America’s One-sided Domestic Financial War

Politics / Financial Markets 2018 Jun 08, 2018 - 12:21 PM GMTBy: Raymond_Matison

Domestically, there are two institutions which are capable of starting, executing, and managing a domestic or a global financial war. The first is the Federal Reserve System, which with its banks has the unfettered power to print money, create credit, and set interest rates. The second is our own government which through its elected officials sets foreign policy that includes its demonstrated power to influence foreign elections, covertly remove uncooperative foreign leaders from office, and to wage war both physical and financial without any formal declarations. America’s participation in the Korean War over seventy years ago was defined as a police action rather than a war which would have required Congressional approval, and conflicts since then have mostly eluded the requirement for congressional approval. However, no financial war has required a formal declaration nor Congressional approval, as they are initiated against any targeted country without visible bloodshed, frequently on a clandestine basis.

Domestically, there are two institutions which are capable of starting, executing, and managing a domestic or a global financial war. The first is the Federal Reserve System, which with its banks has the unfettered power to print money, create credit, and set interest rates. The second is our own government which through its elected officials sets foreign policy that includes its demonstrated power to influence foreign elections, covertly remove uncooperative foreign leaders from office, and to wage war both physical and financial without any formal declarations. America’s participation in the Korean War over seventy years ago was defined as a police action rather than a war which would have required Congressional approval, and conflicts since then have mostly eluded the requirement for congressional approval. However, no financial war has required a formal declaration nor Congressional approval, as they are initiated against any targeted country without visible bloodshed, frequently on a clandestine basis.

A review of corporate election donations shows that banks are major contributors to both political parties and to individuals seeking political office. Accordingly, we can surmise that bankers ultimately get such politicians in office which provide helpful legislation which aids or profits banks. In this regard, corporations and banks in particular have the greatest influence on the legislative direction of the country, and they may be said to run or rule the country. Given their primacy of self-interest, the country is run for the benefit of corporations rather than all citizens. This former conjecture has been confirmed by a study conducted in 2014 by Princeton and Northwestern Universities, which analyzed targeted benefits of congressional legislation.

The study “Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens” used extensive policy data collected between 1981 and 2002 to determine the extent to which the majority of Americans influence legislation. The empirical study constituted analyzing nearly 1,800 U.S. policies enacted in that period and comparing them to the expressed preferences of average Americans (50th percentile of income), affluent Americans (90th percentile), and large special interests groups. The researchers concluded that the U.S. is dominated by its economic elite. Therefore, the U.S. government does not represent the interests of the majority of the country's citizens, but is instead ruled by the rich and powerful for their own benefit. They concluded that the U.S. is an oligarchy, not a democracy!

Since its founding in 1913, the Federal Reserve has been singularly independent and immune to any oversight or audit. In effect it is neither accountable to the nation’s citizens nor its elected representative politicians. The Federal Reserve System is a non-governmental organization owned by private banking interests for the benefit of its owners. Accordingly, the owners of the Federal Reserve are bankers or industrialist bank owners, who through their corporate political donations and selected election of politicians dominate and run the United States. Therefore, very few of America’s policies, domestic or foreign have come about accidentally. We can surmise that the domestic century-long financial war against Americans is also by design.

War and money creation

Without a central banks ability to create fiat money, most of the wars in the world could not take place. Wars are expensive, and they siphon money from budgets of ordinary citizens to military ends through increased taxation. As taxes are never sufficient to finance a war of any but the shortest duration, therefore, a less direct approach of money printing and increasing national debt has been used. Former Congressman, Ron Paul states in his book “End the FED”:

“Following the creation of the Fed, the government would discover other uses for an elastic money supply aside from keeping the banking system from defaulting on its obligations. It would prove useful in funding war. It is no coincidence that the century of total war coincided with the century of central banking.”

Wars cause thousands of soldier deaths, also creating a larger sub-society of living maimed invalids from these foreign wars. Yet none of our alleged enemies have truly threatened security or the sovereignty of the United States, nor had the capability to wage war on our shores which has the most powerful military in the world. So it begs the question as to who benefits from America’s initiation or participation in these foreign wars? What benefit or increase in security has America received from the wars in the Middle East where thousands of our citizens have died, and our national debt has risen to the level of creating an economic crisis?

Such horrendous and expensive wars, of course, would never be approved by even simplest-minded voters – so wars are promoted through false flag operations, falsely inflated fears to our national security, and lies by our most senior national leaders, and financed by central bank money printing, bank credit creation, and ever-increasing national debt.

