Consumers Have Finally Become Bearish on Stocks

Stock-Markets / Stock Markets 2018 May 01, 2018 - 03:01 PM GMTBy: Troy_Bombardia

The Consumer Confidence survey also measures what consumers think the stock market will do. This is essentially a sentiment survey for the stock market.

The Consumer Confidence survey also measures what consumers think the stock market will do. This is essentially a sentiment survey for the stock market.

Consumers were bullish on the stock market from Trump’s election until this month. Whenever the stock market goes at least 1 year without consumers being bearish on the stock market, the stock market tends to go higher in the medium-long term (historically).

Here are the historical cases in which consumers became bearish on the stock market after being consistently bullish for at least 1 year.

- August 1990

- April 1994

- April 1997

- September 1998

- January 2001

- September 2005

- September 2015

Here’s what the U.S. stock market did next

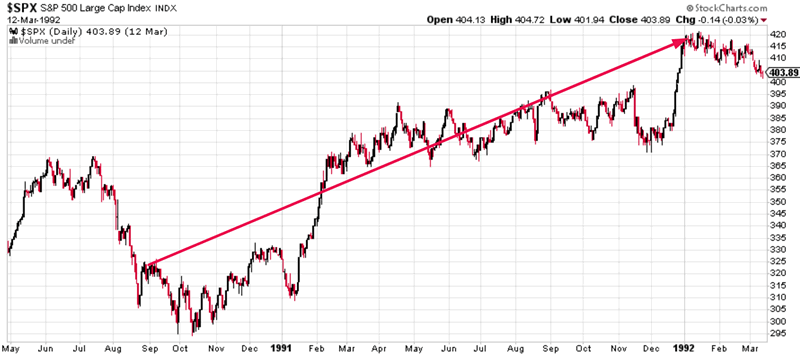

August 1990

This occurred near the bottom of the S&P 500’s “significant correction”. The S&P bottomed soon. The next “significant correction” began 3.5 years later in 1994.

April 1994

This occurred after the S&P made a “significant correction”. The S&P swung sideways throughout the rest of 1994 before soaring in 1995.

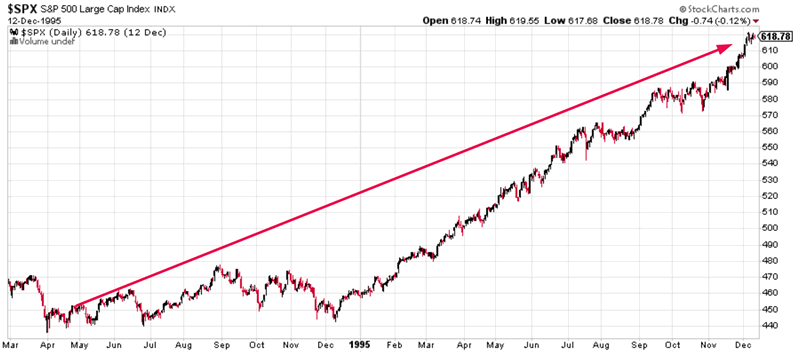

April 1997

The S&P rallied until it began a “significant correction” more than 1 year later in July 1998.

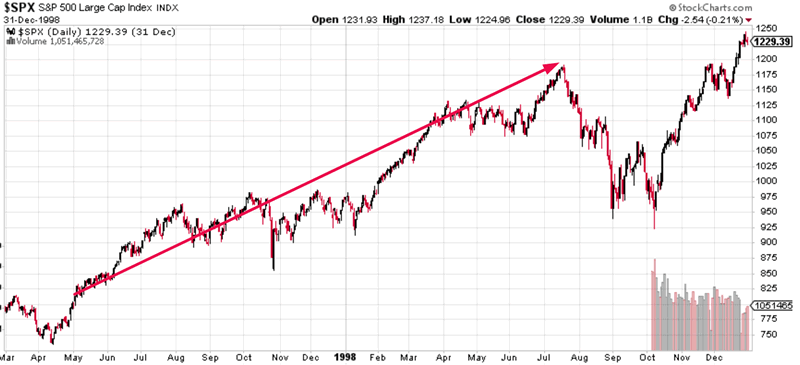

September 1998

This occurred near the bottom of the S&P’s “significant correction”. The stock market rallied for another 1.5 years until the next bear market began in March 2000.

