Stocks Bear Markets Don’t Start when Real Interest Rates are this Low

Stock-Markets / Stocks Bear Market May 13, 2018 - 04:01 PM GMTBy: Troy_Bombardia

The biggest fear among bearish investors is that “the Fed hiking interest rates will kill the economy and stock market”. But here’s the mistake they’re making.

The biggest fear among bearish investors is that “the Fed hiking interest rates will kill the economy and stock market”. But here’s the mistake they’re making.

Interest rates don’t matter. REAL (inflation-adjusted) interest rates are what matters. Real interest rates are still low right now.

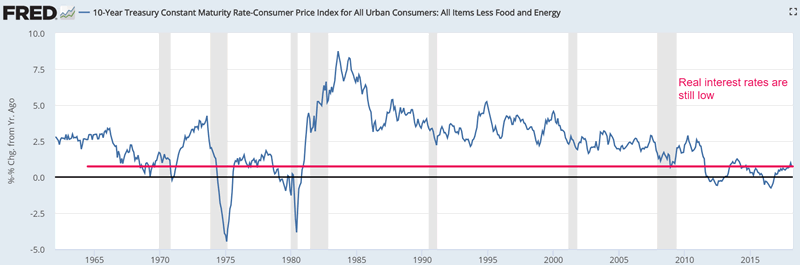

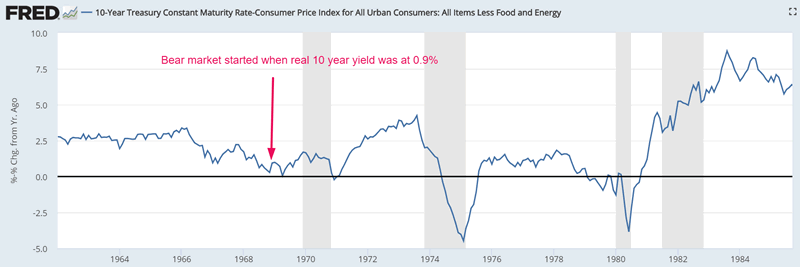

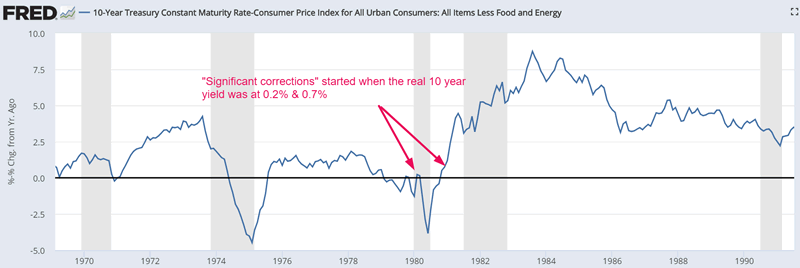

This chart demonstrates the real, inflation-adjusted 10 year yield. It subtracts year-over-year Core CPI growth from the 10 year Treasury yield.

The real 10 year yield is still historically low at 0.74%.

As you can see, historical bear markets don’t usually start when real interest rates are this low. Rates need to go much higher before a bear market can start.

Bear markets don’t start when real interest rates are so low

Here are the 4 historical bull market tops since 1950

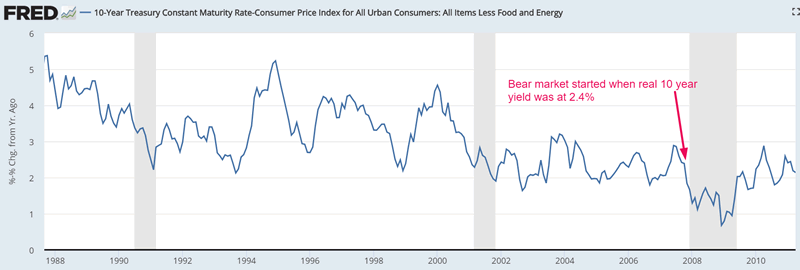

October 2007

This bull market ended when the real 10 year yield was at 2.4%. It’s currently at 0.7%.

