America 2.0

Politics / US Politics Apr 08, 2018 - 03:33 PM GMTBy: Raul_I_Meijer

It’s Dr. D again. Told you he’s on a roll. He remains convinced America can re-invent itself. If only because it must.

It’s Dr. D again. Told you he’s on a roll. He remains convinced America can re-invent itself. If only because it must.

Dr. D: Herbert Stein’s Law states “What Can’t Go On Forever, Doesn’t.” This is a neat summary of the present trade and currency imbalance. China makes real goods and the U.S. consumes them by typing digits on a keyboard. This is the very definition of what cannot go on forever.

• How long do you expect a nation can make nothing and consume everything?

• How long do you expect a nation without manufacturing, without a workforce, and now without a viable military to remain pre-eminent?

• How long does wealth and influence remain in a nation that makes nothing, does nothing, and knows nothing?

Reminds me of that other Law: “A fool and his money should be parted as soon as possible”, for to be wealthy, and helpless, and dumb, is not a combination that lasts for very long.

Since China cannot send the U.S. free goods forever, ergo, they won’t. That means slowly or quickly, now or later, they will cut us off. Right now it appears that can never happen, but I assure you it will very soon. And what will the U.S. do then? Actually, that’s very simple: the U.S. will have to close a $600B trade deficit instantly. Roughly, that means the U.S. will no longer import $600B worth of goods and be $600B/year poorer, or $2,000/year per person. Nor is this unusual. History is rife with examples of nations that once were prosperous and were suddenly cut off: Spain and Greece come immediately to mind. So how does this happen?

The Core nation, the trading hub has failed dozens of times in history, from Venice to Holland, Spain to England, and although most of history was on a gold standard, nevertheless the same thing happened: repudiation and devaluation of the currency. That’s why a U.K. Pound is no longer a troy pound of pure silver ($192) and why the U.S. Dollar is no longer 1/20th ounce of gold ($267). So let’s run down how this might unfold.

Like other empires, the U.S. rose to prominence with hard work and industry. Like other empires, this personal and physical industry was the foundation of an effective military. This military eventually stood alone, leaving the U.S. to set the rules of trade, the rules of diplomacy, and the rules of conduct. Like other nations, the U.S. bent those rules in its own favor, both early and late. Like other nations, the natural way to take advantage was to run an overvalued currency, which draws in capital from all trading partners worldwide, creating a 100-year spiral of wealth and influence that seems truly endless.

However math, the cruelest of Mother Nature’s laws, is not fooled. If you bend the rules to create market distortions, those distortions are indeed created. If there were fair trade, a gold standard, a nation that increases their wealth would find its currency rise. A rising currency would dampen manufacturing and efficiency, the gold would flow back out, and the unfair advantage would be corrected. But only in a free market. Any market on Earth has an Army, and that Army’s job day and night is to make sure that unfair advantage does NOT end. Ask Smedley Butler.

Mother Nature is never deterred. However long it takes, she waits. Lacking fair trade, an abnormally strong currency does the only other thing it can: destroy the Core nation’s industry, totally and completely. More certain than a nuclear explosion, economics will not miss a single spot until the wrong is righted and the truth is out. At first the low-gain commodity industries go: mining, shipping, smelting; then their sooty kinsmen: heavy rail, ships, ports, transportation.

After that go the lighter industries: manufacturing, stamping, autos, and so on up to mainframes, silicon chips and phones, and with them, their children, manufacturing processes and R&D. However, as London and NY showed, you can forestall currency correction even now by moving market distortions into services and financial engineering. At this point, however, the Core nation has nothing left but Banks, Universities, and the Government/Military, and no underlying economy to support them.

However, what Charles Hugh Smith calls the fiefdoms of monopoly cartels and apparatchiks of the 1% now lead an empty parade, horse-whipping the uncompliant 99% into supporting an economy that exists only in their minds. And then “What can’t go on, doesn’t.” The empire collapses from within, to the total surprise of historians of the 1%, and the total lack of interest of the 99%, for whom it had already collapsed decades before.