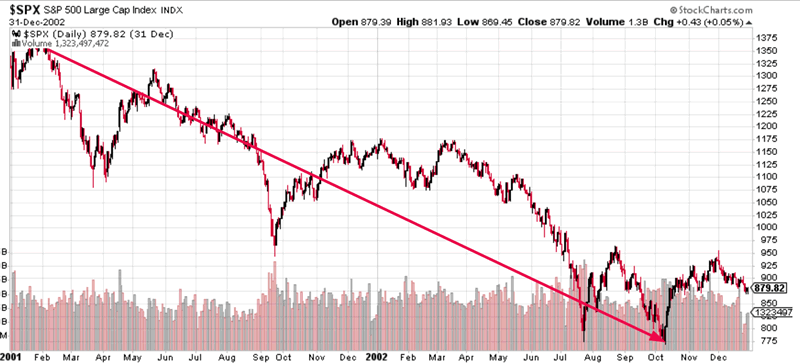

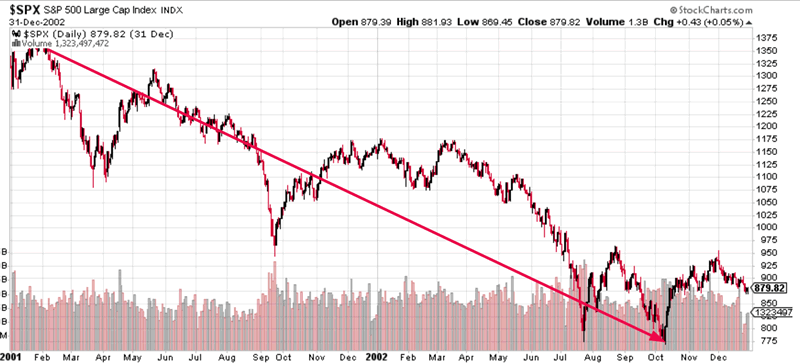

January 2001

This occurred near the beginning of the 2000-2002 bear market.

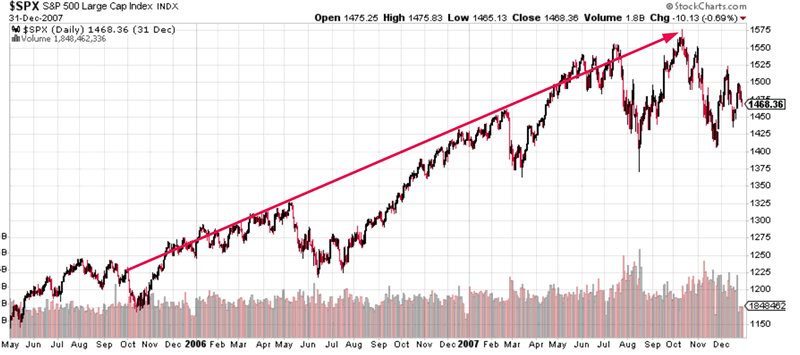

September 2005

The S&P rallied until the next bear market began 2.5 years later in October 2007.

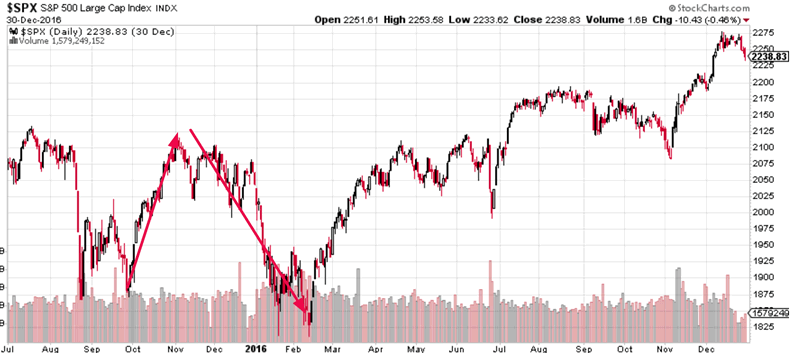

September 2015

This occurred near the bottom of the S&P’s “significant correction”. The S&P later retested this level in early-2016, but it didn’t go much lower.

Conclusion

You can see that this was usually a bullish sign for the stock market from a risk:reward perspective. The stock market sometimes fell a little more in the short term, but the medium-long term trend was UP.

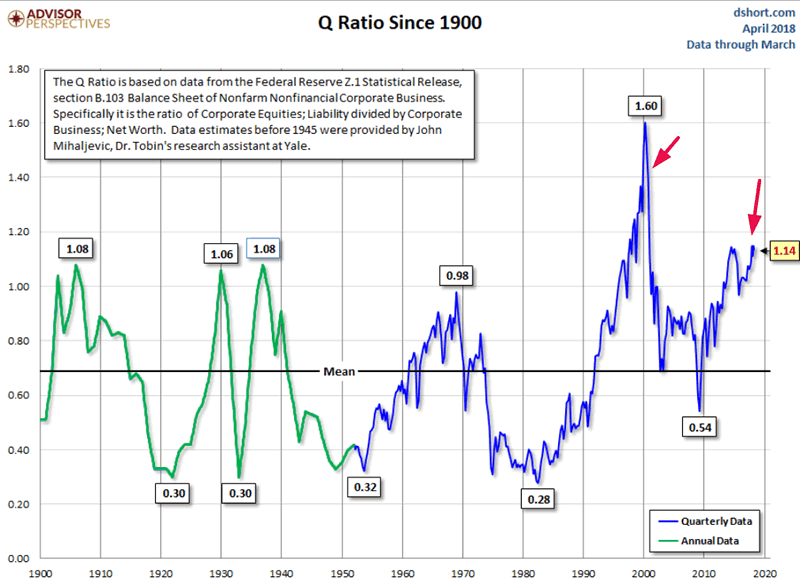

The one bearish case – January 2001 – has 1 big similarity to today. Both cases occurred when the stock market’s valuation was very high. This historical case was very bearish.

I think the bullish and bearish cases cancel eachother out. This is neither bullish nor bearish for the stock market. I usually avoid sentiment-related indicators.

Read Stocks on April 28-29: weekend outlook

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.