Semiconductor Stock Market Canaries: Chirp, Warble… Soon a Croak and Silence?

Stock-Markets / Stock Markets 2018 May 19, 2018 - 04:05 PM GMTBy: Gary_Tanashian

In light of earnings reactions in the Semiconductor Equipment sector, it’s time for an update of a theme we have had in play since November, 2017

In light of earnings reactions in the Semiconductor Equipment sector, it’s time for an update of a theme we have had in play since November, 2017

The canary is no longer chirping in a healthy manner and the economy’s coal mine has a toxic gas leak. While the recent Lam Research (LRCX) earnings report was pretty good and there were positive aspects to that of Applied Materials (AMAT), these highly cyclical companies that have been at the front end of the entire economic cycle that had its beginnings in 2013 are showing signs of wear.

Business is still good but when you are talking about cyclical leaders, it is growth rate that matters. I have read article after article touting strong current business and future drivers that will change the typical Semiconductor cycle as next generation Fabs are needed for ever more dynamic specialty chips for higher-end devices.

Applied Materials Slides After Softer Q3 Forecasts on Weaker Smartphone Demand

“Smartphone sales have been below expectations, particularly for high-end models, and in response, both semiconductor and display suppliers have made adjustments to their capacity planning,” CEO Gary Dickerson told investors on a conference call. “With inventory rebalance that we’re seeing from smartphones, we’re going to see a sequential dip in the Q3. But from our guidance into Q4, you can see that it recovers nicely into Q4.”

Taking the pulse of the analyst community, from the large houses to the boutiques to the chattering blogosphere, the theme seems to be that a buying opportunity is developing for the likes of AMAT and LRCX, two excellent companies. If you take Applied CEO Gary Dickerson’s view at face value, a decline in these stocks would be exactly that, an opportunity.

But as someone from the real world (as opposed to the Armani wearing analyst community) I can tell you that these companies have no better visibility than you or I. How can they? The global macro economy is subject to many inputs and if future outcomes were that easy to read, we’d all be rich beyond our wildest dreams because we’d have already seen around every corner. The global economy, while healthy now is not immune to the business cycle.

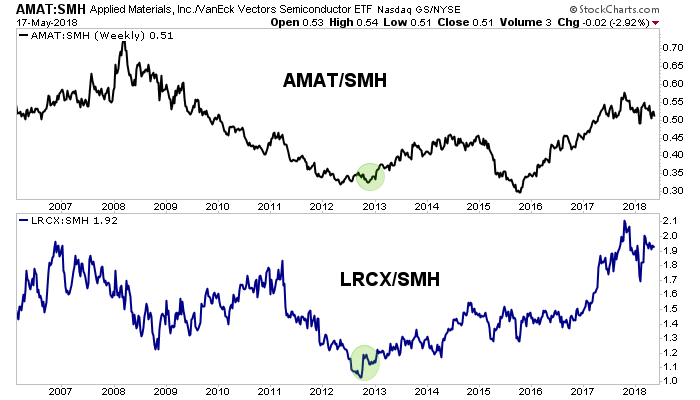

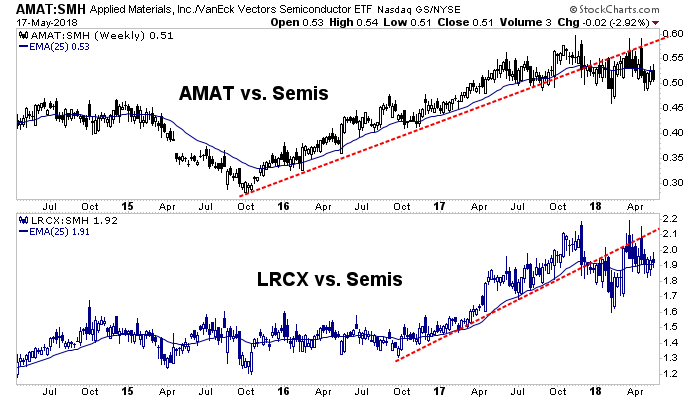

So here is a corner to look around. In NFTRH we began using this chart in Q4 2017 after a major financial media outlet published an article touting these two companies as great values for great investment returns in 2018. Leadership by the Semi Equipment companies has flattened out.