And of the other side? Thanks to the overly-high currency of the Core nation, the perimeter nation has an artificially LOW currency. They didn’t do that, because they are by definition small and weak and aren’t using an army to set the rules. The artificially low currency leads to low costs, low labor, high enterprise, and in the mirror image of the Core nation, the constant INCREASE in manufacturing. The increase in wealth, and the addition of commodity goods, then heavy industry, then manufacturing, then R&D. Whose fault is that? Who used a worldwide army to enforce the very rules that gutted their homeland? Not the Vandals; not China. It was Rome; it was D.C.

What is this whole imbalance based on? In our case, the artificially strong dollar, backed by a worldwide U.S. military. So how must it end? With a weak dollar, falling real markets, and a U.S. military returning home.

You say this can’t happen? Yet it must happen. To say otherwise means China will give us free goods for 10,000 years, and the U.S. will get always weaker that whole time. So how does the transition go?

The U.S. financial bulwark cracks, being highest and most based on psychology, not reality, very likely in conjunction to a military failure or withdrawal, as in empire finance, the military and currency are equivalent. Slowly, then rapidly, the tide flows out, the U.S. dollar gets weaker, the Chinese Yuan gets stronger, and the whole process reversed as it should have done years ago.

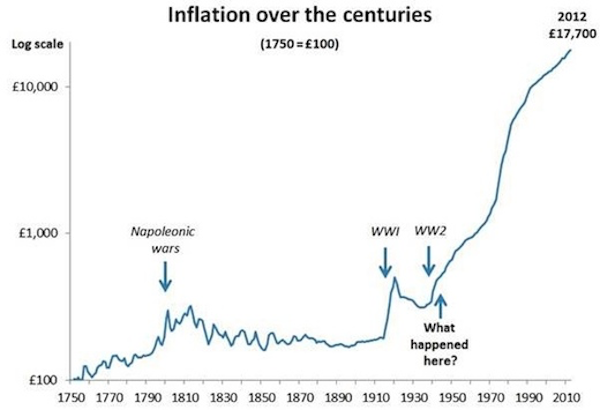

(mind the log scale)

Mother Nature isn’t fooled, and those 70 years of repression and manipulation are made up in a few years.

Down on the ground, what happens is not that China shuts off free imports to the U.S. directly, with a political embargo, what happens is the U.S. is seen as a has-been and the U.S. dollar falls in purchasing power on the world market, raising the price of foreign goods in a “free” and “open” marketplace. Lacking manufacturing and the military power to stop it, the U.S. can’t hold off Mother Nature and the laws of physics any more.

Knowing this to be inevitable, how would a nation prepare? For one thing, you would need to kick-start your industry, post-haste. Anything that can be made internally will find its prices stabilize and not rise. Yet before the currency rates are corrected this face overwhelming headwinds. Second, as income will be lost and the borders will be shut off, you need to switch the focus of taxation from income to tariffs, from finance to real goods.

Third, you need to open your pipelines, ports, and infrastructure, and expand the required steel, oil by any means necessary, even armed standoffs. Fourth, you’ll need to shove the culture away from government support and subsidies that will soon disappear, and into self-reliance and productivity. Firth, you’ll need to downsize the government and especially the military, which will and must return home. Any of those platforms sound familiar?

Despite what you read, it’s not all bad. Just as “The arrogant people will be brought down, and high and mighty people will be humbled”, “Every valley shall be raised up, and every mountain and hill shall be made low; and the crooked shall be made straight, and the rough places smooth.”

This is a master reversal of all manipulations, of all imbalances that have reached extremes. As the U.S. – China trade deficit must balance, we know that Chinese goods must rise. But that also means the cost of production for U.S. goods must fall. This cost-advantage puts Americans back to work just as it did the Chinese, while the rise of the Yuan will make China rich, but less productive.

