Will the Stock Market Soar Over the Next 6-12 Months?

Stock-Markets / Stock Markets 2018 Jun 26, 2018 - 10:21 AM GMTBy: Troy_Bombardia

As always, the economy’s fundamentals determine the stock market’s medium-long term outlook. Technicals determine the stock market’s short-medium term outlook. Here’s why:

As always, the economy’s fundamentals determine the stock market’s medium-long term outlook. Technicals determine the stock market’s short-medium term outlook. Here’s why:

- The stock market’s long term is bullish.

- The stock market’s medium term is bullish.

- The stock market’s short term is a 50-50 bet.

- Small caps will probably continue to outperform large caps over the next few months.

Let’s go from the long term, to the medium term, to the short term.

Long Term

The Medium-Long Term Model is bullish right now. It doesn’t see a bear market or “significant correction” on the horizon. With that being said, here are some medium-long term bullish signs for the stock market from the past week.

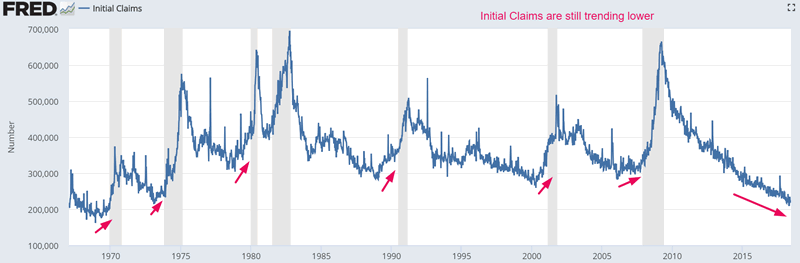

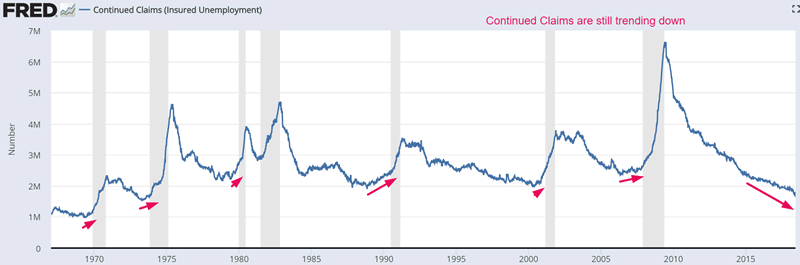

Initial Claims and Continued Claims are still trending lower (improving). These 2 data series move inversely with the stock market. They also lead the stock market.

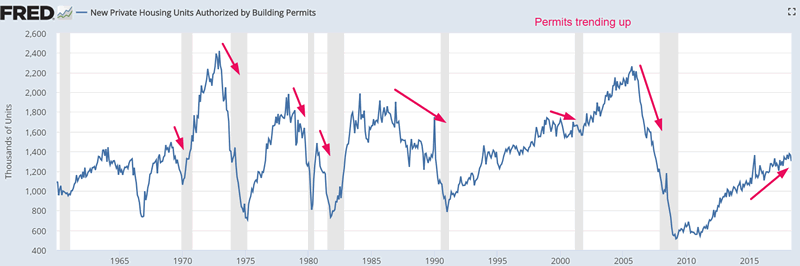

Building Permits are still trending higher (just like Housing Starts and New Home Sales). This data series leads the stock market. An improving Building Permits = long term bullish for the stock market.

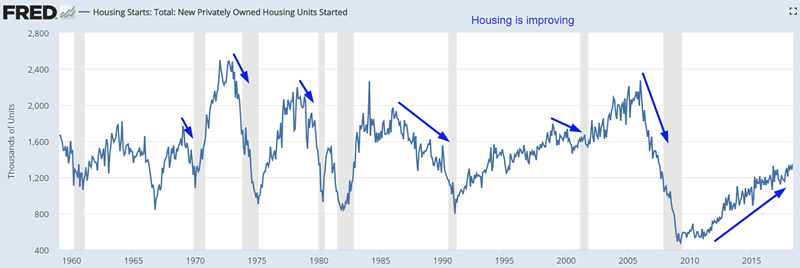

Like Building Permits, Housing Starts are trending higher. Housing Starts just made a new high. This is a long term bullish sign for the stock market and economy.

