Fed FOMC Update: Stagflation on the Horizon

Economics / Inflation May 03, 2018 - 06:12 PM GMTBy: Graham_Summers

The Fed is fast approaching its worst nightmare.

Stag-flation.

Stagflation is when inflation is rising at the same time that the economy is weakening, if not contracting.

The Fed has always argued that low levels of inflation (2%) were acceptable provided the economy was also growing. Indeed, this is the very gimmick the Fed has utilized to mask the fact that quality of life has been falling in the US since the early ‘70s (by understating inflation, the Fed has overstated economic/ income growth).

All of the negative effects of inflation (wealth inequality, higher costs of living, increased debt required to maintain living standards) are “masked” by the Fed’s argument, “look how well the economy is doing! If we weren’t running things everything would be much worse. A little inflation isn’t a bad thing after all!”

Not with stagflation.

With stagflation you’ve got the economy shrinking, meaning people are losing their jobs and incomes are falling at the SAME time that the cost of living is exploding higher and thing are getting more expensive.

Cue yesterday’s Fed FOMC statement in which the Fed REMOVED its claim that the “economy outlook has strengthened.”

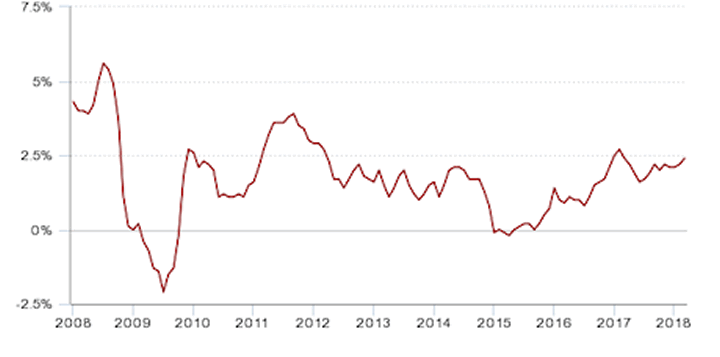

So the Fed has noticed that the economy is slowing and no longer has a great outlook. And this is happening at a time when the Fed’s official inflation measure, the CPI, is clocking in at 2.36% year over year (which incidentally the Fed is trying to ignore).

Put simply: stagflation is here.

We just published a Special Investment Report concerning a FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.