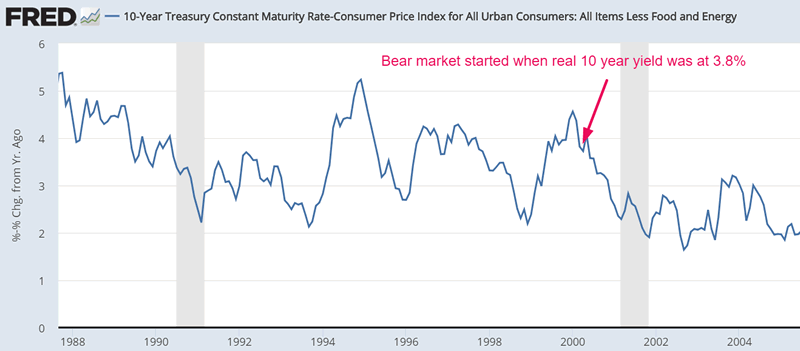

March 2000

This bull market ended when the real 10 year yield was at 3.8%. It’s currently at 0.7%

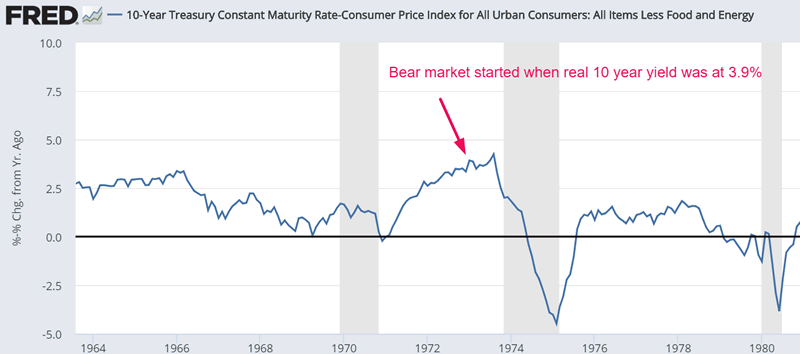

January 1973

This bull market ended when the real 10 year yield was at 3.9%. It’s currently at 0.7%.

December 1968

This bull market ended when the real 10 year yield was at 0.9%. It’s currently at 0.7%.