Here is the November 21 2017 post in which we disputed the sensational MSM headline:

“Fund manager looks beyond ‘FAANG’ stocks and finds even bigger winners for 2018”

Semi Equipment Spending Record, 2018 Growth, but…

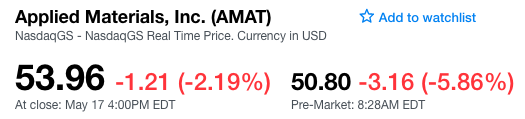

And now this morning in pre-market we have a reaction to AMAT’s earnings. From Yahoo Finance:

While other aspects of the market are positive this morning, we are looking at a progression of cyclicality and that progression, as we have noted many times since using it toward a positive cyclical view in early 2013 is…

Semi Equipment → Semiconductors → General Manufacturing → Economy → Employment = Cemented Opinions of the Herd

Okay, I know it’s simple but when confronted with legions of analytical entities with firmed up views (like a buying opportunity in Semi Equipment) it pays to at least consider that when we became constructive on not only the Semi sector but looking forward, the economy as well, it was not canaries we were hearing; it was crickets! As in ‘cue the crickets’ in the economic analytical community. That was the response when we claimed a positive cycle was at hand.

Now? Your favorite buttoned down analyst and/or your favorite financial blogger may be on the opposite side and an article like the one you are reading right now is definitely in the minority. I expect the response to be largely ‘cue the crickets!’.

This chart dials out to the late 2012 low and new cycle leadership by the two major Semi Equipment companies over the general sector. Each ratio is currently in a nasty looking pattern that is not likely to be improved after today’s market activity.

At this point I want to give proof that I am not just some bear waiting interminably to finally give you the big “I told you so!” a few years after establishing a bias.

When it was time to call b/s on the ‘end of the Semi cycle’ that the major media were scaring everyone with after Microchip Semi’s (MCHP) dour forward forecast (the media incorrectly dubbed MCHP a “canary in a coal mine” for the Semi sector) in 2014, NFTRH disputed that assertion per this post and NFTRH 322 excerpt…

Semiconductor Equipment Sector Update (December 26, 2014)

And then there was the disturbance in 2015-2016, in which we kept NFTRH subscribers on course with the correct – as opposed to media instigated – view of a still-positive macro backdrop.

AMAT Chirps, b2b Ramps, Yellen Hawks and Gold’s Fundamentals Erode (May 30, 2016)

It is vital to show your work, just as you had to do in grade school. Otherwise you are just spewing opinions, stirring emotions and/or confirming peoples’ bias. I don’t go negative unless given reason, with a great example being a timely post on the over-hyped 3D Printing mania that the Armani suits were shoving down peoples’ throats. Shortly after it was written, at the height of the promotion and ridiculous valuation, the sector imploded.

3D Printing; no Barrier to Future Losses for Investors (February 24, 2014)

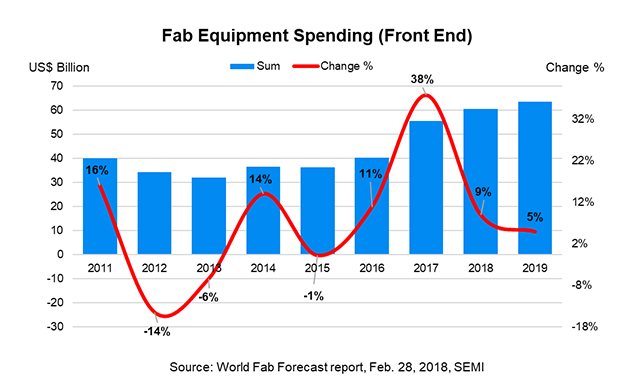

One SeekingAlpha article recently cited Semiconductor industry experts as a guide to a bullish view on the industry. Lest you think I am grabbing data out of thin air, realize that I have used that source (SEMI) for both positive and negative views. They no longer publish the Semi bookings side of the book-to-bill ratio (b2b) we found so important to guiding a bull view back in 2013 and reaffirming it in 2016. But they do provide ongoing analysis. The issue is in the interpretation of the data.

Today’s happy-go-lucky analysts see the still-positive projected growth for 2018 and headlines like this and project positive outcomes well into the future.

Stunning growth for fab equipment spending – four years in a row

Others on the other hand, try to look around corners, whether toward positive or negative outcomes. Add the slowing Fab Equipment growth rate to the list of negatives that the charts and now, corporate guidance are starting to burp up.

As a final thought, consider that no single analyst should ever put out a view for peoples’ consumption that is set in stone, to be defended come hell or high water. That only ends up hurting those who believe in the authority with which the analyst seems to speak.

So if I am wrong and the sector is only providing a buying opportunity (as in 2014 and 2016) then so be it. Adjustments will be made. I am not marrying the view. But since last November when a goofy MSM headline called my attention to the subject, I have not seen much to dissuade a negative Semi Equipment view and hence, eventually a negative economic cycle view. Patience and perspective, as always.

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.