Bitcoin Hater George Soros Finally Admits He Wants In On Crypto

Currencies / Bitcoin Apr 19, 2018 - 09:40 AM GMTBy: Jeff_Berwick

America’s favorite power broker, the evil bloated Ringwraith himself, George Soros, is now poised to invest in cryptocurrency, despite trashing Bitcoin just a few months ago.

America’s favorite power broker, the evil bloated Ringwraith himself, George Soros, is now poised to invest in cryptocurrency, despite trashing Bitcoin just a few months ago.

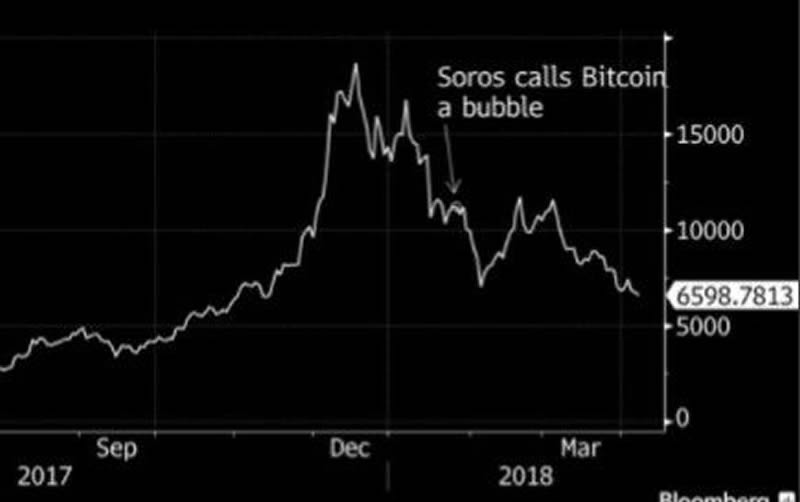

In addition to calling Bitcoin a “bubble”, Soros ironically stated that digital currencies are a tool for dictators:

As long as you have dictatorships on the rise, you will have a different ending, because the rulers in those countries will turn to Bitcoin to build a nest egg abroad.

Bloomberg is now reporting that Soros Fund Management has been approved to start investing in virtual currencies.

So the tide has turned, and Adam Fisher, the fund’s manager of macro investing and no doubt one of Soros’ Orcs, has finally been given the greenlight on crypto. As of now, though, no wagers have been made.

It’s a big move by someone notoriously dubbed “the man who broke the Bank of England” thanks to his incredible financial scheming back in the 90’s when he was essentially the good guy, not the bad guy.

On Black Wednesday, September 16, 1992, Soros sold short over $10 billion worth of British Pounds against the BoE—a massive amount back in the day.

The cunning maneuver earned Mr. Ringwraith around $1.1 billion—and he was soon invited to meet with the Dark Ring Lord herself, the Queen of England. Not long after, though, Soros started his foundation, and so began his decades-long quest for global dominance.

Is Soros’ move into crypto a sign that decentralized digital currencies are actually taking over?

Or does the diabolical investor have something more sinister up his sleeve?

I have to admit, I feel very queasy about him getting involved now… but we’ll see how things turn out in the coming years.

In the past, we here at TDV have followed a few of Soros’ financial moves---now he’s following ours.This probably make some libertarians feel sick to their stomachs yet, still, we both expect to enjoy massive profits---but while the Ringwraith has shown he intends to use his wealth for a globalist, statist agenda, we’re using our riches to spread freedom far and wide.

It’s an epic battle and no one knows who the eventual winner will be yet. But if you care about all things good, you’ll be cheering for our side.

You can find our winning strategies and perspectives in The Dollar Vigilante newsletter. Not only do we present profitable positions each month that our subscribers have acted on, but we have anticipated Soros by months and, in some ways, even by years.

If you read TDV (subscribe HERE), you know we're fighting the system by selling the government’s tanking dollars and buying gold and gold-related securities. We’re also protecting ourselves by taking many other innovative approaches.

In fact, the “Dollar Vigilante” name was inspired by what Soros did in the 90s. He was dubbed a “bond vigilante” which sounded awesome at the time. Since then, though, he clearly has gone down the dark path. Apparently that happens whenever anyone gets too close to that goddamned ring.

See, in The Lord of the Rings, the ring of power symbolized the state---it’s a tale about freedom written by anarchist J.R.R. Tolkien. While the men, elves, dwarves, and hobbits fought against the ring’s absolute power, we are dollar vigilantes battling the State’s absolute power... in real life.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2018 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.