DOW Jones and CRUDE Oil on a Cliff Edge, Waiting for a Nudge!

Stock-Markets / Financial Markets 2018 May 17, 2018 - 02:53 PM GMTBy: Enda_Glynn

UPCOMING RISK EVENTS:

UPCOMING RISK EVENTS:

USD: Building Permits, Capacity Utilization Rate.

EUR: N/A.

GBP: N/A.

JPY: N/A.

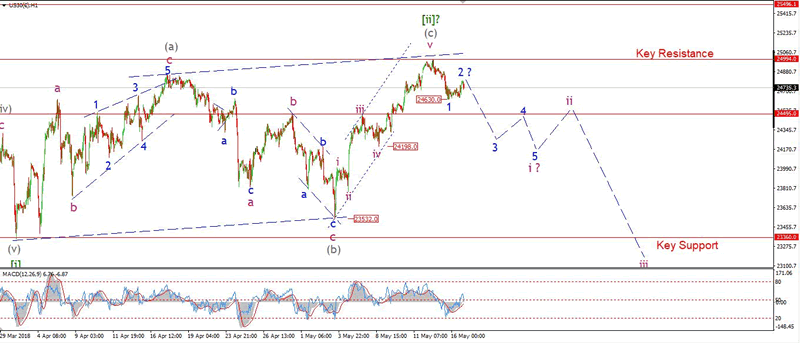

DOW JONES INDUSTRIALS

30 min

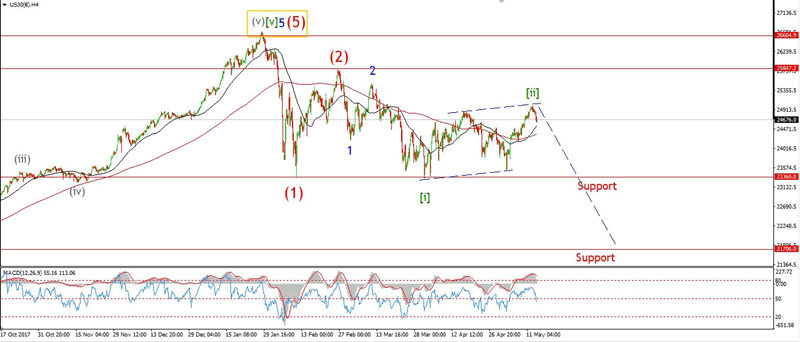

4 Hours

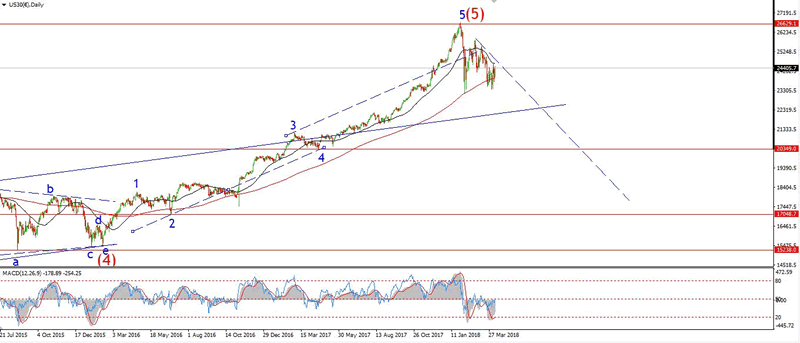

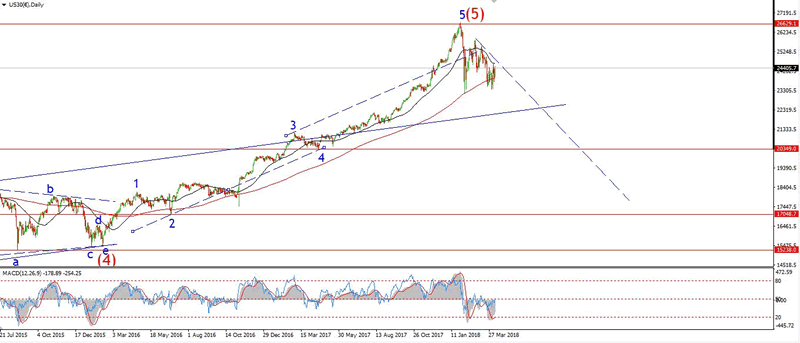

Daily

My Bias: market topping process completing

Wave Structure: Impulsive 5 wave structure, topping in an all time high, now beginning new bear market.