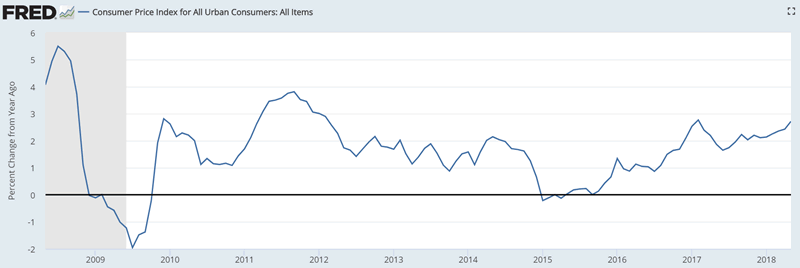

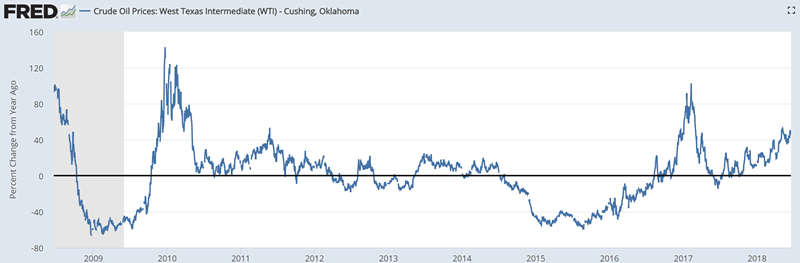

In addition, inflation will probably start to flatten in the next few months. Inflation is mostly a function of the year-over-year change in oil. With oil prices starting to stabilize, the year-over-year change in oil will start to flatten too. That will cause inflation to flatten.

The following 2 charts demonstrates how inflation moves with the year-over-year change in oil.

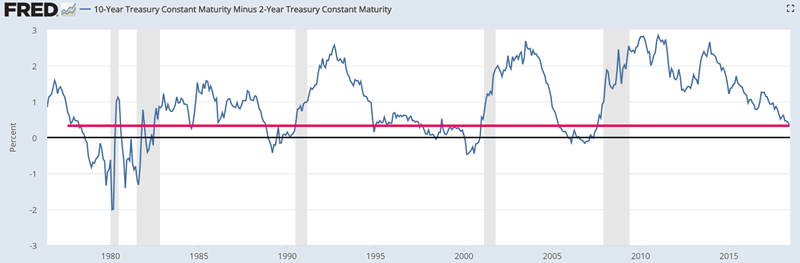

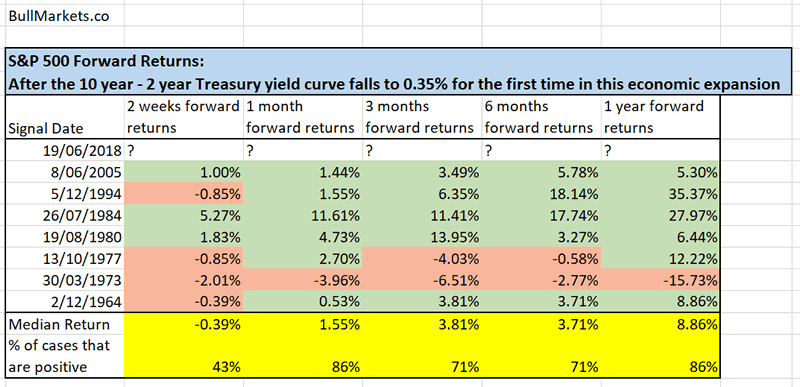

And lastly, the yield curve continues to flatten.

Historically this means that the stock market will probably continue to go up in the next year. Remember: the yield curve isn’t bearish for stocks UNTIL the yield curve becomes inverted (i.e. the number reaches zero).

Medium Term

The stock market’s medium term outlook is bullish. Several recent studies suggest that the stock market will SOAR in the next 6-12 months.

One of the most notable things has been the Russell 2000’s (small caps index) massive outperformance year-to-date.

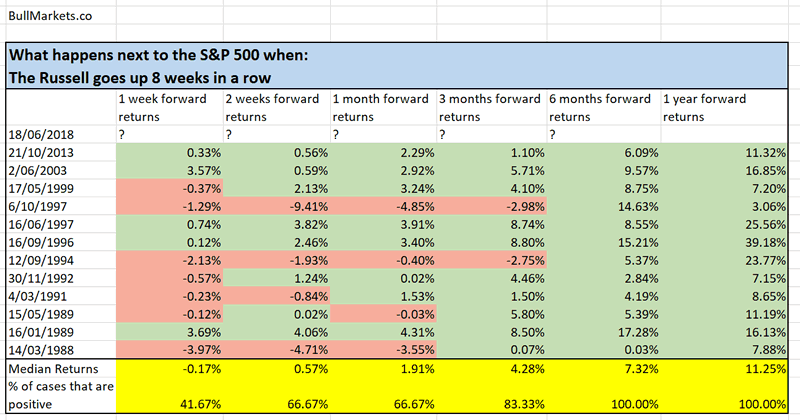

The Russell has gone up 8 weeks in a row, which is a sign of extreme strength.

