SPX futures are higher, but so is VIX

Stock-Markets / Stock Markets 2018 May 14, 2018 - 03:54 PM GMT Good Morning!

Good Morning!

SPX futures are marginally higher. It’s hard to say whether the trendline gives way or not this morning.

ZeroHedge reports, “S&P futures are higher, maintaining overnight gains as most Asian markets advance with the MSCI Asia Pacific index 0.5% higher, as sentiment was boosted by President Trump unexpected reversal on China telecom giant ZTE over the weekend when in a Sunday morning tweet, Trump vowed to get the Chinese telco back to business in a surprising policy U-turn after the company announced a halt to major operating activities following a US 7-year supply ban order.

Europe was broadly, if modestly, in the red as a result of the EUR rising to session highs just shy of 1.20, the highest in over a week, after the ECB's Villeroy said the first rate hike could come quarters, not years after the end of asset purchases, while political strains in Italy outweighed optimism over waning global trade tensions. Thanks to the weaker dollar, emerging-market stocks built on their first weekly advance in four weeks.”

VIX futures are higher, but not above the mid-Cycle resistance at 13.87. Above that level may be considered an aggressive buy signal.

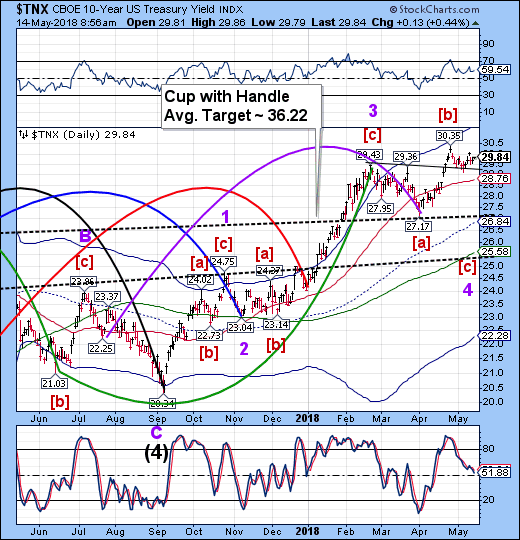

TNX is elevated, but no breakout here. A collapse in yields is likely….

ZeroHedge observed, “A roller-coaster week for rates and the dollar did not stop large speculators adding to their already record-high short positions across the entire term structure.

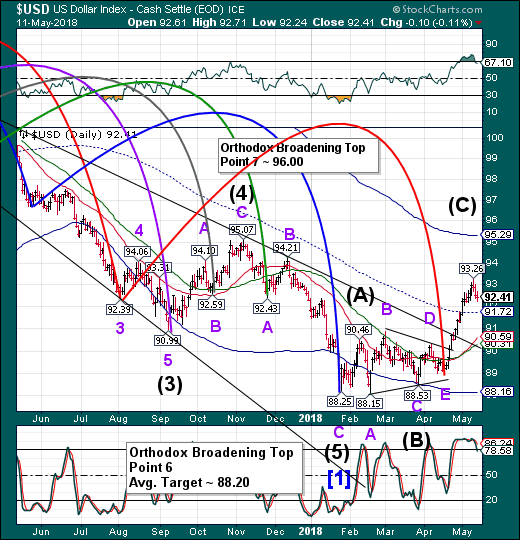

USD Shorts have started to cover aggressively...

Driven mostly by additions to EUR shorts...

BUT, record bond shorts keep getting record-er...

From the shortest-end (ED futures) to the belly (5Y at record shorts...)...

And the longest-duration 'ultras' also at record shorts...

Interestingly, as the Treasury curve has collapsed, it is clear from the chart below that large speculators are betting on curve steepening (reducing their shorts in 2Y TSY and adding to shorts in 10Y TSY) - so far it is failing miserably as the curve crashes to new cycle lows...

Putting this all together, large speculators have never been more short across the entire interest-rate curve - over $4 trillion notional bets in Eurodollars (short-term rates going higher) and around $117 billion notional equivalent short across the Treasury futures curve...

USD futures have made a new low this morning at 92.14 with a probable target near the mid-Cycle support at 91.72.

I’m a little under the weather, but will be in touch as the market develops.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.