US Economy Is Cooked, the Growth Cycle has Peaked

Economics / US Economy Apr 23, 2018 - 09:14 AM GMTBy: Adam_Taggart

Hours ago, European Central Bank chief Mario Dragho conceded: "The growth cycle may have peaked"

Hours ago, European Central Bank chief Mario Dragho conceded: "The growth cycle may have peaked"

Of course, those paying attention to the data already knew this. Our politicians and central planers have been peddling to us the fantasy that the global economy is strengthening, finally ready to fire on all cylinders after nearly ten years of dependence on monetary stimulus.

That just ain't so.

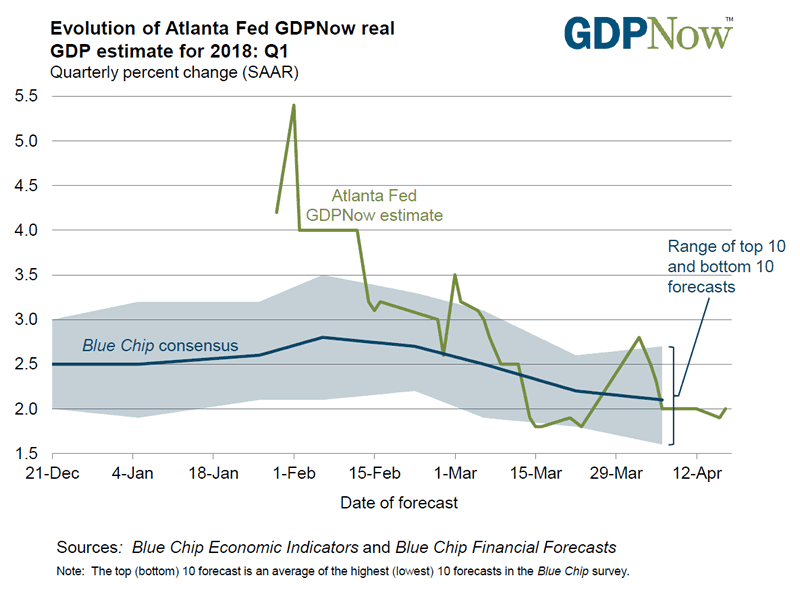

The Federal Reserve of Atlanta's GDPNow measure, which gives a forecast of Q1 2018's expected GDP, is currently coming in at 2.0%, down from the much more vigorous 5.4% growth predicted as recently as early February:

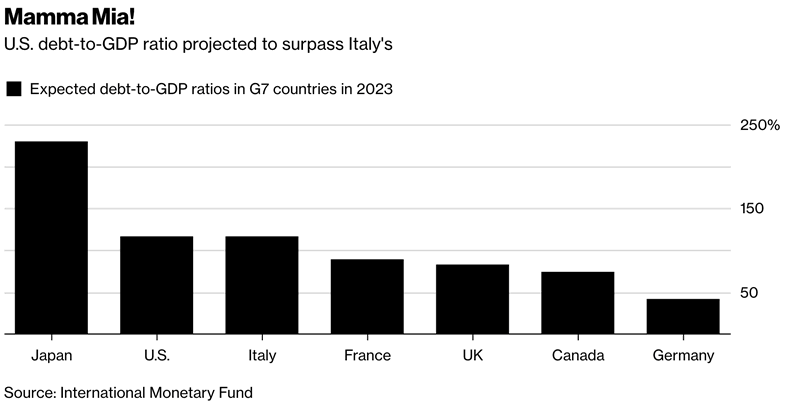

Generating this growth, meager as it is, has required a tremendous amount of new debt. So much more so that the US will soon have a worse debt-to-GDP ratio than perennial fiscal basket-case Italy:

U.S. Debt Load Seen Worse Than Italy's by 2023, IMF Predicts (Bloomberg)

In five years, the U.S. government is forecast to have a bleaker debt profile than Italy, the perennial poor man of the Group of Seven industrial nations.