There are many historical examples of false flag operations and inflated national security threats. The most recent examples are our overt and covert military activities in Syria and Iran. Neither Syria nor Iran have conducted any military activities that threaten the sovereignty of the U.S., and are geographically an astounding half a world away, without their military having any realistic means to even getting close to our national borders. Our entanglement there relates to controlling the global supply of oil, while practicing world hegemony as the financial colonialist of the current century. Our war initiation in Iraq was based on “proof” that Iraq had weapons of mass destruction – but the proof turned out to be a lie. Our war initiation in Vietnam was based on alleged Vietnamese attack on a U.S. ship – but the alleged attack was a lie. The Korean war was fought allegedly so that Communism would not spread through the Asian part of the world and eventually to America – yet our leaders over decades have refused to secure our own borders and allowed, if not promoted, socialism to bloom right here in the land of the free.

Interest rates, markets, and money creation

People who follow investment markets or are responsible for managing money are often ready to make or reverse portfolio decisions in a very short period of time depending on the perceived signals from global markets or economic trends. This sort of action seems very reasonable to the portfolio manager whose investment performance is reassessed by investors every three months. However, central banking decisions are implemented and have effect over a long period of years, if not decades.

When the FED provides funding for a military participation in a war, it should be understood that such funding and war will take place over a period of many years. Not only are war bonds issued over a period of years, their maturities can extend for decades in the future. While such bonds remain outstanding they contribute to the economic statistics which the central bank then uses to determine its future monetary policy.

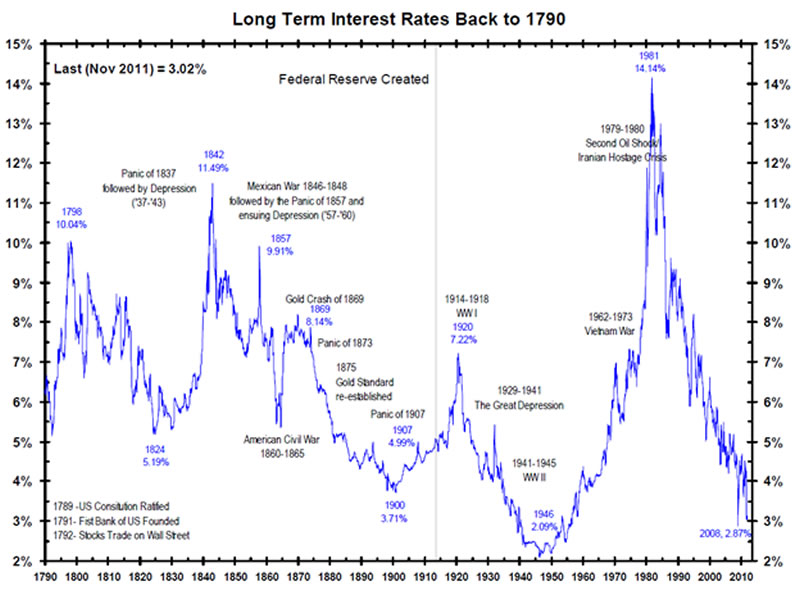

If interest rates are going to be strategically increased or decreased, this action also can take place over decades. For example, the last long term uptrend in interest rates roughly between 1950-1980 took over thirty years to develop, while the major down-trend in interest rates took place from 1980 to the present – again over thirty years.

It should be recognized that the setting of interest rates is called price fixing. Our government aggressively pursues corporate price fixing of products with penalties of fines or even jail sentences to its perpetrators, but price fixing of our most important product – the price of our fiat money - is unexplainably immune from such oversight.

In the following chart (courtesy of Bianco Research LLC) please note that there are several periods over which interest rates rise or decline. Looking at the most recent period of the chart, there should be little question as to what the direction of interest rates will be going forward. That eventual rise in interest rates will make the expense of the nation’s former war funding unsustainable, increasing annual budget deficits, and raising national debt further, and causing destructive inflation. It hardly needs to be stated that such a financial and economic environment will also be destructive to an already nervous, increasingly volatile bubble market.

The value of fiat currency

The most frequently associated action with the FED is that of constantly increasing the nation’s money supply – which has been taking place steadily since its founding over a century ago. The fiat system of money creation requires consistent increases in that supply for it to survive. The system must expand by the growth of interest on existing debt or credit – money which does not exist and has to be created. Therefore the only certainty of this fiat system is that money and debt has to increase, and that the value of this fiat currency will continue to decrease – as long as this money creation system remains in existence.

It is estimated that today’s fiat dollar has approximately the same purchasing power that three cents had in 1913 when the FED was formed. Over time more accurate financial measurements have been employed, even as the definition of some economic indicators have been altered to obscure the real changes in order to benefit politics of the time. But since 1971, when spending on the Vietnam War, Medicare, and building president Johnson’s Great Society forced President Nixon to renege on the Bretton Woods agreement to exchange $35 for an ounce of gold to international banks, the calculation is even more illuminating. Based on the CPI measures in 1971 and 2017, one dollar today will purchase what required only $0.16 in 1971. No wonder that Warren Buffett had claimed that inflation at any amount is theft.

