Bearish Sentiment Can Only Take Gold so Far

Commodities / Gold and Silver 2018 Jul 04, 2018 - 02:53 PM GMTBy: Jordan_Roy_Byrne

Despite its lack of bullish fundamentals and the poor price action, Gold is now technically oversold and has reached strong support with sentiment approaching potentially extreme levels. The conditions are in place for a rally. That being said, bearish sentiment by itself is not enough to push Gold beyond a relief rally.

Despite its lack of bullish fundamentals and the poor price action, Gold is now technically oversold and has reached strong support with sentiment approaching potentially extreme levels. The conditions are in place for a rally. That being said, bearish sentiment by itself is not enough to push Gold beyond a relief rally.

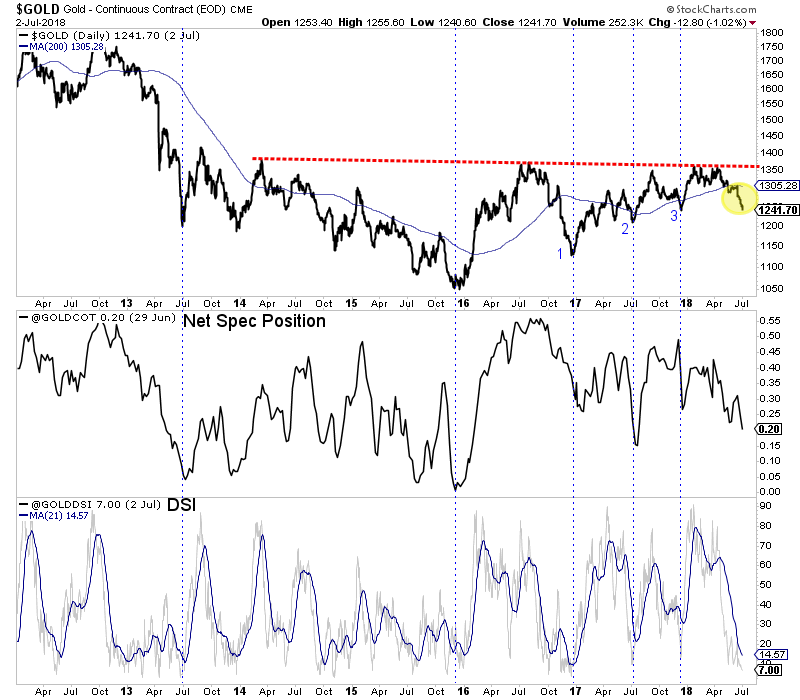

While the combination of the net speculative position (CoT) and daily sentiment index (DSI) was near its lowest point at the end of 2015, Gold enjoyed its best gains then because its fundamentals turned and remained bullish. Real interest rates declined as the Fed, after its December 2015 hike, did not hike for another 12 months despite a pickup in inflation.

Sentiment was perhaps just as bearish in June 2013 but that did not trigger anything more than a relief rally as fundamentals remained bearish. The same could be said for summer of 2015.

Following 2016, Gold’s fundamentals were no longer bullish as real interest rates began to rebound. Fed hikes were (at worst) keeping pace with inflation.

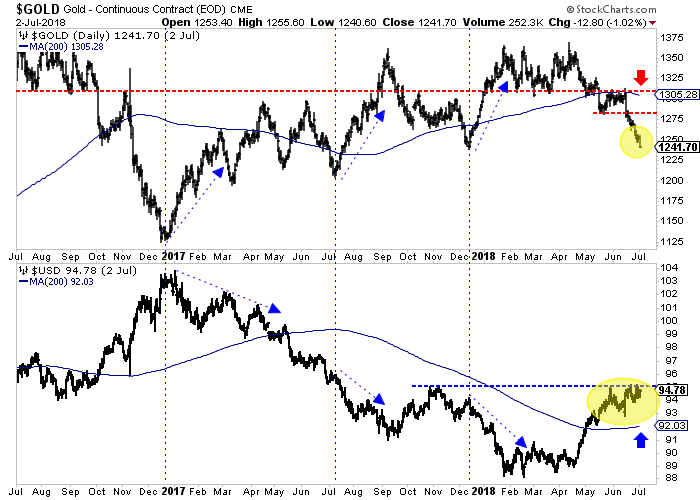

Gold’s next three important lows (denoted as 1,2,3 on the chart) gave way to rebounds thanks to extremes in sentiment, but more importantly, declines in the US Dollar.

Without the US Dollar to support it, Gold has broken down and lost support at $1300-$1310. Meanwhile, the US Dollar appears to be consolidating bullishly above its 200-day moving average, which is now sloping higher. A bullish consolidation (or correction) is intact if it holds above the 200-day moving average.

Yes, Gold is very oversold and should enjoy a strong July.

However, without the backdrop of strong fundamentals and now a weak dollar (which saved Gold in 2017), rallies are just that. Rallies.

When or how could that change?

Our view is Gold will enter a bull market when the Federal Reserve is done hiking rates.

Unless fundamentals somehow change during the summer, we would use the coming strength to de-risk portfolios. Given our cautious views on the sector we have narrowed our focus to a small group of companies, capable of performing well in this environment, while preserving cash to buy the bargains that could come at the end of the year.

To follow our guidance and learn our favorite juniors, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.