The U.S. debt-to-GDP ratio is projected widen to 116.9 percent by 2023 while Italy’s is seen narrowing to 116.6 percent, according to the latest data from the International Monetary Fund. The U.S. will also place ahead of both Mozambique and Burundi in terms of the weight of its fiscal burden.

The numbers put renewed focus on the U.S. deteriorating budget after the enactment in December of $1.5 trillion in tax cuts, and the passage more recently of $300 billion in new spending. President Donald Trump’s administration argues that the tax overhaul combined with deregulation will help the economy accelerate, which in turn will generate enough extra revenue to avoid any fiscal fallout.

Officials with the Federal Reserve and Congressional Budget Office are skeptical about those expectations, as they forecast long-term economic growth will fall short of expansion rates needed to fund tax cuts. The central bank’s most recent forecasts show a median estimate of 2.7 percent for this year’s expansion slowing to 2 percent in 2020, while the CBO sees GDP growth slowing from 3.3 percent this year to 1.8 percent in 2020.

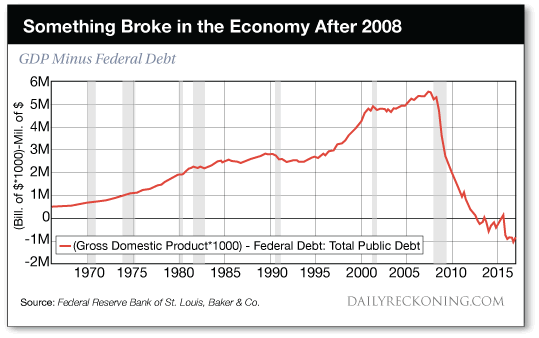

Looking back across the past 50 years, we can clearly see that the 2008 Great Financial Crisis was a turning point. That was the moment where our addiction to exponentially increasing our debts began to have real consequences.

The chart below clearly shows that, since then, we've been in an era of diminishing returns in exchanging debt for growth:

What can ride to the rescue at this point? Not much.

Our 'recovery' since 2008 is now one of the longest on record; another recession will occur sooner or later (Fannie Mae head economist Doug Duncan thinks one will likely arrive by next year).

Rising interest rates will only accelerate the advance of a recession. And interest rates are indeed on the rise, with 10-year Treasury yields having nearly doubled since July 2016:

10-YEAR TREASURY YIELD (%)

And with the arrival of recession, what will our leadership do? The only thing it knows how: print, borrow and deficit spend in attempt to boost 'growth'. Except the debt will be even more expensive this time, and it's ability to generate incremental growth per unit of new debt even weaker.

The Bigger Predicament

But sadly, as prodigious as it will be, our growing pile of debt isn't going to be the primary limiter of growth in the coming decades.

Instead, it will be Energy.

Oil prices are on the rise again, as the world is waking up to the fact that annual demand will exceed supply for decades to come and that the US shale 'miracle' will be a short-lived mirage. All while new oil field discoveries are the worst since World War 2.

With increasingly expensive energy -- and increasing global competition for it -- the economy will find itself increasingly constrained. We will be faced with a future of doing less.

This is not fear-mongering; it's science. Specifically, our destiny is in the hands of the Laws of Thermodynamics. Without a surfeit of new, plentiful, BTU-dense and affordable energy sources (which we simply don't see on the horizon), economic growth cannot be sustained.

One of the best explanations I've read on this is the report my fellow Peak Prosperity co-founder, Chris Martenson, wrote upon finishing the book version of The Crash Course. It remains to this day one of his most seminal warnings of the global predicament we a species face on this finite planet.

In Part 2: Energy Is The Non-Negotiable Element Defining Our Future, we re-publish this report in full, which is even more relevant and important to heed today then when Chris wrote it eight years ago -- as our economy specifically, and humanity in general, are totally unprepared for a future of even slightly less energy.

Everything is tuned to grow exponentially. There is no "plan B".

We have no models yet for how to manage in a world of de-growth, so we will blindly slam into this crisis head-on. But as painful as they will be, the economic woes at that time will be the least of our worries.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

Adam Taggart

© 2017 Copyright Adam Taggart - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.