Too Many Stock Investors on the Same Side of the Boat

Stock-Markets / Stock Markets 2018 May 03, 2018 - 03:25 PM GMT Good Morning!

Good Morning!

SPX futures are down and appear to have declined beneath the May 1 low. The Dow is the first major Index to break its 200-day Moving Average on no news.

ZeroHedge observes, “Dow futures suddenly dropped at around 0745ET - led by a drop in the dollar and Treasury yields - breaking below its 200-day moving average...

There was no clear catalyst though some suggested an 'old news' headline that hit Bloomberg at 0740ET - GIULIANI SAYS COHEN `DEFINITELY' WAS REIMBURSED - may not have helped. But as Dow futures broke the 200DMA, gold jumped...”

NDX futures are lower this morning, as well.

ZeroHedge observes, “It has been a confusing 24 hours, with US futures slumping after yesterday's unexpectedly hawkish-yet-dovish FOMC, which first slammed the dollar, then sent the USD surging, and sparking an equity selloff even as rates remained relatively unchanged. Today's this confusion spilled over into international markets, with both Asian and European shares retreating, as traders are on edge ahead of the US-China trade talks taking place today and tomorrow.

The weakness continued this morning, when another disappointing euro-zone core CPI number (1.1%, Exp. 1.2%, last 1.3%) led to sharp rally across EGBs, dragging Treasurys higher in response, and bull-flattening the curve as 10Y yields slumped.”

VIX futures are higher, but have not exceeded the May 1 high, much less the Wave 1 high at 19.84. To many, VIX appears to be “normal.” However, note the rising bottoms, suggesting a growing upside momentum. The breakout ma be spectacular.

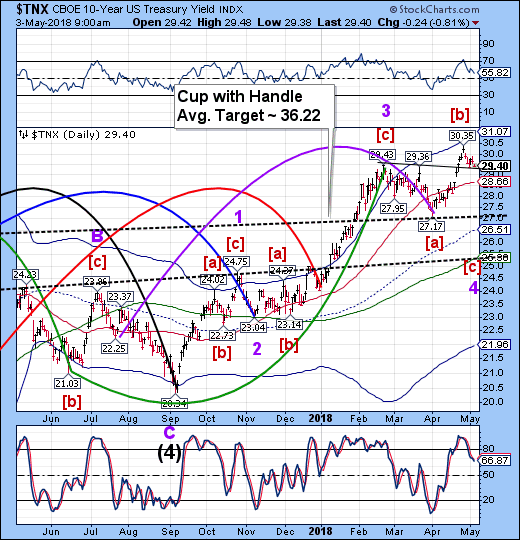

TNX is “hugging” the trendline at 29.30, but hasn’t yet broken down. Please read my Mid-Week Report on UST. The Commercials are hugely net long UST while both large and small Speculators are hugely net short. A breakdown appears to be about to happen.

Lance Roberts observes, “In early 2018, I penned a post which illustrated the legendary Bob Farrell’s 10-investment rules. Bob, one of the great investors of our time, had a very pragmatic approach to managing money. Investing rules, and a subsequent discipline, should be a staple for any investor who has put their hard earned “savings” at risk in the market. Unfortunately, far too many invest without either which leads to less than desirable outcomes.

As of late, there has been a lot of excitement over two areas of the market in particular: interest rates and oil prices. In fact, at this moment the speculation in these two areas is at record levels.”

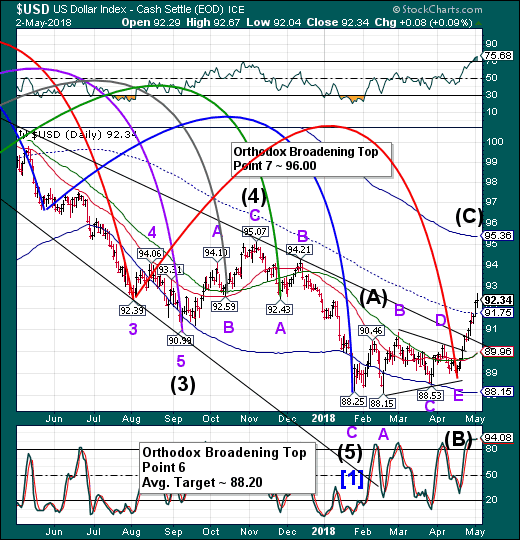

USD futures are taking a bit of a reprieve this morning. There is nothing in the Cycles Model to suggest a reversal here, but we may expect to see a pullback to mid-Cycle support at 91.75. Those still short the USD may have a chance to get off the boat.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.