Stock Market SPX May Tangle with the 50-day MA

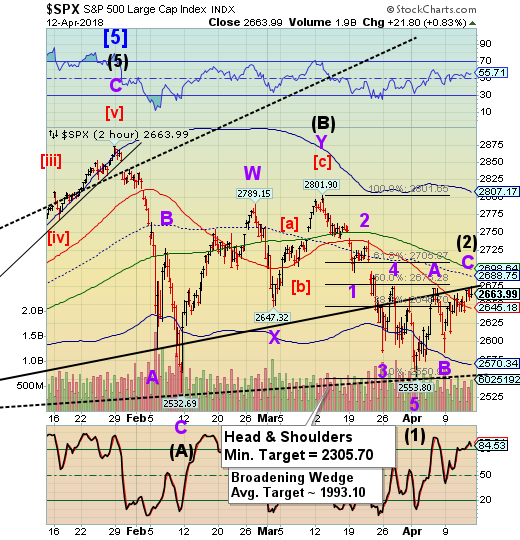

Stock-Markets / Stock Markets 2018 Apr 13, 2018 - 03:11 PM GMT SPX has been correctively chopping higher on declining volume the past four days. It has bumped against the 2-year trendline five times in the past three days without a breakout. It hasn’t broken above the 50% Fib retracement at 2677.85. Could there be a breakout this morning? The EW Wave structure does allow a boost to just under 2700.00 with the current view. The 50-day Moving Average is at 2698.64.

SPX has been correctively chopping higher on declining volume the past four days. It has bumped against the 2-year trendline five times in the past three days without a breakout. It hasn’t broken above the 50% Fib retracement at 2677.85. Could there be a breakout this morning? The EW Wave structure does allow a boost to just under 2700.00 with the current view. The 50-day Moving Average is at 2698.64.

ZeroHedge reports, “As DB's Jim Reid says this morning, "Welcome to Friday 13th. As everything is so calm and stable in the world at the moment what could possibly go wrong today?" As of this moment, not much judging by the solid bid in overnight markets.

Are stocks getting trade and/or "hot" war burnout on this ominous day in the calendar? Judging by the relatively lethargic overnight volumes, this may be the case. And with volumes low, it means the levitation algos have been activated, pushing both US stock futures...”

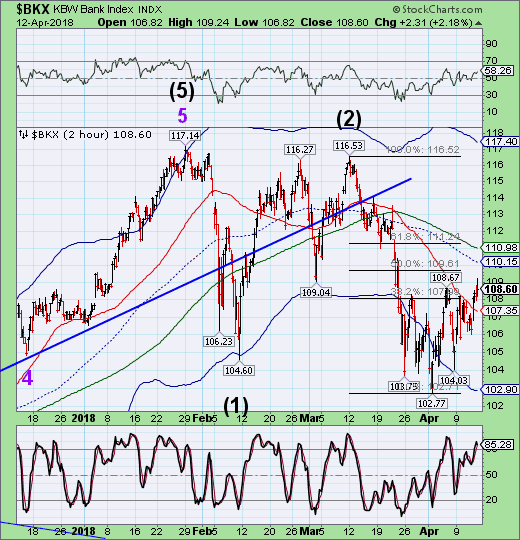

On Wednesday Jim Cramer opined that the bulls may be looking for some relief from bank earnings, which start being announced today. He commented, “On Friday, earnings season will kick off in earnest with reports from four big banks — Citigroup, J.P. Morgan, Wells Fargo and PNC Financial— and CNBC's Jim Cramer thinks it'll be just what this market needs.

"This is the most important earnings season for the big banks in years," the "Mad Money" host said on Wednesday. "Some good performance by the financials [is] one of the few things that could get us back on track."

ZeroHedge reports, “Unofficially launching the Q1 earnings season (technically PNC was first), moments ago JPMorgan reported Q1 earnings which beat on both the top and bottom line, with revenue of $28.5BN above the $27.68BN consensus est (and above the highest sellside estimate of $28.23BN), generating EPS of $2.37, also beating expectations of a $2.28 print.”

However, there is a fly in the ointment. ZeroHedge points out that, “While JPM was quick to highlight all the favorable data in its oddly shrinking earnings presentation supplement, one thing that continued to be conspicuously missing was the bank's slide on "Mortgage Banking And Card Services" which year after year, quarter after quarter was traditionally part of the bank's earnings presentation - it was certainly featured prominently one year ago... “

So, yes, there is a probable boost in the market from bank earnings, but it may be short lived. Chapter 11 bankruptcies are up 63% from a year ago. Another cloud on the horizon is that S&P has put Deutsche Bank on Credit Watch yesterday.

VIX came down further this morning, hitting a low of 17.72. That brings the retracement percentage to 65%, which is not excessive for the VIX.

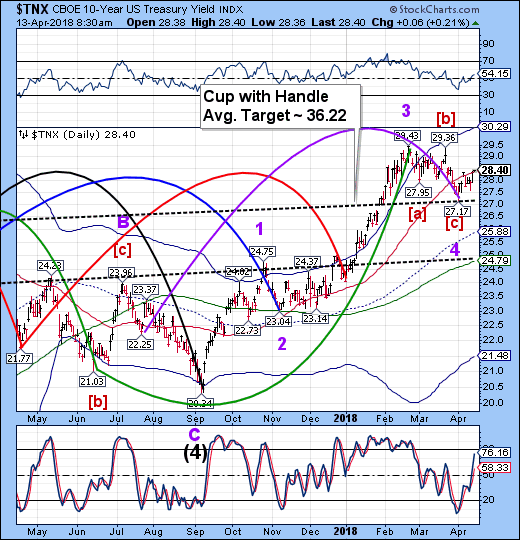

TNX appears to be riding higher on Intermediate-term support at 28.36. Should it remain above support, it may continue its upward path through the second week of May. The upward thrust in treasury yields may be the undoing of the stock market, as well as bonds.

While 30-year Treasuries sold at the lowest yield since January, while the US Government is starting to admit it has a spending problem.

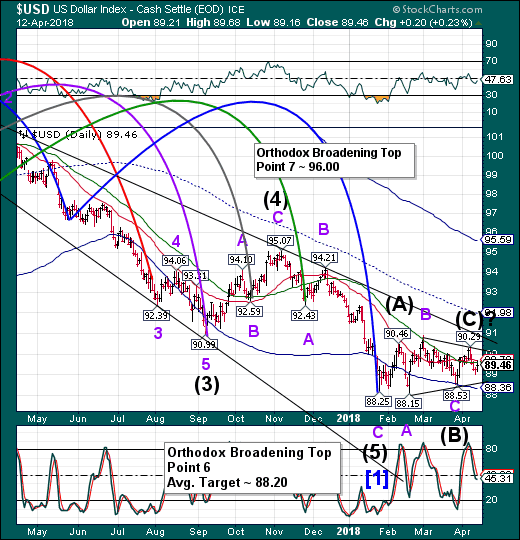

USD futures are steady this morning while we await a breakout in either direction. The Cycles Model suggests a decline through next week. A shallow decline suggests a Triangle formation is developing followed by the Dollar on a rebound. A deeper decline may not be recoverable.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.