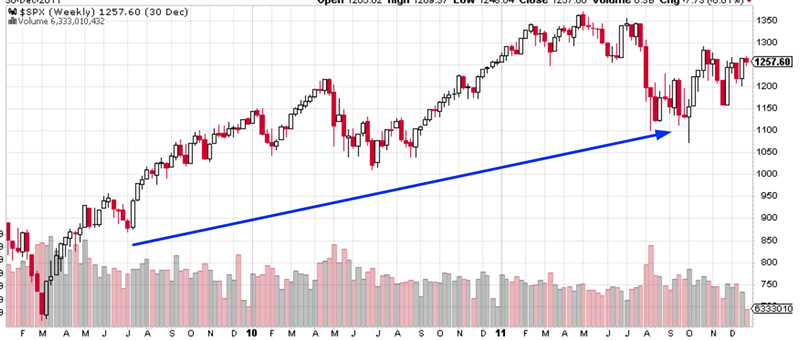

July 2009 – September 2011

The S&P went higher when inflation went up, even though there were 2 big corrections along the way.

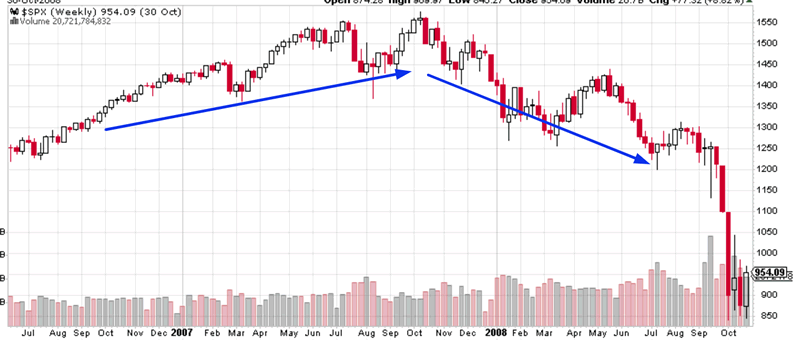

October 2006 – July 2008

The S&P went up at first when inflation went up. But then the S&P started to go down when inflation turned into stagflation.

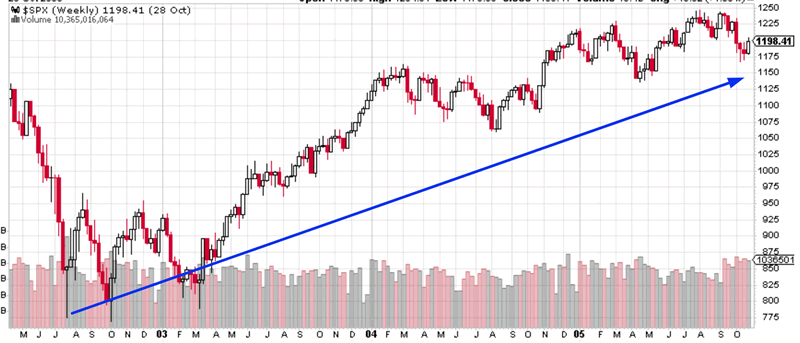

June 2002 – September 2005

The stock market and inflation went higher at the same time. This is normal for the first leg of a bull market.

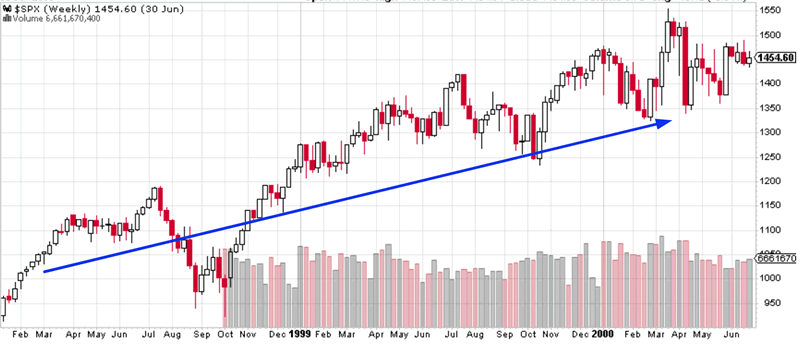

March 1998 – March 2000

The stock market went higher, although there was a “big correction” and multiple “small corrections” along the way.

