What Happens Next to Stocks when Tech Massively Outperforms Utilities and Consumer Staples

Stock-Markets / Sector Analysis Jun 18, 2018 - 01:53 PM GMTBy: Troy_Bombardia

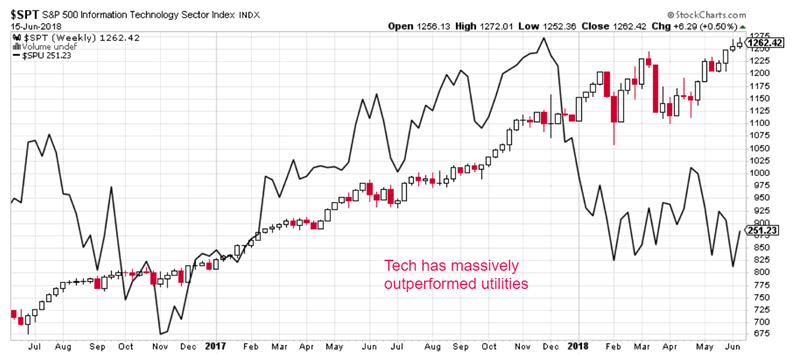

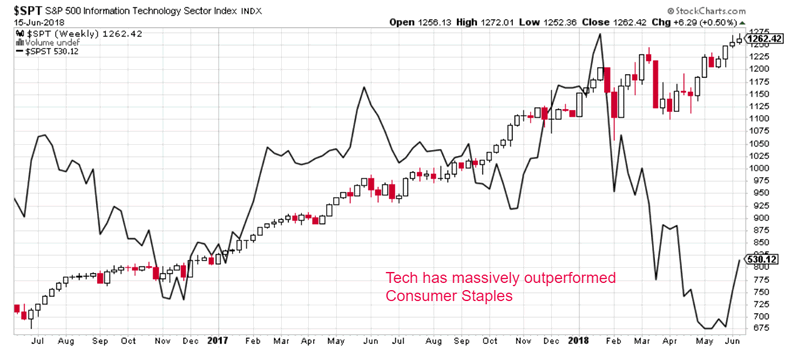

The tech sector has massively outperformed the utilities and consumer staples sectors over the past year.

The tech sector has massively outperformed the utilities and consumer staples sectors over the past year.

- The S&P 500 Information technology sector is up 33%…

- While the Utilities sector is down -8%….

- While the Consumer Staples sector is down -8%

Some people see this as a bearish sign for the stock market because “tech is in a bubble”.

That’s a slightly wrong conclusion. This phenomenon happens either:

- Near the end of bull markets, when the bull market has 1-2 years left, or…

- Near the beginning of bear markets, when the previous bear market ended just a few months ago.

Since we are 9 years into the current bull market, this phenomenon is a sign that the bull market doesn’t have many years left.

Here are the historical cases in which the tech sector outperformed the utilities sector by 40% over the past year, and what happens next to the S&P 500.

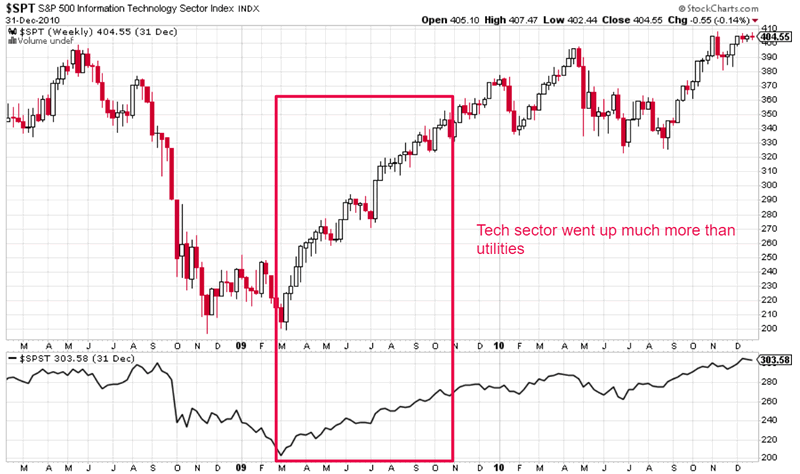

October 26, 2009

The tech sector outperformed utilities in the year preceding October 26, 2009. But that’s because this was the first rally of the present bull market. Since tech is a more volatile sector than utilities, it’ll naturally go up surge a lot more than utilities because the entire U.S. stock market soared from March-October 2009.