What’s more, as matters reverse, the U.S. will raise prices on their exports: food and oil, two things China must have and cannot get elsewhere. Agriculture is at an all-time, 1,000 year low and must rise. Stocks and housing are at an all-time high and must fall. In a reversal, the high prices fall, the low prices rise, that’s obvious. That’s what “reversal” means, that’s what “extreme” means.

As for manufacturing, the world is changing fast. Even China is opening “dark” factories that employ no people, only robots. That will be true here as well, which undercuts any labor savings they once had. There’s a few problems, however: robotic mega-factories only work with very large scale of identical goods that can source reliable, high-quality inputs. If oil is too high, and/or shipping or marketing fractures, those factories scale down, retool more, and therefore require more people than presently.

How is China going to have huge robotic mega-factories if half their export market can no longer afford them? If the U.S. and China split the market, aren’t all those factories half the size of present? Since the U.S. will now have low-cost people and raw materials, what advantage does China bring to offset shipping and tariffs? The “market” isn’t uniform. There was worldwide mass-integration of manufacturing between India and England and the world in 1910 too, yet it’s didn’t persist; it changed.

One way it can change is to leapfrog China. We hear about how the U.S. is a has-been as we are supporting legacy copper telephones while the 3rd world goes directly to fiber and cell, and this is true. However, China has mainlined on low-price, low-profit, mass-manufacturing. Why would anyone compete with them there? It’s irrational. Build a baseline and let them have all the low-profit, environment-destroying work they want, the U.S. can’t and won’t beat them there.

We can beat them by leapfrogging into technology that’s out there, but no one is revealing yet, things they haven’t done, but Americans are good at doing: innovating, high-tech, medical. Much as I hate high-tech and its panacea as an answer, yet I believe there are goods, ideas out there that can transform the way things work.

Look at the rapid development and uptake of LEDs for example. The patent office is filled with them, and an outsized number are American. We have superconducting maglev, field physics, material science of no-weight foam, color-shifting paint, hyperconducting graphite, and transparent concrete to name a few. All there, all unused. Let’s make an example case in a very large, very quiet investment.

Medical and Biotech are to some extent used up, with overpriced, mass-market pharmaceuticals being rejected by price and form even by the wider population. But that’s so last-century. The new biotech is going to take a blood or DNA sample and synthesize a drug specifically for your blood and DNA. They are going to create another organ, a blood transfusion no one but you can use.

In one way, this may be more expensive, and that’s good for profits, but in another way, they will work for you, much better and guaranteed, and therefore fix your health faster, spare you useless drugs, bad side effects, and actually work, and therefore be cheaper. What does it take to make them? A complete revolution in drug manufacturing. Multi-billion dollars’ worth of equipment, extremely unique development and patents, a 20 year head start.

Could you sell such a thing to the Chinese? You bet. Could they get off retail manufacturing and scoop us on it? Not a chance. So you see how such a thing could happen, even with a U.S. dollar falling and a hard readjustment ahead. And that’s just one.

If boutique and robotic goods are the new industries, what do we do with 200 million unemployed? We won’t have 200 million. That’s a consequence of the distorted extreme of our finance, our centralization, our currency. For one thing, we have only 100 million now and a lower dollar will definitely restore the competitive advantage of highly-productive U.S. workers. At the same time, if work requires fewer workers, we will find a solution. Why?

Because you can’t have 200 million unemployed. Not even 100 million. The resulting inequity and income disparity can and has caused a revolution. Faced with that, any nation will adjust because they must or perish. As difficult as Americans can be, they are a practical people above all. This has happened to dozens of nations in the past: Spain, France, Germany, England, China, Japan, and they all still exist. Things rotated out in the big wheel of time. New things were made and the old ones faded away, and we will too.

We’re going back to being just one of many nations, and a fair and productive one too. There are ways and we will find them. How can I be so sure? Because “What Can’t Go On Forever, Doesn’t,” and it won’t this time either.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2018 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.