Is War "Hell" for the Stock Market?

Stock-Markets / Stock Markets 2018 Apr 19, 2018 - 03:52 PM GMTBy: EWI

Take a look at stock market behavior in times of war… and peace

Are wars bullish or bearish for stocks?

With the recent news of airstrikes on Syria and a threat of a global war, this question is extremely relevant. But does war really cause stock markets to rise and fall?

You might be surprised when you review these six charts.

William Tacumseh Sherman was a U.S. Army general during the Civil War who is known for the burning of Atlanta.

He also uttered the famous phrase, "War is hell."

Of course, this is very true.

But, is war also a big negative for the economy and stocks? Some market observers believe so. They argue that war diverts resources from productive enterprise, and mention the factories that are destroyed in war.

Others posit that war is good for stocks and the economy because the government forks over big money to companies to produce war materials.

So, who has the winning argument?

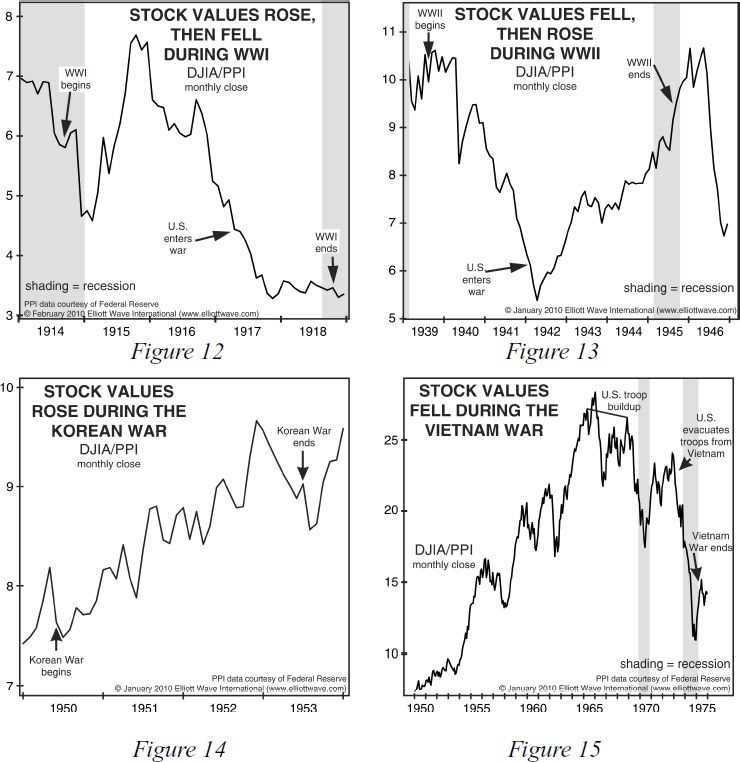

Elliott Wave International wanted to know the answer to that question ourselves. So, we looked at the path of stock prices during World War I, World War II, the Korean War and the Vietnam War to see if we could find any consistent correlations.

These four charts from Robert Prechter's 2017 book, The Socionomic Theory of Finance, show you what our research revealed (comments from the book are below):

Figure 12 shows a time of war when stock prices (normalized for inflation) rose, then fell; Figure 13 shows a time when they fell, then rose; Figure 14 shows a time when they rose throughout; and Figure 15 shows a time when they fell throughout the hottest half (1965-1975) of a twenty-year conflict. Who wins the war doesn't seem to matter. A group of allies won World War I as stock values reached fourteen-year lows; and nearly the same group of allies won World War II as stock values neared fourteen-year highs.

Obviously, we found no consistent correlation between the performance of the stock market and war.

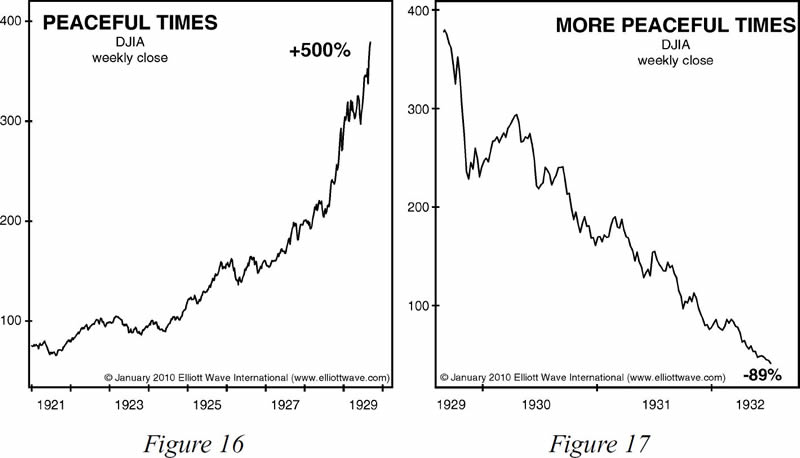

But, how about during times of peace? Well, we checked that out too.

Here are two more charts from The Socionomic Theory of Finance, along with the commentary:

Figure 16 provides an example from the 1920s in which stock prices seemingly benefited from peaceful times. The Dow rose over 500% in just eight years as peace mostly reigned around the globe.

Figure 17, however, shows that in the three years immediately thereafter, peace likewise mostly reigned around the globe yet stock prices fell more than they had risen in the preceding eight years!

So, despite the universal assumption to the contrary, the evidence shows that there's no consistent relationship between stock prices and peace -- or war.

However, we do encourage you to analyze the market's Elliott wave structure.

Other research we've conducted shows that market prices trend and reverse in recognizable patterns.

Is Your Portfolio Built on False Assumptions?

Download this Free 33-Page Report to Find Out.

Did you know that the vast majority of portfolios are built on false assumptions? These false assumptions -- or Market Myths -- have been passed down across generations. They are so baked into investor psyche that no one ever thinks to challenge them... but we do. Do earnings really drive stock prices? Can the FDIC actually protect you? Is portfolio diversification a smart move? Download Market Myths Exposed now and find out whether your portfolio is built on flawed foundations. We guarantee you'll be shocked to find the truth.

Sign up now and get FREE access to The Market Myths Exposed eBook

This article was syndicated by Elliott Wave International and was originally published under the headline Is War "Hell" for the Stock Market?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.