Stock Market Window Dressing Day

Stock-Markets / Financial Markets 2018 Jun 29, 2018 - 05:10 PM GMT SPX futures went as high as 2737.00 (~2732.00 cash) this morning before pulling back. There is still a probability of the retracement rally probing the mid-Cycle resistance at 2742.03, which is an approximate 50% retracement of the decline. Thus far this quarter has seen nearly a 3% gain in the SPX and today would be an important window dressing day.

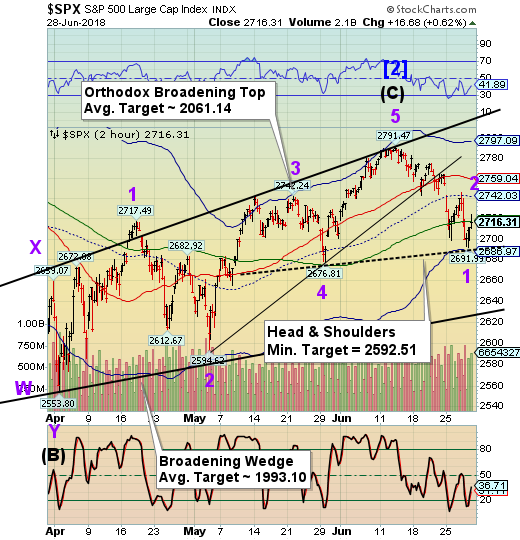

SPX futures went as high as 2737.00 (~2732.00 cash) this morning before pulling back. There is still a probability of the retracement rally probing the mid-Cycle resistance at 2742.03, which is an approximate 50% retracement of the decline. Thus far this quarter has seen nearly a 3% gain in the SPX and today would be an important window dressing day.

Wave [i] of 1 would be considered a Leading Diagonal, while Waves [iii] and [v] appear to be impulsive. There is a cluster of Cycle Pivots starting today and going through the weekend. The first Cycle Pivot occurs around 1:00 pm today.

ZeroHedge reports, “On the last day of a volatile, tumultuous quarter European stocks rebounded sharply following a broad-based rally in Asia on hopes for an upbeat end to the week and quarter, with risk on sentiment further unleashed by an early morning ("vaguely worded") European deal on migration which sent the Euro and 10Y Italian bonds surging. Indeed, it was nothing but green across global markets this morning:

However, the sense of precarious peace was shattered shortly after 6am ET when Axios reported that after several days of calm, President Trump has repeatedly told his advisers he seeks to withdraw the US from the WTO - a decision that would "throw global trade into wild disarray."

NDX futures went as high as 7113.25, exceeding the mid-Cycle resistance at 7074.40. It did not quite reach the top of Wave [iv] of 1 at 7128.77, leaving an irregular correction, should that be the final print. We’ll see just how resilient the equities markets are today.

You may wish to read Bloomberg’s “Pulling Billions Out of Equities Is the New Thing: Taking Stock”

VIX futures are pulling back toward mid-Cycle support, but may have already bottomed.

Bloomberg observes, “It’s summer. But in the Florida offices of Raymond James & Associates and at brokerages around the U.S., February is still in the air.

Repercussions from that month’s rout won’t go away -- not in chats with clients, not in the market itself. Gone are the days when you could buy an exchange-traded fund tracking the S&P 500 and turn off the ringer. Look away for five minutes, and some customer is on the phone demanding to know what the latest swerve did to his portfolio.

“It’s not an investor’s market anymore. It’s a trader’s market,” said Andrew Adams, 32, an equity strategist for Raymond James in St. Petersburg. “There’s definitely much more hand-holding. I do a lot more talking than before.”

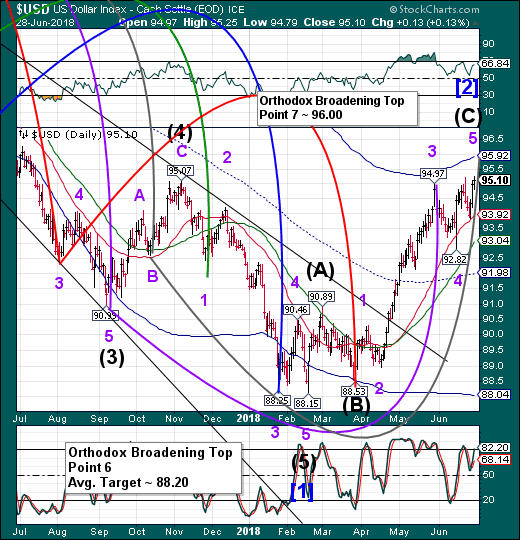

USD futures appear to be pulling back from its new retracement high at 95.25 yesterday. Yesterday was also day 258 in the current Master Cycle. It appears that USD may have made its time target but not price, so far. But it hasn’t pulled back enough to consider it a reversal, so let’s give it some time to see if it makes the final probe to the Cycle Top at 95.92.

Bloomberg comments, “For steadfast dollar bears, a two-month uptick in the currency does not a trend make.

Despite a 5.8 percent advance since March for Intercontinental Exchange Inc.’s U.S. Dollar Index, long-term outlooks are trending downward once again, indicating many strategists aren’t buying the greenback’s recent rally. In fact, forecasts compiled by Bloomberg suggest the U.S. currency is set to decline by 11 percent through the end of 2019.”

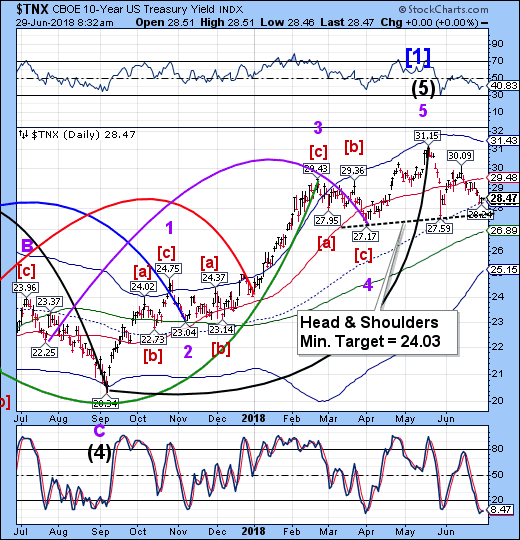

TNX appears to be flat this morning after trading in a narrow range overnight. This may be the final day of strength for TNX, which is in a high correlation with the USD. This suggests both may turn down today, taking equities with them. The Master Cycle low in TNX is due the week of July 23.

Crude oil futures have eased back from yesterday’s high, which appears to have been an inverted Master Cycle high. The June 18 low was a few days early, while yesterday’s high was 7 days late. Of the two, the inversion makes more sense. This was a difficult call, since it appeared that the decline had begun already. However, the market is always right.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.