This historical case doesn’t apply to today because we are 9 years into the current bull market (late stage, not early stage).

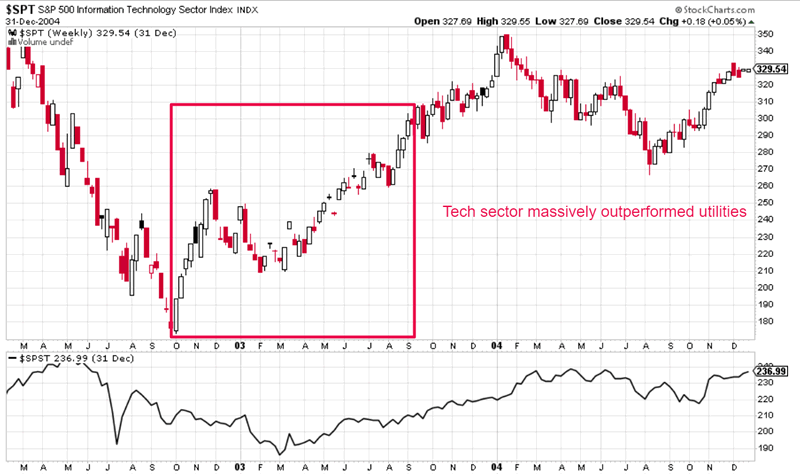

September 5, 2003

The tech sector outperformed utilities in the year preceding September 5, 2003. But that’s because this was the first rally of 2002-2007 bull market. Since tech is a more volatile sector than utilities, it’ll naturally go up surge a lot more than utilities because the entire U.S. stock market soared from October 2002 – September 2003.

This historical case doesn’t apply to today because we are 9 years into the current bull market (late stage, not early stage).

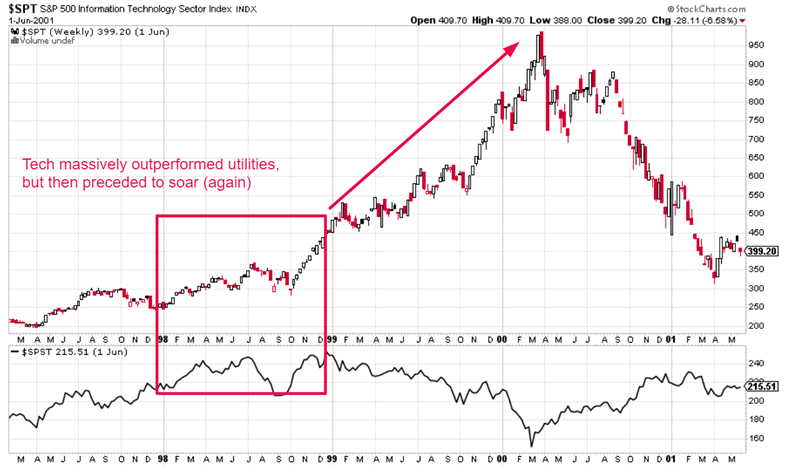

December 8, 1998

This historical case is most similar to today. The tech sector massively outperformed by utilities sector by 40% in the late stage of the dot-com bubble.

However, the bull market continued for more than another year before topping. The stock market soared during that last year.

Conclusion

When tech massively outperforms low beta sectors like Utilities or Consumer Discretionary, it’s a sign that the broad stock market (S&P 500) is either in the early stage of a bull market or late stage of a bull market.

We certainly aren’t in the early stage of this bull market. Hence we must be in the late stage of this bull market.

However, the caveat here is that even though we are in the late stage of this bull market, it probably has at least another year left.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Troy_Bombardia Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.