The Great Unwinding of the Commodities Carry Trade

Commodities / Credit Crisis 2008 Sep 12, 2008 - 02:33 AM GMTBy: Mike_Shedlock

Commodity Bulls Jump The Shark

Commodity Bulls Jump The Shark

The GlobeAndMail is reporting on The Real Reason Commodities Are Tumbling .

To hear Donald Coxe tell it, the commodity selloff ripping through Canada's stock market is no accident. It is the result of a deliberate, brilliantly executed plan hatched at the highest levels of the U.S. Federal Reserve and Treasury.

U.S. authorities engineered the collapse in commodities a move he said was necessary to shore up the global financial system to be bitter. My attitude is, goddamn it, they're good it was brilliant.

To understand why commodities are plunging now the S&P/TSX plummeted another 488 points yesterday you have to go back to mid-July, when the U.S. Federal Reserve and Treasury first announced steps to support mortgage giants Fannie Mae and Freddie Mac.

The move, which ultimately led to the Treasury taking control of Fannie and Freddie this week, touched off a chain-reaction of market events that culminated with the wrenching decline in commodities.

The Fed's ultimate goal was to trigger a rally in financial stocks, which would, in theory, help banks hammered by the credit crisis raise fresh capital and repair their balance sheets. To accomplish this, the decision to support Fannie and Freddie was deliberately announced on a Sunday, which had the effect of maximizing the reaction from thinly traded financial stocks on overseas markets.

Because many hedge funds were using massive leverage to short financials and go long on commodities, when North American markets opened and banks initially rallied, the funds were forced to cover their short positions.

At the same time, the U.S. dollar was rallying because the risk of holding Fannie and Freddie paper had diminished. The rising dollar, in turn, made commodities less attractive, giving funds that were already scrambling to cover their financial shorts another reason to dump oil, grains and other commodities.

The losses were swift and dramatic. On the Friday before the July 11 announcement, crude oil closed at $145.18 a barrel. Over the following five days, it plunged 11 per cent. “Leverage was being unwound dramatically,” Mr. Coxe said on a conference call last week. “We had a true panic.”

As oil and other commodities were tumbling, fears about the slowing global economy were mounting, giving resources another push downhill. This was also in keeping with the Fed's wishes, because lower commodity prices would help quell fears about inflation.

Mr. Coxe has no proof that the Fed and Treasury acted in concert to boost financials and sink commodities. He is basing his assertions on conversations with hedge fund managers and on years of watching financial markets. “There's no doubt whatever in my mind” about what happened, he says.

Don Coxe Jumps The Shark

See definitions #2 and #6 for the intended meaning of " Jump The Shark "

Those who want listen to an audio of shark jumping can do so at the Don Coxe Weekly Webcast 9/12/2008 .

While it is true the Treasury is guilty of blatant manipulation when it comes to the bailout of Fannie Mae and Freddie Mac, the dollar did not rise nor did oil or commodities drop because of it.

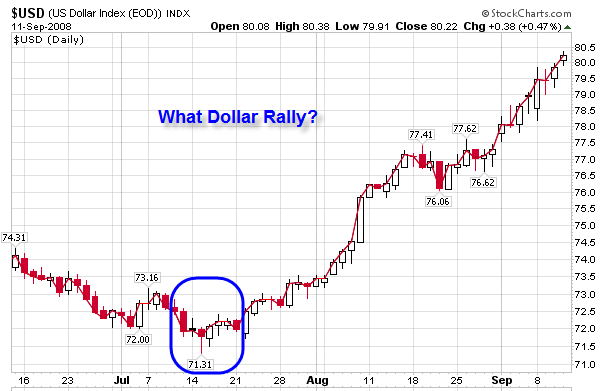

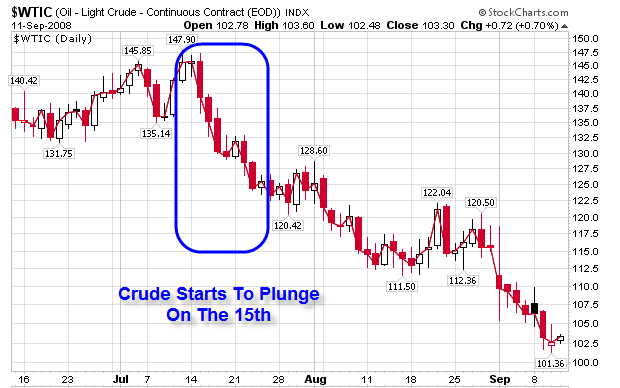

Let's take a look at charts of the US dollar and crude in the aforementioned 5 days around July 11 when crude started to plunge.

