Thoughts On Credit Default Swaps

Companies / Corporate Bonds Sep 10, 2008 - 02:39 AM GMTBy: Mike_Shedlock

Credit Default Swaps (CDS) on Lehman (LEH) and Washington Mutual(WM) were soaring on Tuesday. This should not be surprising given that both stocks were hammered today. Lehman was down a whopping 45% and Washington Mutual was down 20%. Also of note, Wachovia (WB) was down 14%. For more on Lehman, please see Lehman Worth A Big Zero?

Credit Default Swaps (CDS) on Lehman (LEH) and Washington Mutual(WM) were soaring on Tuesday. This should not be surprising given that both stocks were hammered today. Lehman was down a whopping 45% and Washington Mutual was down 20%. Also of note, Wachovia (WB) was down 14%. For more on Lehman, please see Lehman Worth A Big Zero?

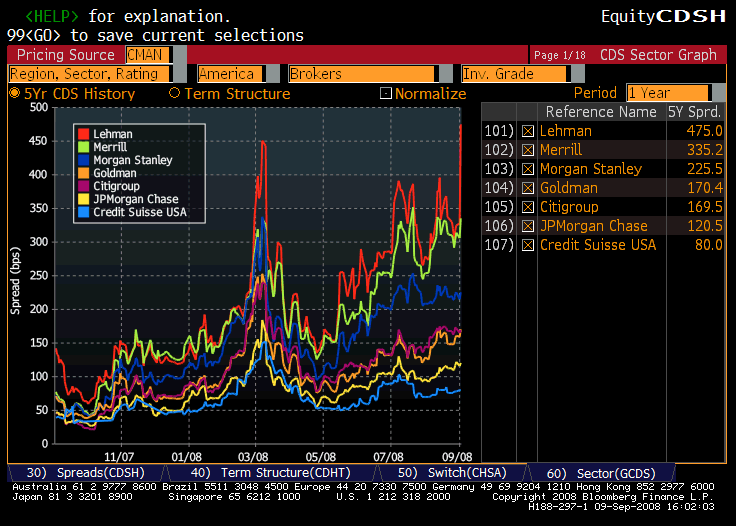

Here are some CDS charts courtesy of Chris Puplava at Financial Sense .

Washington Mutual, Wachovia CDS

Lehman, Broker Dealers CDS

Washington Mutual CDS soared to a new all time high today at 1798. Those looking for a survivor of this mess might notice Wells Fargo (WFC) at 129. Wachovia (WB), for whatever reason is hanging suspiciously tough at 312. Lehman soared to a new high at 475.

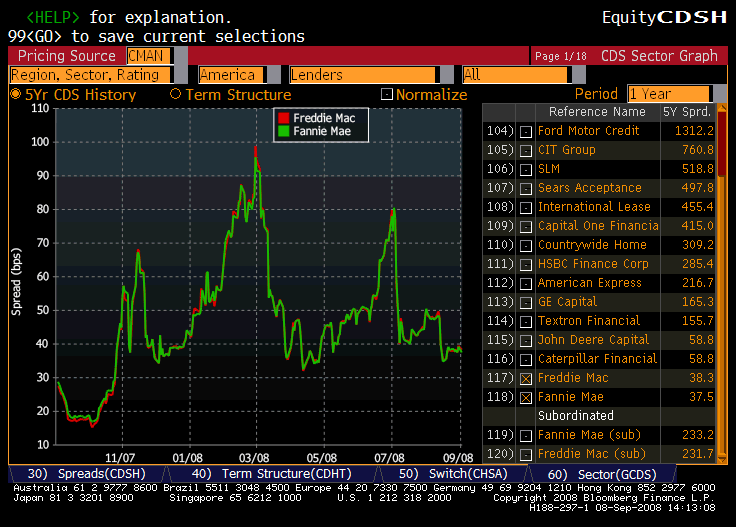

One of the problems with this kind of evaluation can be found in an analysis of Fannie Mae and Freddie Mac. Inquiring minds may wish to consider Big Non-Event In Fannie, Freddie Credit Default Swaps .

Here is the pertinent chart.

Fannie and Freddie Credit Default Swaps

In the case of Fannie and Freddie a technical default triggered under 40. What happened was the government (taxpayer) agreed to the tune of a $200 billion backdrop to guarantee the debt of Fannie and Freddie. Please see Paulson Rolls The Dice At Taxpayer Expense for more details.

Bear Stearns too was involved in a taxpayer bailout. And Bear Stearns CDS were soaring before the marriage. I do not have the contract high but in a brief span the CDS soared from 450 to 750.

In case you missed it there are some fascinating details of the shotgun wedding between Bear Stearns and JPMorgan in Bear Stearns neared collapse twice in frenzied last days .

After the Paulson/Fed sponsored shotgun marriage the Bear Stearns CDS collapsed. As with Fannie and Freddie, those betting on the demise of Bear Stearns were correct. Those betting via credit default swaps at the wrong time had their head handed to them. This is just something to keep in mind going forward when attempting to find meaning in various CDS issues.

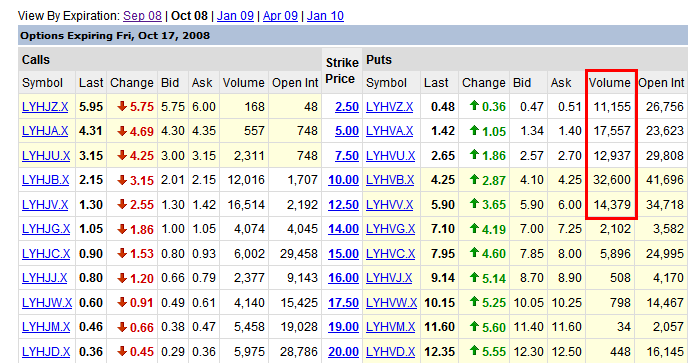

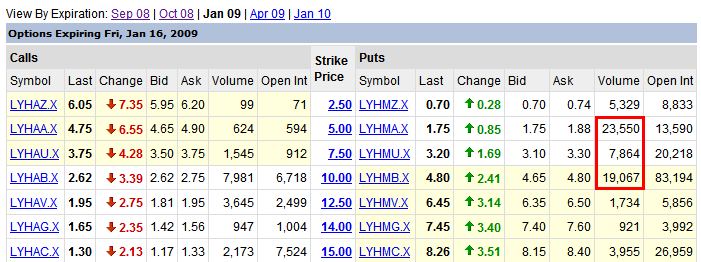

Lehman PUTs

As happened with Bear Stearns before its collapse, PUT volume on Lehman has been soaring.

http://finance.yahoo.com/q/os?s=LEH&m=2008-09-19

AJTJ on IHUB sent me the following.

This is interesting. With about 30-minutes left in the trading day, the non-LEH equity put/call ratio was about 0.86. With LEH it was about 1.13.

I think we need to consider LEH plays smart money, so the equity put/call ratio is really closer to 0.86 rather than the elevated 1.13.

LEH action is about 17% of the equity options traded today. Amazingly unusual.

September PUTs

October PUTs

Jan 2009 PUTs

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.