Cultural changes from money expansion

As we have shown, one predictable result from the omnipresent central bank policy of money expansion and attendant inflation is the loss of purchasing power of the dollar – which has been responsible for important long-term cultural changes in our country. For decades, the American family was comprised of the working husband as breadwinner, while the wife was at home raising children and caring for their family. However, the persistent purchasing power loss of money meant that a husband could eventually no longer bring home enough income for the family to thrive. This meant that over time his wife voluntarily made the required decision to work outside the home in order to raise their effective family income. Thus, the FED’s money printing policy has been directly responsible for the huge cultural change which altered, if not destroyed, the traditional American family.

This more modern society with both husband and wife in the work force, providing two incomes made it seem that their families once again prospered. This however did not take account of the fact children were no longer guided by the stable family moral compass of a mother, now exchanged for guidance provided by mass media television and other outsiders. The result is a new generation of people who no longer have the ethical values or beliefs of the previous generation – thus the culture of society itself has degraded. Unfortunately, the continuing persistence of purchasing power dilution over further decades from FED money creation eventually lead to a point where the two income family was no longer sufficient for it to thrive either.

This period leads us to those more recent years of the early 2000’s, when families were taking money out of their largest single investment – that of their home equity. So quite literally, because inflation adjusted wages had not increased since the early 1970’s, common living expenses required that money had to be taken out of their home value.

That cash-out soon resulted in a rise in mortgage default rates, such that it created the huge market and economic implosion of 2007-2008. As a result, FED policy over the most recent decades has created yet another substantial cultural change – that of now creating citizen debt slaves. Such bondage comes from the loss of purchasing power of our fiat currency due to persistent inflation of our money supply, and is visible now also through excessive and record mortgage debt, and increasing defaults on student loans, auto loans, and credit card balances.

Another important trend that is becoming a cultural change is the uneven distribution of fiat currency in the system. Business owners and industrialists have excess currency which is invested in our bond and equity markets. The ordinary citizen, who is struggling to have his wages last to his next pay period, does not have money to invest. Bank created money goes to support investment markets on the false premise that further enriching the wealthy will create trickle-down benefits for the populace.

Therefore, our system of money creation necessarily rewards the elite, and penalizes the average citizen by creating an ever greater disparity in income and assets. This financial system destroys our democracy’s most fundamental building block – our middle class citizens. Hence, if unchanged, our capitalist system’s propensity to create this disparity in income will reach an end point that will be no different than the end point of socialism or communism – tyranny by a small unelected oligarchy.

Financial Consequences for the middle class

The few dollars that ordinary citizens have invested is usually through their company pension fund. These plans have been eroded over time to the benefit of corporate earnings as such programs were switched over decades from defined benefit plans to defined contribution plans. The difference in the two plans is huge – one provides guaranteed benefits, whereas the other simply exposes worker pensions to the vagaries of the financial markets – with zero guarantees. The increase in earnings from this change in benefit plans supports higher stock prices benefiting the major shareholders, our oligarchs.

Currently, with the decades-long near zero interest rate price fixing by the FED, bond interest rates are at historic lows while the equity markets have been blown up to enormous bubble territory. The historically low interest rates have diverted billions of dollars from pension accounts and contributed greatly to the underfunding of state, corporate and individual pensions. In addition, the loss of additional billions from savings accounts due to the FED accommodating the servicing of mountainous national war debt with record decade-low interest rates, is further impoverishing ordinary citizens and destroying democracy’s middle class. It is a continuing domestic war against American citizens.

Inflation and our financial markets

Due to the triple effects of growth, innovation and inflation, the long-term direction of the equities market should always be up. Growth increases sales, and should increase profits. Innovation creates tools and machinery which reduces the cost of production, thereby increasing profit margins and corporate earnings, which supports a higher stock market. Innovation also creates new products and entire new industries which customers find compelling to purchase. Therefore, persistent innovation is a strong driving force to the investment markets.

However, the constant devaluation of money also acts to increase stock prices as inflation increases product prices, revenues and earnings – all of which support a higher-valued market. In other words the stock market will go up due to the dollar’s loss of purchasing power, as more of its less-valued dollars are required to purchase an investment. The rise in market indexes creates no real wealth; rather it destroys real asset value as the nominal rise in price due to inflation must be shared with government through capital gains taxes.

The following historical chart of the Dow Industrial Average was chosen because it has a compressed vertical scale for stock prices, which more effectively dramatizes visually the results of persistent innovation and inflation. What remains to be explained is why markets can, do and will crash. As long as investors accept inflation in the money supply of several per cent per year, the market ignores this dilution and investors focus exclusively on earnings growth as if it was all produced from growth and profit margin improvement. When inflation rises by an amount such that purchasing value declines by larger and alarming amount, confidence declines in the dollar causing fear in stability of the system itself. That is the time when inflation no longer increases stock price nominal amounts, but dramatically reduces them.

