Stock Market Distribution Pattern Revealed

Stock-Markets / Stock Markets 2018 May 25, 2018 - 02:59 PM GMT Good Morning!

Good Morning!

SPX futures were positive overnight until 6:45 am, when the Commercials weighed in. I am illustrating a probable way the Commercials went from -132,091 short contracts on January 22 to -511,373 short contracts last Monday. It has been happening gradually over the past two months since the markets have been thin and getting thinner at each rally.

You may be wondering how over $8 billion went into the stock market last week, yet the entire week was a loss. It appears to be happening again this week. The reason is that, while the market isn’t performing as it had, there is still a fear of missing out (FOMO) of the next rally. Wall Street and the media are still sending out glowing reports about the next rally.

The Commercials are capitalizing on this by selling short in the first two hours of the day to retail investors. You can see the action, like clockwork, where the market is sold until 11:00 am every day. The Commercial activity is usually the first and last hours of the day. On May 22, the selling occurred at both intervals.

Today we may see a sharp decline (Wave [b]) until 11:00 am., then a rally (Wave [c]) into the close due to the Memorial Day weekend. It appears that next Tuesday the decline starts in earnest.

NDX futures are flat this morning, compared to SPX. The action in the NDX isn’t as regular, since it appears that the FAANGs are not being bought as vigorously since the earnings announcements.

ZeroHedge comments, “For much of the overnight session, the market's attention was focused on North Korea's amicable reaction to Trump's cancellation of the June 12 summit, an indication that yesterday's selloff may have been overdone as Trump's gambit was merely a negotiating ploy, and a successful one at that.”

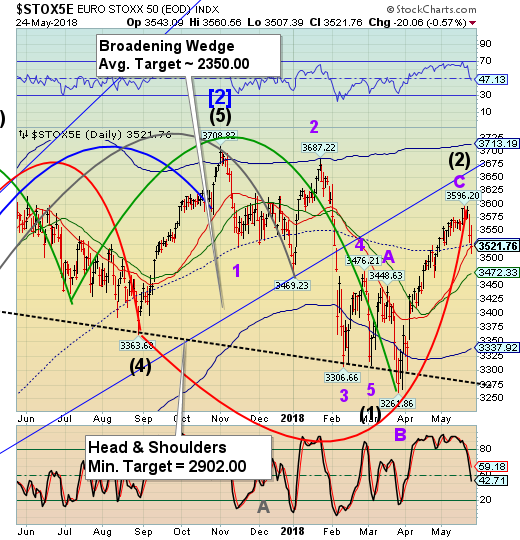

Europe is where the action appears to be, although the equities markets there appear to be rallying. Yesterday the STOXX completed an impulsive decline. Today it appears to be in need of a Wave 2 retracement. This can be a bit discombobulating, since the market appears to be rallying on bad news. However, seem my comments on the SPX. The same pattern applies.

ZeroHedge observes, “When it comes to the latest rout in Italian bonds, which has continued this morning sending the 10Y BTP yield beyond 2.40%, a level above which Morgan Stanley had predicted fresh BTP selling would emerge as a break would leave many bondholders, including domestic lenders with non-carry-adjusted losses...

... there has been just one question: when does the Italian turmoil spread to the rest of Europe?”

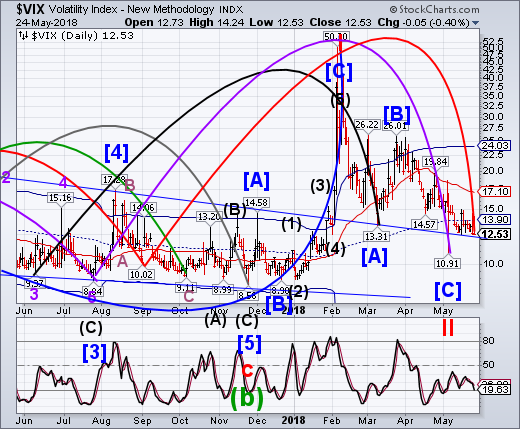

VIX futures are green this morning, although they were red just a couple of hours ago.

WTI futures are being slammed this morning. As discussed, the Master Cycle in WTIC came a week later than the Model indicated. It appears to have been worth the wait. While crude oil did not “limit down” as lumber has, it appears to have started its decline with a bang.

ZeroHedge reports, “As we detailed earlier, what OPEC can jawbone up, OPEC can - apparently - jawbone back down.

Amid extreme record speculative longs and the goldilocks of apparent supply constraints (Venezuela and Iran) and global synchronous growth driving demand, it appears the smoke and mirrors are falling apart as the latter growth is disappearing and the former 'tightness' is now rebuffed as OPEC and its allies are likely to gradually boost oil output in the second half of the year to ease consumer anxiety as prices trade near $80 a barrel, said Saudi Energy Minister Khalid Al-Falih.”

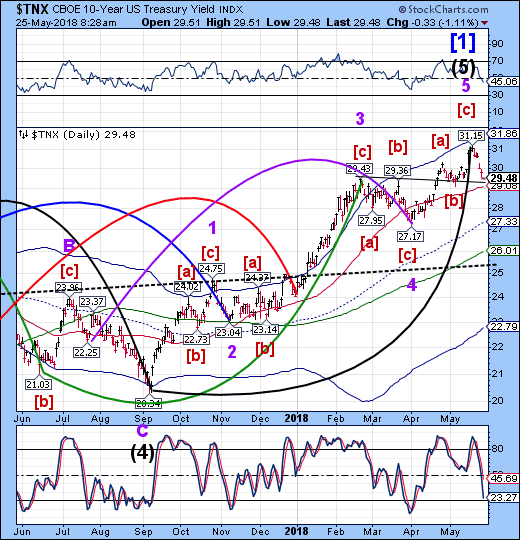

TNX appears to have completed its first impulsive decline from the top. It is in need of a bounce that can be shorted (or long UST).

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.