Contrary to popular belief, extreme strength isn’t bearish. It’s:

- Short term bearish.

- Medium-long term bullish.

The S&P 500 tends to SOAR in the next 6-12 months when the Russell 2000 goes up 8 weeks in a row.

In this study, the S&P’s

- Median 6 month forward return is 7%. This brings the S&P to 2950.

- Median 1 year forward return is 11%. This brings the S&P to 3056.

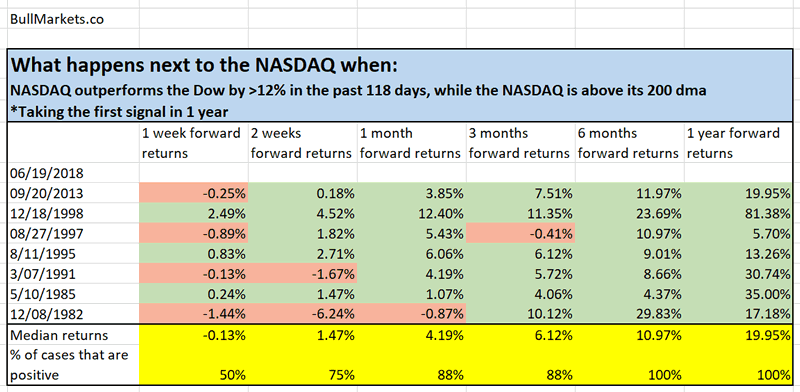

Like the Russell, the NASDAQ (tech) has massively outperformed this year as well (see study). When the NASDAQ outperforms the way it has year-to-date 2018, both the NASDAQ and S&P tend to soar in the next 3-12 months.

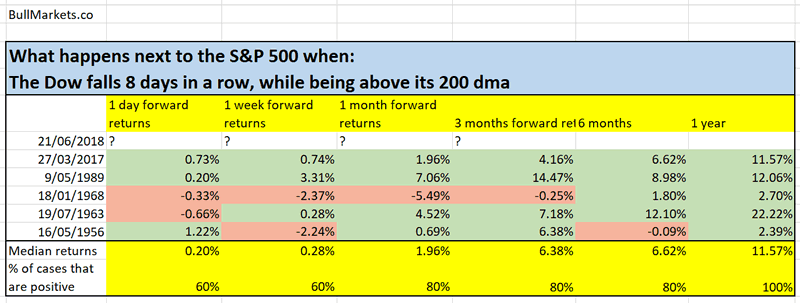

We looked at the Dow’s underperformance. The Dow fell 8 days in a row this week. That is a rare scenario when the Dow was still above its 200 daily moving average. Historically, the stock market’s 6-12 month forward returns were bullish.

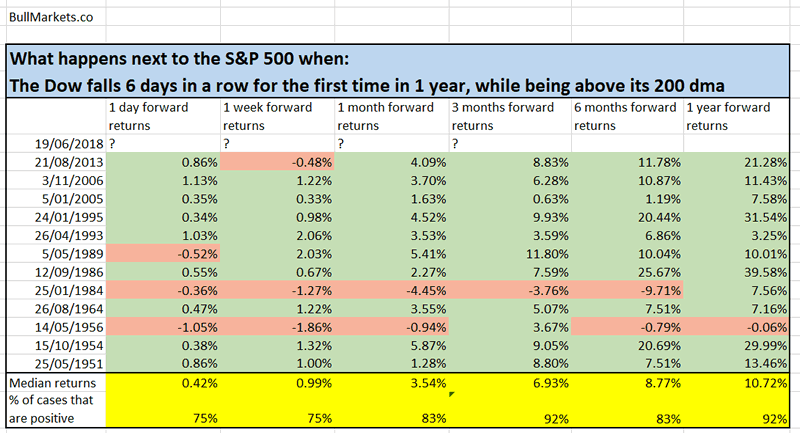

As you can see, the data sample in this study is small (n=5). When we expanded the sample size by looking at “what happens next when the Dow falls 6 days in a row while being above its 200 dma”, the study’s results were exactly the same. The stock market’s future returns are bullish.

