This is Italy Not Sparta

Politics / Italy Jun 01, 2018 - 06:12 PM GMTBy: Raul_I_Meijer

“European Stocks Surge Celebrating New Spanish, Italian Governments”, says a Zero Hedge headline. “Markets Breathe Easier As Italy Government Sworn In”, proclaims Reuters. And I’m thinking: these markets are crazy, and none of this will last more than a few days. Or hours. The new Italian government is not the end of a problem, it’s the beginning of many of them.

“European Stocks Surge Celebrating New Spanish, Italian Governments”, says a Zero Hedge headline. “Markets Breathe Easier As Italy Government Sworn In”, proclaims Reuters. And I’m thinking: these markets are crazy, and none of this will last more than a few days. Or hours. The new Italian government is not the end of a problem, it’s the beginning of many of them.

And Italy is far from the only problem. The new Spanish government will be headed by Socialist leader Pedro Sanchez, who manoeuvred well to oust sitting PM Rajoy, but he also recently saw the worst election result in his party’s history. Not exactly solid ground. Moreover, he needed the support of Catalan factions, and will have to reverse much of Rajoy’s actions on the Catalunya issue, including probably the release from prison of those responsible for the independence referendum.

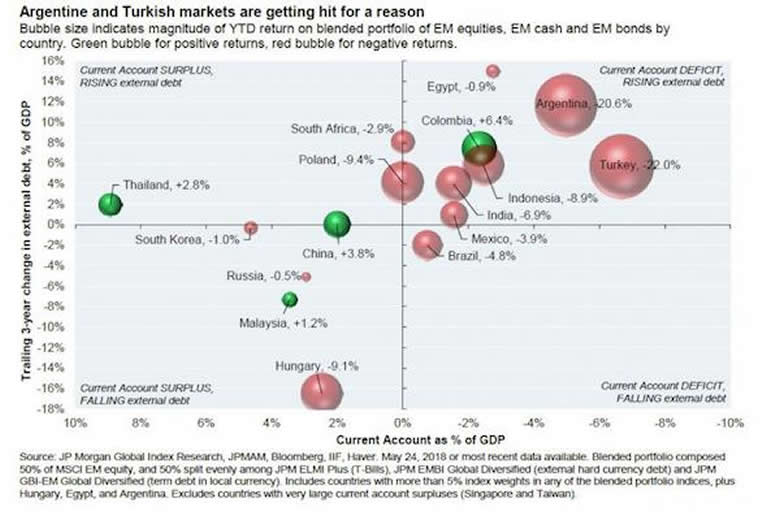

Nor is Spain exactly economically sound. Still, it’s not in as bad a shape as Turkey and Argentina. A JPMorgan graph published at Zero Hedge says a lot, along with the commentary on it:

The chart below, courtesy of Cembalest, shows each country’s current account (x-axis), the recent change in its external borrowing (y-axis) and the return on a blended portfolio of its equity and fixed income markets (the larger the red bubble, the worse the returns have been). This outcome looks sensible given weaker Argentine and Turkish fundamentals. And while Cembalest admits that the rising dollar and rising US rates will be a challenge for the broader EM space, most will probably not face balance of payments crises similar to what is taking place in Turkey and Argentina, of which the latter is already getting an IMF bailout and the former, well… it’s only a matter of time.

And now Erdogan has apparently upped the ante once more yesterday. Last week he called on the Turkish population to change their dollars and euros into lira’s, last night he ‘suggested’ they bring in their money from abroad (to profit from ‘beneficial tax rules’). Such things have, by and large, one effect only: the opposite of what he intends. He just makes his people more nervous than they already were.

It’s June 1, and the Turkish elections are June 24. Will Erdogan be able to keep things quiet enough in the markets? It’s doubtful. He has reportedly already claimed that the US and Israel are waging an economic war on Turkey. And for once he may be right. A few weeks ago Erdogan called on all member states of the Organisation of Islamic Cooperation to boycott all Israeli products (and presumably America products too).

On April 30, the IMF warned that the Turkish economy is showing “clear signs of overheating”. On May 1, Standard & Poor’s downgraded the Turkish economy to double-B-minus. Economic war? Feels a bit more like a political war. Erdogan has three weeks left to win that election. Don’t expect things to quieten down before then. But as the graph above shows, Turkey itself is the problem here first and foremost.

Expect Erdogan to say interest rates -usury- are immoral in Muslim countries. Expect much more pressure from the west on him. Erdogan has also been busy establishing Turkish ‘enclaves’ in Syria’s Afrin territory (where he chased out the original population) and in the Turkish-occupied northern part of Cyprus (where he added 100s of 1000s of Turks).

No, the West wouldn’t mourn if the man were defeated in the vote. They can add a lot more pressure in three weeks, and they will. Will it suffice? Hard to tell.

Back to Italy. Where the optimism come from, I can’t fathom. The M5S-Lega coalition has never made a secret of its program and/or intentions. Just because pronounced eurosceptic Paolo Savona was shifted from Finance to EU minister doesn’t a summer make. New Finance minster Tria may be less outspoken than Savona, but he’s no europhile, and together the two men can be a woeful pain in Europe’s behind. This is Italy. This is not Sparta.

The essence of the M5S-Lega program is painfully simple: they reject austerity as the basics of economic policy. And austerity is all that Europe’s policy has been based on for the past decade at least. That spells collision course. And there is zero indication that the new coalition is willing to give an inch on this. Tsipras may have in Greece, but Italy’s sheer size means it has a lot more clout.

To begin with, the program wants to do away with the Eurozone’s 3% deficit rule. It speaks of a 15-20% flat tax, and a €780 basic income. These two measures would cost between €109 billion and €126 billion, or 6 to 7% of Italian GDP. As Italy’s public debt stand at €2.4 trillion, 132% of GDP.

“The government’s actions will target a programme of public debt reduction not through revenue based on taxes and austerity, policies that have not achieved their goal, but rather through increased GDP by the revival of internal demand,” the program says. Yes, that is the opposite of austerity.

The parties want a roll-back of previously announced pension measures to a situation where the sum of a person’s age and years of social security contributions reach 100. If someone has worked, and contributed to social security for 40 years, they will be able to retire at 60, not at 67 as the present plans demand.

In an additional plan that will make them very popular at home amongst the corrupt political class, the parties want to slash the number of parliamentarians to 400 MPs (from 630) and 200 senators (from 318). They would be banned from changing political parties during the legislature.

And then there are the mini-Bots, a parallel currency system very reminiscent of what Yanis Varoufakis proposed for Greece. Basically, they would allow the government to pay some of its domestic obligations (suppliers etc.) in the form of IOUs, which could then in turn be used to pay taxes and -other- government services. They would leave what is domestic, domestic.

There’s a lot of talk about this being a first step towards leaving the euro, but why should that be so? The main ‘threat’ lies in the potential independence from Brussels it may provide a country with. But it’s a closed system: you can’t pay with mini-Bots for trade or other international obligations.

Italy, like an increasing number of Eurozone nations, is looking for a way to get its head out of the Brussels/Berlin noose that’s threatening to suffocate it. If the EU doesn’t react to this, and soon, and in a positive manner it will blow itself up. Yes, if Italy started to let its debt balloon, the European Commission could reprimand it and issue fines. But the Commission wouldn’t dare do that. This is Italy. This is not Sparta.

Anyway, risk off, as the markets suggest(ed) this morning? Surely you’re joking. And we haven’t even mentioned Trump’s trade wars yet. Risk is ballooning.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2018 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.