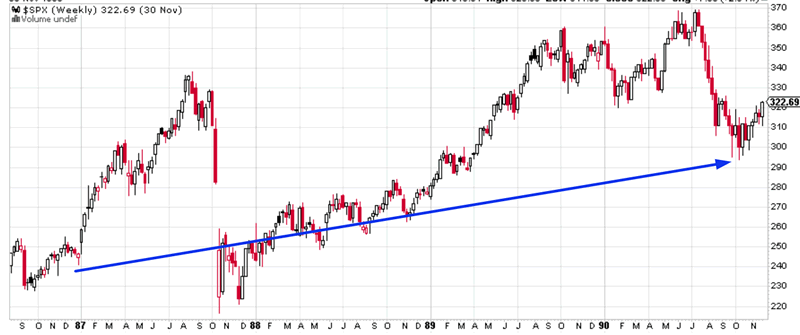

December 1986 – October 1990

The stock market generally went higher, although there were 2 big corrections along the way.

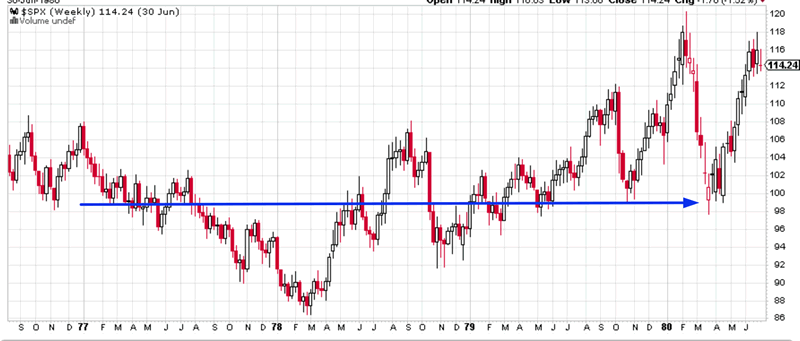

December 1976 – March 1980

The S&P was generally flat during this period of rising inflation. There was a big correction along the way.

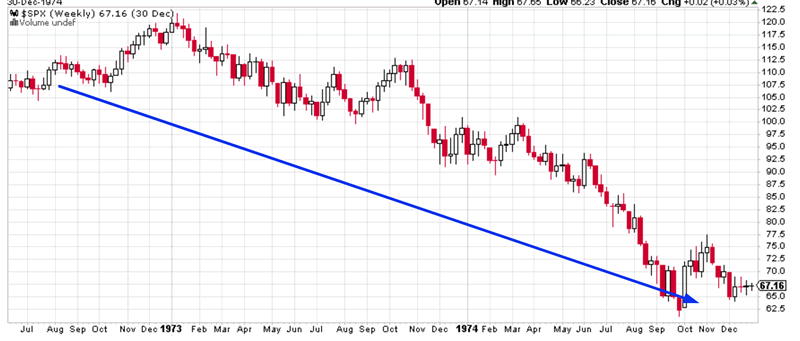

August 1972 – November 1974

The stock market went down (bear market) during this period of rising inflation.

April 1959 – February 1970

The stock market generally trended higher, with multiple “big corrections” in between.

June 1955 – April 1957

The stock market generally went up, with multiple “small corrections” along the way.

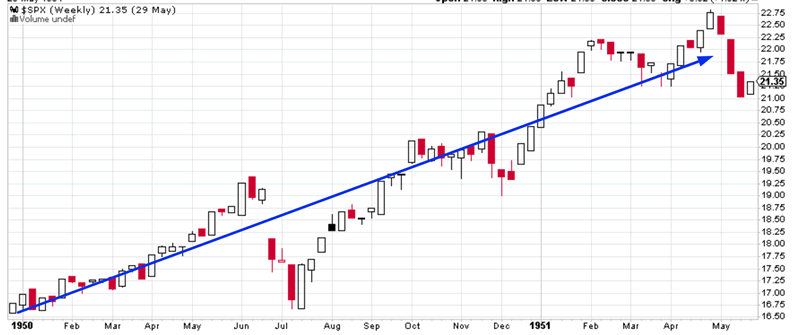

August 1949 – April 1951

The stock market generally went up, even though there was a “big correction” along the way.

Conclusion

The stock market generally trends higher as inflation rises. However, rising inflation does cause the stock market’s volatility to increase (i.e. multiple corrections along the way).

Inflation causes corporate costs to rise. But it also causes corporate revenues to rise, which means that inflation doesn’t have a significant impact on real (inflation adjusted) corporate earnings.

*We are looking at the nominal value of stock prices.

Ultimately it’s stagflation that kills bull markets in stocks. There are no signs of significant economic deterioration right now, but we are on the lookout.

Click here for more market studies

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Troy_Bombardia Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.