Courtesy of Stock Charts

Direction and effect of interest rates

Recently the FED has started to raise interest rates, as it needs higher rates from which it can once more reduce them at a time when their reduction would tend to help stimulate an economy. But when consumers are beyond their capacity to service additional debt, lower interest rates will not help. Nonetheless, as these interest rates start increasing – either by the actions of the FED or by markets rejecting low interest rate debt, forcing such rates much higher – both bond and equity markets will be drastically market-adjusted downward, reflecting the higher discount rate.

The increase in available higher interest coupon bonds cannot immediately offset the huge decline in bond market values; therefore, the real result of interest rates reversing to the norm will mean that the presently underfunded pension plans will essentially be destroyed. In his famous economics book “The Road to Serfdom” F.A. Hayek stated: “the most important change which excessive government control produces is psychological change, an alteration in the character of the people.” This may be the time that the century-long financial war by the FED will be counter-attacked by over 300 million angry financially impoverished citizens of this nation.

Electronic or crypto-currency

Currently there is much discussion in our financial press about the introduction of electronic money and its displacing our paper fiat currency. There may be years of such discussion and evaluation creating doubt as if it ever will take place. But the path is clear and decisive. The advent of independent crypto-currencies as realistic competitors to bank-created and controlled money absolutely require banks to eventually replace its fiat paper currency with their own electronic version - which can compete with or overtake the independent public version. Banks will not condone having been outmaneuvered by an independent money system which is not under their control. Since banks and elites control what legislation is approved, we should expect restrictive legislation and other impediments to public crypto-currencies coming from bank controlled government which will stifle this public-spirited innovation.

The final cultural change

This continuing destruction of money’s value can easily be projected into the future to show what is to come next over several decades. It will bring forth the final cultural change to our republic. When citizens lose their purchasing power to the extent that people can no longer support growth of our consumer driven economy, this failure will first show up in convincing economic statistics. Presently we already can observe that the growth rate of our economy has been gradually slowing over the last several decades as incomes to consumers lose value from inflation, and as welfare dependent and homeless numbers are increasing.

Negative economic statistics will in turn cause financial markets to turn down massively. At this point the FED will demonstrate its “benevolence” towards the “ordinary folks” and support our financial markets by buying both bonds and stocks in the market directly so as to support their price. Note that central banks in Japan and Switzerland already buy directly such financial instruments. But what this means in reality is that central banks, by purchasing bonds and stocks, will actually have direct significant ownership of the wealth of this country. Their ownership of bonds or equities representing real assets will have been purchased by the fiat money they create at will and essentially without cost.

The end result of this final cultural change is that the FED will wind up owning a significant portion of the real assets of the United States. It will finally make plain to even the most naïve what the consequences and end point are of central bank fiat currency unremitting expansion. It will either remind or force people to learn what Thomas Jefferson understood and warned against over 250 years ago: “If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around the banks will deprive the people of all property – until their children wake-up homeless on the continent their fathers conquered”.

Our elitist controlled State Department is constantly re-formulating foreign policy so as to arguably protect the United States from evil foreign enemies. We demonize, sanction, and wage financial and military war with countries which seek only to maintain their sovereignty and improve the lives of their citizens through economic development. Our fake media attention on all the alleged evil extant in the world ignores the huge elephant in the room - it is our oligarchs and their control of policy at the Federal Reserve that is now our most dangerous national security threat, and a clear and present danger to America and its citizens.

Allowing for the possibility that at one time, long ago, the FED’s intent was more noble, we quote again Mr. Hayek who stated: “Is there a greater tragedy imaginable than that, in our endeavor consciously to shape our future in accordance with high ideals, we should in fact unwittingly produce the very opposite of what we have been striving for?”

Noble or not, this one-sided domestic political and financial war has been waged for over a century; and the average American has been losing to our persistently victorious oligarchs. Soon to come pension losses and currency collapse, and people’s eventual understanding of its underlying cause may yet create a spontaneous volunteer army which will take this long battle back to the oligarchs.

Raymond Matison

Mr. Matison was an Institutional Investor magazine top ten financial analyst of the insurance industry, founded Kidder Peabody’s investment banking activities in the insurance industry, and was a Director, Investment Banking in Merrill Lynch Capital Markets. He can be e-mailed at rmatison@msn.com

Copyright © 2018 Raymond Matison - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raymond Matison

Mr. Matison was an Institutional Investor magazine top ten financial analyst of the insurance industry, founded Kidder Peabody’s investment banking activities in the insurance industry, and was a Director, Investment Banking in Merrill Lynch Capital Markets. He can be e-mailed at rmatison@msn.com

Copyright © 2018 Raymond Matison - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.