US$ Index

Crude

The chart clearly shows that crude started to plunge long before the dollar rally. Right off the bat we can see clearly see Coxe is off on his timeframe in regards to action on the US dollar.

Furthermore, the odds of a Fannie Mae bailout causing crude to plunge immediately but the dollar to stay flat for two weeks then soar are virtually zero.

Yes Coxe is correct that Paulson wanted to ignite a rally in financials, but when it comes to Fannie Mae (FNM), Washington Mutual (WM), Freddie Mac (FRE), Lehman (LEH), and others, I believe one needs to take a look at actual results before making claims of brilliant execution.

Here are the actual results: Fannie Mae and Freddie Mac are both trading under $1. Lehman is under $4. Washington Mutual touched $1.75. Do "brilliantly executed plans" as Coxe puts it, always succeed so spectacularly? If that's success, pray tell what constitutes failure?

The plain fact of the matter is there were many fundamental reasons for the dollar to rally, and it did. Likewise there were fundamental reasons for Fannie and Freddie to become worthless, and they did, in spite of admittedly massive intervention (manipulation).

I have discussed the dollar at great length recently so let's do a review. I ask readers to consider the following:

US Dollar Discussion

- Steve Saville On The US Dollar And Gold

- Marc Faber - Bullish On The US$, Bearish On Commodities

- Currency Intervention And Other Conspiracies

- Fannie, Freddie Common Stock Is Now A Call Option

People will see what they want to see, but the dollar rallied because there was every fundamental reason for it to rally. Was there jawboning by Paulson and Trichet? Of course there was.

However, the market ignored Paulson's jawboning for forever and a day, while Trichet's statements were in regards to a weakening Europe that is now clearly deteriorating rapidly. The dollar was poised to soar on the story of a weakening global economy that was supposed to decouple from the US but failed to do so.

Carry Trade Blows Sky High

An massive unwinding of the carry trade is now fueling the dollar rally. Huge speculation by traders shorting the Yen and going long the Euro, the Pound, the Australian Dollar, and the New Zealand Dollar is being unwound.

Similarly there was massive speculation by traders shorting the dollar and going long the Euro, the Pound, the Australian Dollar, and the New Zealand Dollar. That too is being unwound.

Those sorry bets were made on the misguided belief that Europe, Asia, and especially China would decouple from the US. In other words, massive bets were made that the tail would wag the dog. Now we see how foolish those bets were, especially for the Johnny Come Latelies who plowed into the trade just as it was about to reverse.

New Zealand, Australia, Germany, Ireland, Spain, and the UK are in or rapidly sliding towards recession. This is an enormous fundamental factor and very supportive of a strengthening US dollar.

The net effect of the unwinding of carry trades is the US dollar is rising against every major currency but the Yen, while the Yen is rising against everything.

Inquiring minds may wish to read Carry Trade Rout Continues for more details.

What About Oil?

The reality is there was no fundamental reason for oil to have risen to $148 in the first place. The US economy is in recession. The UK, Japan, New Zealand, Spain, Ireland, Australia and other countries are likewise headed for if not already in recession. There is simply no way that China could keep the energy bull going by itself.

While it may not have been apparent at the time, it certainly should be in hindsight.

China Fuel Buying Binge Ends

Please consider A long wait for China to repeat fuel buying binge .

China's nine-month auto fuel buying frenzy ahead of the summer Olympics helped lift global oil markets to records, but beleaguered bulls beware -- it could be years before conditions force it to launch another raid.