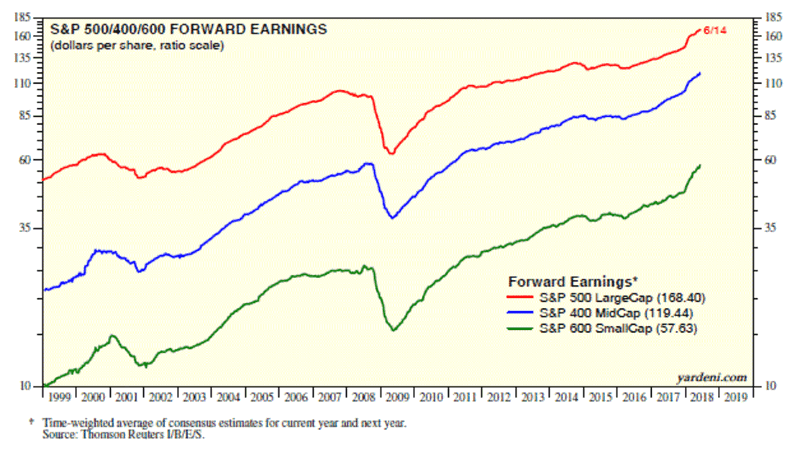

And lastly, it’s surprisingly bullish that 12 month forward earnings expectations for the S&P 500 are still going up.

The stock market, corporate earnings, and the economy all move in the same direction in the medium-long term. Analysts tend to do a pretty good job at estimating earnings, except when a recession is imminent. The data suggests that a recession isn’t imminent right now. This means that corporate earnings will probably be higher 12 months from now, which suggests that the stock market will be higher 12 months from now.

Short term

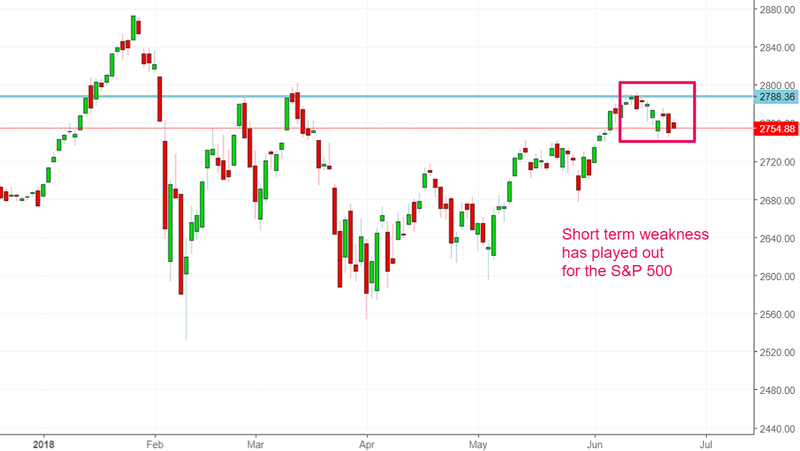

I had predicted some short term weakness over the past 2 weeks, and that has played out.

Whether the short term weakness will continue past this point is a 50-50 bet. The stock market might go down another week if the Russell breaks its “8 weeks up” streak.

As expected, the stock market fell a little bit after Trump’s trade war news.

But the market’s reaction to trade war related news is becoming smaller and smaller. That’s bullish price action.

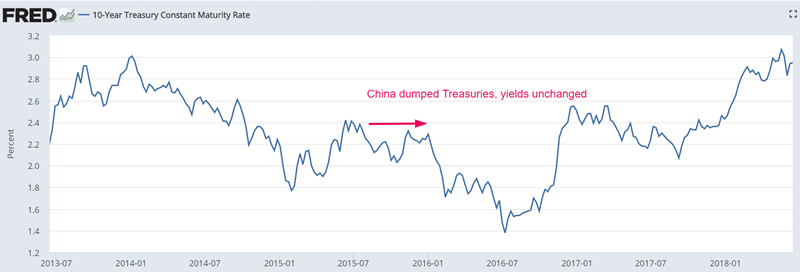

China’s options for fighting this trade war are limited. They can’t match the U.S.’ tariffs dollar for dollar simply because China exports a lot more to the U.S. than the U.S. exports to China. Dumping Treasuries might not even be that effective: China dumped Treasuries in 2015, and U.S. interest rates didn’t even go up.

In other words, now is the time to ignore the short term and focus on the medium-long term. Predicting the medium-long term is much easier than predicting the short term.

