Stock Market Futures Bounce, But Stopped at Trendline

Stock-Markets / Stock Markets 2018 Apr 16, 2018 - 02:25 PM GMT SPX futures bounced back but appear to be stopped at the 2-year trendline at 2675..00-2680.00 without making a new high. The Cycles Model suggests there may be some residual strength throughout the week during which options expiration may take precedence. OpEx has the ability to increase turmoil in the markets. As a result, this period may be protected by the powers that be.

SPX futures bounced back but appear to be stopped at the 2-year trendline at 2675..00-2680.00 without making a new high. The Cycles Model suggests there may be some residual strength throughout the week during which options expiration may take precedence. OpEx has the ability to increase turmoil in the markets. As a result, this period may be protected by the powers that be.

Once Wave (3) begins, it should be unstoppable. However, there may be an effort to delay its onset.

ZeroHedge reports, “Global markets breathed a sigh of relief on Monday after this weekend's Syrian airstrikes, with bond yields rising, the dollar lower, Asian and European stocks mixed, and US futures spiking, as investors assessed the prospect of escalating geopolitical tensions after a U.S.-led airstrike on Syria hit only 3 targets - instead of the rumored 8 - and with Russia failing to respond, fears of an imminent military conflict have been sharply ratcheted down, resulting in a generally bullish market reaction.”

VIX futures hit a new retracement low over the weekend. The Master Cycle low is now two weeks overdue which makes it likely tha the low is imminent if not having occurred over the weekend. It is rare to see a Master Cycle low come due more than 17 days beyond the mean period of 258 days.

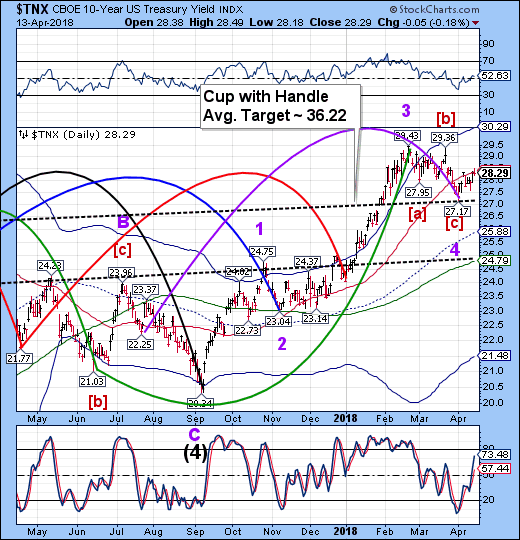

TNX futures are higher this morning. The threat of higher rates may be the downfall of the equities.

ZeroHedge comments, “Is the global economic recovery over?

That is the question investors are grappling with just as Q1 earnings season - the best since 2011 with its 18% Y/Y expected EPS growth - enters its busiest week yet. Meanwhile, as discussed here extensively in recent weeks, over the past two months economic data from around the globe, but especially Europe and the US, has come in unexpectedly soft resulting in the first negative print in Citi's Global Eco Surprise Index, and now the most negative since early 2016...

... and, more notably, an inversion in the forward OIS curve - the first in 13 years - which as JPMorgan noted was the clearest confirmation that the US economy is very "late cycle", and that a conventional yield curve inversion (2s10s), a harbinger of recession, is not far behind.”

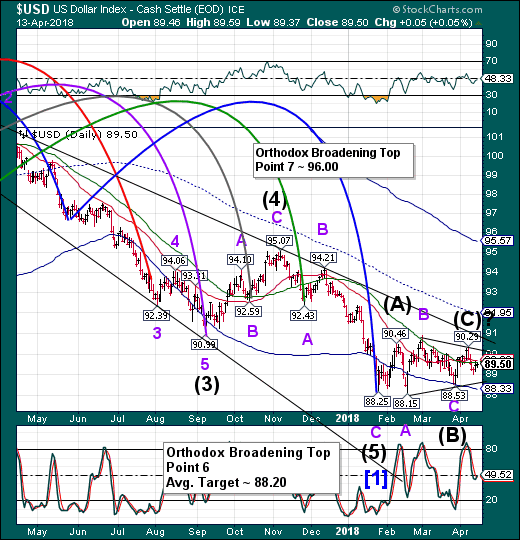

USD futures are declining. The Master Cycle low is due over the next few days. Its potential target may be as low as the Cycle Bottom at 88.33. From there we may see a rally to the Cycle Top resistance at 95.57.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.