The S&P 500 and Treasury Yields: A 20-year perspective

Stock-Markets / Stock Markets 2018 May 10, 2018 - 11:47 AM GMTBy: Donald_W_Dony

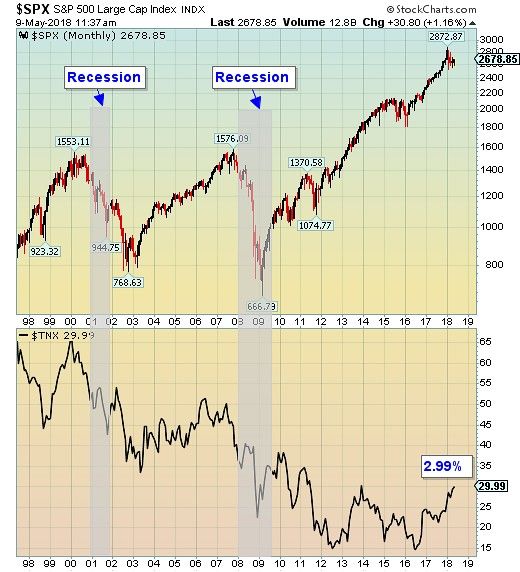

This is a chart comparison between the S&P 500 and the 10-year yields. It shows the rise in bond yields is a normal action during a bull market.

In the last phase of the 1980 to 2000 secular equity rise and throughout the 2003 to 2007 bull market, 10-year U.S. Treasury yields advanced.

And in the course of the last two recessions, rates dropped sharply to try and invigorate a slumping economy and stock market.

During the last six years, rates were kept contained between 1.50% and 2.95%. Bond yields are starting to rise again in 2018 as the U.S. economy posted its 7th quarter of continuous GDP expansion.

We can see how the Fed has used the rate to accelerate the economy and growth, and when needed, apply the brakes.

Moving forward, the Fed has mentioned 3 to 4 rate hikes can be expected in the coming 12 months. This rise in bond rates would be on par with past actions during periods of economic expansion and stock market growth.

Bottom line: Following the past movements from the Fed, the 10-year Treasury yields are expected to rise in 2018. Models project a late 2018 target of 3.70%.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2018 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.