"The massive import levels that we witnessed are not likely to be duplicated for a long time. The point about demand threatening to stall is a real important one," said U.S.-based independent analyst Paul Ting.

Data due on Wednesday should confirm that China imported a hefty 530,000 tonnes (128,000 barrels per day) of diesel in August, a last batch of purchases after buying a record near 1 million tonnes in July, rivaling the United States.

China in Manufacturing Recession

Those who want further evidence of a slowdown in China should consider China's Manufacturing Contracts for Second Month .

Manufacturing in China, the world's fastest-growing major economy, contracted for a second straight month in August, according to a survey of purchasing managers.

The Purchasing Managers' Index was a seasonally adjusted 48.4, unchanged from July, the China Federation of Logistics and Purchasing said today in an e-mailed statement.

Since July, Chinese policy makers have put extra emphasis on sustaining the economy's expansion rather than cooling inflation. Growth has slowed for four quarters and Vice Commerce Minister Gao Hucheng said last week that weakness in global demand will weigh on China's exports for the rest of the year.

Runup In Price Explained

So there you have it. China was ramping up crude supplies like mad ahead of the Olympics. When imports went back to normal levels and Chinese manufacturing went into contraction, the price of crude crashed.

None of this had a thing to do with Paulson or Fannie Mae.

US Fuel Demand Drops

Let's now consider Oil Falls After U.S. Says Refinery Rates, Fuel Demand Dropped .

Sept. 10 (Bloomberg) -- Oil futures fell to a five-month low in New York following a U.S. government report that showed fuel demand declined and refinery production dropped after Hurricane Gustav shut plants along the Gulf Coast.

Operating rates declined to 78.3 percent of capacity in the week ended Sept. 5, the lowest since 2005, when hurricanes Katrina and Rita struck the Gulf, the Energy Department said today in a weekly report. Demand for fuels averaged over the past four weeks declined 3.8 percent, the department's report showed.

Oil supplies increased by 1.77 million barrels in states along the Gulf of Mexico at the same time regional producers shut all U.S. crude output in preparation for Hurricane Gustav. Regional inventories reached 159.6 million barrels, the highest since May.

"We ended up with more oil on the Gulf Coast than we thought because refineries didn't use as much," said David Pursell, an analyst at Tudor, Pickering, Holt & Co. in Houston. "The decrease in refinery usage was offset by a reduction in imports so we ended up with a little more oil in the Gulf Coast, rather than big draws."

OPEC Says It Will Cut Oil Production

If demand for crude was soaring we would not be seeing this: OPEC Says It Will Cut Oil Production .

September 9, 2008

VIENNA — In an unexpected decision made after a six-hour meeting that lasted well into the night, the OPEC oil cartel said it would reduce its oil production by about half a million barrels a day in a bid to stem a rapid decline in oil prices in recent weeks.

Fears that the market was currently oversupplied while demand for oil was slowing led the group to say it would “strictly comply” with production quotas set in September 2007. Since then, the group has been producing above those levels to drive prices down.

In its final statement, the oil-producing group said it had noted “a shift in market sentiment causing downside risks to the global oil market outlook.”

Oil prices peaked at $145.29 a barrel on July 3 but have been falling lately because of slowing global demand .

Oil Prices Falling Because Of Slowing Global Demand

Ding Ding Ding. We have a winner. It's amazing how few can see the obvious truth!

Slowing global demand and a corresponding unwinding of leverage by commodity speculators and carry trade speculators are to blame for falling gold, silver, energy, and commodity prices in general. See Gold, Silver and the Great Unwind for more on this theme.

Yes, there was massive manipulation in the equities markets by Paulson and the SEC. However, that manipulation actually blew up because it did not succeed at rescuing Fannie and Freddie. Furthermore, the "brilliant execution" caused many unintentional consequences as explained in Slope Of Bailouts Is Slippery And Expensive .

The proper conclusion is that screams of manipulation (no matter how loud or by how many) are nothing more than a scapegoat when it comes to the unwinding of the commodity trade. Those who blame manipulation for the ongoing commodities selloff are jumping sharks.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.