Will small caps continue to outperform?

I think there’s a >50% chance that small caps will continue to outperform for the rest of the year.

Buying something just because it is down (e.g. large caps Dow) is not a sound trading strategy. Things that are down are often down for a solid reason. Don’t be a contrarian purely for the sake of being contrarian.

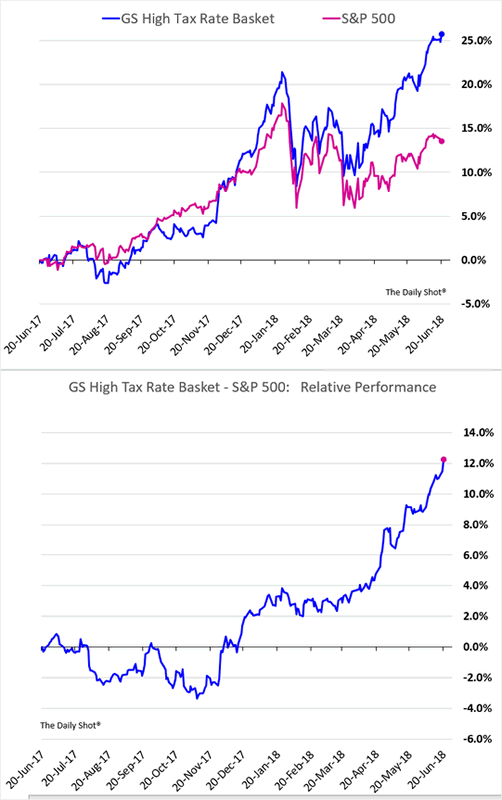

Small caps have 2 things going for them right now:

#1 The tax cut. The tax cut clearly benefits small cap stocks more than large cap stocks. Small cap companies had a higher effective tax rate before the tax cut than large cap companies, which used many offshore loopholes to avoid taxes.

#2 The trade war. For starters, this “trade war” is more like a “trade dispute”. Trump clearly has no intention of letting China off the hook very easily, hence the negotiations will probably continue for a few months. Every now and then a trade war-related piece of news will come out and the stock market (large caps in particular) will fall on the news. I think small caps will continue to outperform large caps until the trade dispute results in a signed deal.

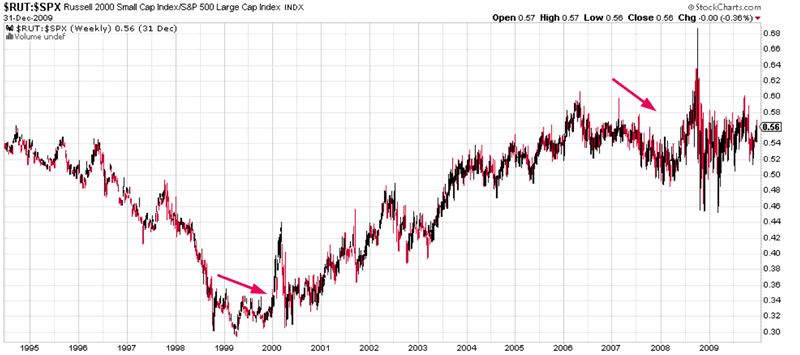

But here’s a more important point. I don’t think small caps will outperform large caps after 2018. This equities bull market probably has 1-1.5 years left based on where the Medium-Long Term Model is right now. Small caps underperformed in the final year of the previous 2 bull markets (1999 and 2007).

Here’s the Russell:S&P ratio. Notice how it tends to fall in the final year of a bull market (i.e. Russell underperforms), then tends to rise during the bear market (i.e. Russell outperforms).

In other words, small caps will probably outperform during the next bear market.

Will I shift from long the S&P to long the Russell?

No. I’m still sticking with long SSO (2x S&P 500 leveraged ETF).

It’s important to trade what you know the best. The Medium-Long Term Model is based on the S&P. It’s not based on the Russell. Hence I’m sticking with what I know.

Will the stock market soar in the next 6-12 months?

That’s asking the wrong question. Predicting how much the market will go up/down is a silly game, just like how analysts’ year end targets for the S&P 500 are mostly wrong.

It’s much better to simply predict whether the market will go up or down in the next 6-12 months. In other words, focus on the direction and not the magnitude.

With that being said, I think the stock market will go up throughout the next 6-12 months. Magnitude? The honest answer is that I don’t know. The Medium-Long Term Model predicts direction and not magnitude.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.