Long term wave count: topped in wave (5)

The low of todays session so far hit 24630,

This is labelled as wave '1' of 'i' of a possible return to the larger downtrend in wave [iii] green.

The rise off todays low is in a clear abc correction wave pattern,

This suggests that a corrective rise in wave '2' blue is underway.

A further break of 24630 tomorrow will confirm that wave '3' down has begun.

In the short term,

The signs are lining up so far that another serious acceleration lower is on the cards.

I want to see a clear five wave pattern in wave 'i' pink,

Followed by a three wave corrective rise in wave 'ii'.

which will create the bearish Elliott wave signal I am looking for.

Tomorrow;

Prices must remain below 24994 from here on out, as per the elliott wave rules.

Watch for a break of 24630 and a decline in wave '3' blue.

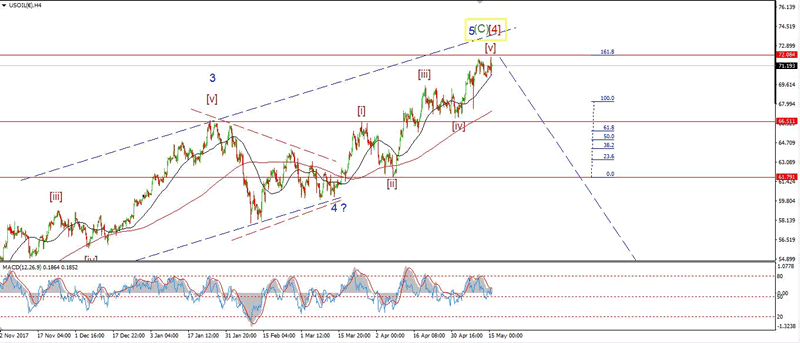

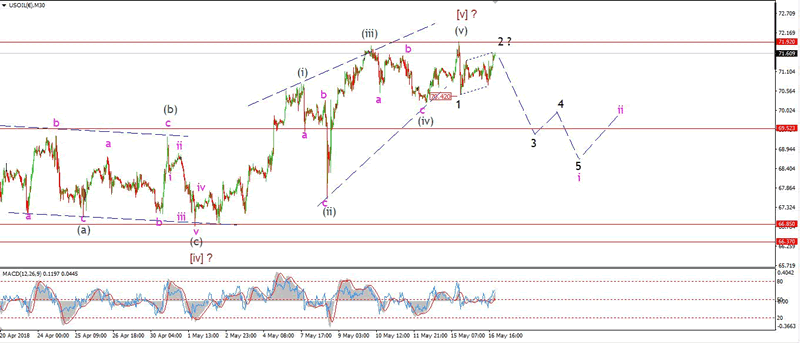

U.S CRUDE OIL

My Bias: topping in a large correction wave [4].

Wave Structure: Double combination higher in wave [4] red now complete.

Long term wave count: wave [5] target $20

30 min

4 Hours

Daily

The rise off Tuesdays low at 70.42,

has created a clear three wave pattern to the upside.

The price has filled the trend channel and should now turn back down again.

I have labelled the rise as a possible second wave complete at todays highs.

Price must not break above 71.92 from here on,

And wave '3' down should begin off todays highs.

Much like the DOW,

followed by a three wave corrective rise in wave 'ii'.

That will complete another Elliott wave indicator sell signal off the recent high,

The stakes are very high in crude oil right now.

And the long term elliott wave pattern could carry the price below $20 if I am correct.

Back to the short term.

Tomorrow;

71.92 must hold to,

Watch for a break of 70.42 in a possible wave '3' down.

There is a big move coming in the markets!

To stay ahead of the next trend,

Check out the membership page.

Enda Glynn

http://bullwaves.org

I am an Elliott wave trader,

I have studied and traded using Elliott wave analysis as the backbone of my approach to markets for the last 10 years.

I take a top down approach to market analysis

starting at the daily time frame all the way down to the 30 minute time frame.

© 2018 Copyright Enda Glynn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.