SPX Bouncing Above Support

Stock-Markets / Stock Markets 2018 Jun 21, 2018 - 02:41 PM GMT SPB futures have been bouncing along the two trendlines near 2760.00 this morning. Should the break down, we may see a decline to the 50-day Moving Average at 2710.37. However, the Cycles Model is unclear about near-term direction. We should be open to the possibility of another probe of the Cycle Top. Depending on the strength of the potential move, we may see a challenge of the March 13 high.

SPB futures have been bouncing along the two trendlines near 2760.00 this morning. Should the break down, we may see a decline to the 50-day Moving Average at 2710.37. However, the Cycles Model is unclear about near-term direction. We should be open to the possibility of another probe of the Cycle Top. Depending on the strength of the potential move, we may see a challenge of the March 13 high.

ZeroHedge reports, “It started off well enough, with S&P futures in the green and the Nasdaq set for another all time high after trade war concerns eased further after Commerce Secretary Wilbur Ross told the Senate neither the U.S. nor China want a trade war, while President Donald Trump said he expects to announce new trade deals with unspecified countries soon.

However, it did not last long, and the risk-off move across asset classes started as soon as Europe opened for traders, and accelerated after the appointment of two prominent euroskeptics to Italian parliamentary positions, sending global markets in the red.”

NDX made a new all-time high on the strength of the FAANG stocks. There is room for another probe higher to finish off the EW pattern.

Lance Roberts writes, “With roughly 98% of the S&P 500 having reported earnings, as of mid-June, we can take a closer look at the results through the 1st quarter of the year. During the most recent reported period, 12-month operating earnings per share rose from $33.85 per share in Q4-2017 to $36.43 which translates into a quarterly increase of 7.62%. While operating earnings are widely discussed by analysts and the general media; there are many problems with the way in which these earnings are derived due to one-time charges, inclusion/exclusion of material events, and outright manipulation to “beat earnings.”

Therefore, from a historical valuation perspective, reported earnings are much more relevant in determining market over/undervaluation levels. It is from this perspective the news improved markedly as 12-month reported earnings per share rose from $26.96 in Q4-2017 to $32.81, or a whopping 21.7% in Q1. This jump, of course, is directly related to the reduction in corporate tax rates following the passage of the “tax reform” bill in December of 2017.

However, as shown below, top-line revenue growth (sales) has also improved since the market bottom in early 2016. The issue is that while sales are indeed rising, the price investors are paying for each dollar of sales has grown exponentially since 2009. In other words, it is already well “priced in.”

VIX futures are running higher this morning, supporting the bearish analysis. It has not crossed above either of the resistance area, however.

The Commitment of Traders reports that the Commercials have increased their long position in the VIX from 40,538,000 long contracts to 57,117 this week. It appears that they are in an accumulation phase.

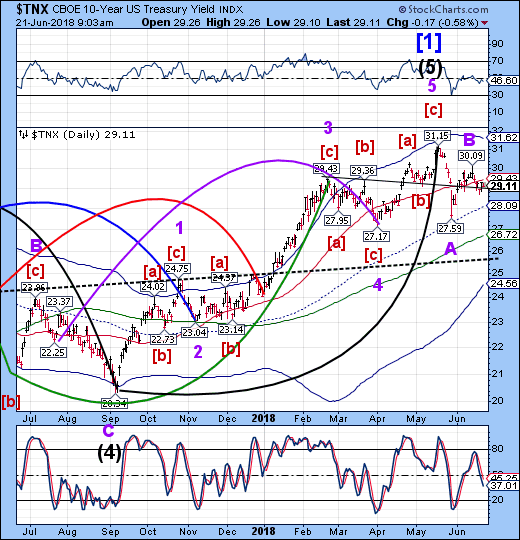

TNX appears to be supported at the trendline at 29.09 thus far this morning. A breakdown would suggest an increased money flow into Treasuries.

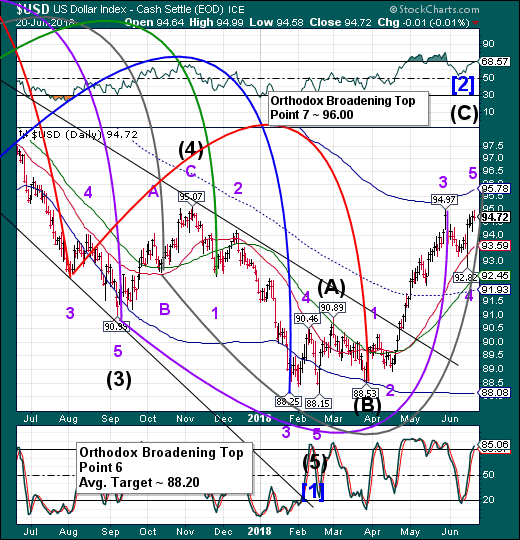

USD futures reached an overnight high of 95.22 before reversing back down. There is a good probability of a Cycle Inversion that may take the USD to its daily Cycle Top at 95.78. A decline beneath Intermediate-term support at 93.59 may have us reassess the outlook.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.