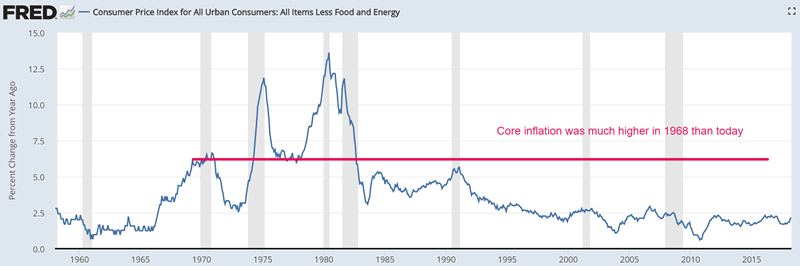

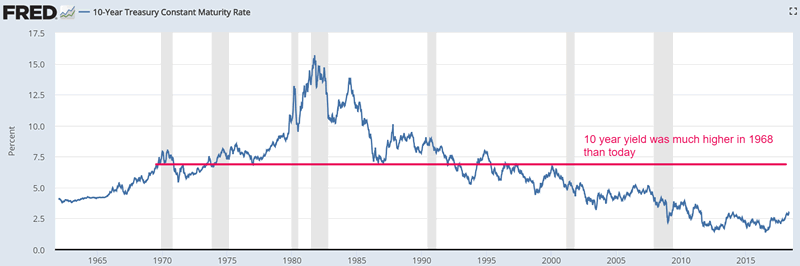

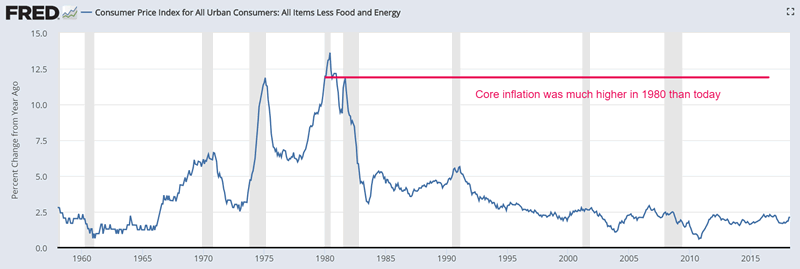

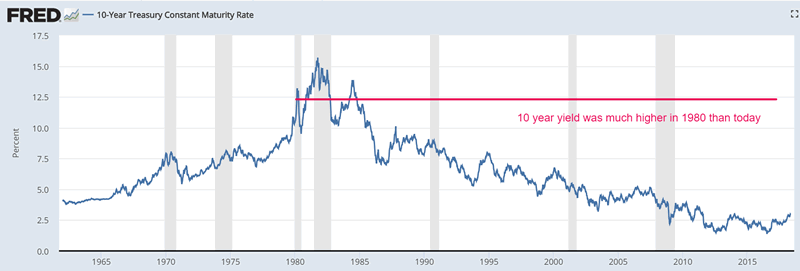

Notice how this historical real 10 year yield isn’t much higher than the current real 10 year yield . But this historical case doesn’t apply to today. The non-adjusted 10 year yield and core inflation were both much higher in 1968 than they are today.

- Core inflation was at 5.1% (vs 2.1% today).

- The 10 year Treasury yield was at 6% (vs. 3% today).

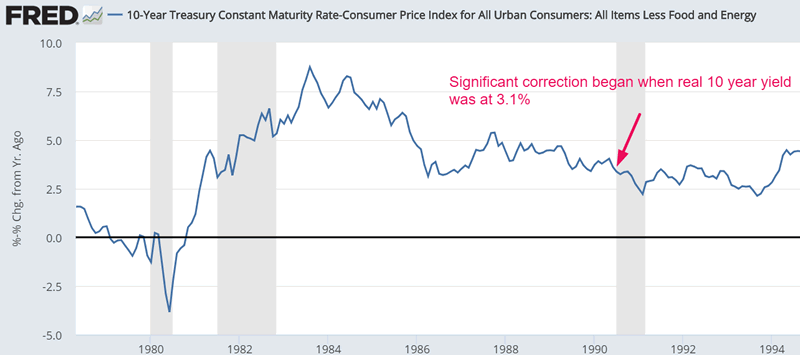

Recession-induced “significant corrections” don’t start when real interest rates are so low

Not all “significant corrections” are caused by recessions, but the ones that are usually don’t start when inflation-adjusted rates are so low.

July 1990

The S&P 500’s “significant correction” started when the inflation-adjusted 10 year yield was at 3.3%. It’s currently at 0.7%.

February 1980

This “significant correction” started when the real 10 year yield was at 0.2%. It’s currently at 0.7%.

This historical case doesn’t apply to today. The non-adjusted 10 year yield and core inflation were both much higher in February 1980 than they are today.

- Core inflation was at 12% (vs 2.1% today).

- The 10 year Treasury yield was at 11.8% (vs. 3% today).

December 1980

This “significant correction” started when the real 10 year yield was at 0.7%. It’s currently at 0.7%.

On the surface it seems like these 2 cases are very similar. They aren’t. The non-adjusted 10 year yield and core inflation were both much higher in December 1980 than they are today.

- Core inflation was at 12.1% (vs 2.1% today).

- The 10 year Treasury yield was at 13.1% (vs. 3% today).

Conclusion

The Federal Reserve needs to hike interest rates much more before this bull market can end. Rates are not “high enough” to hurt the economy and stock market right now. I think it will take another year or two of rate hikes before interest rates will start to hurt the economy and stock market.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.