Eurozone Faces Many Threats Including Trade Wars and “Eurozone Time-Bomb” In Italy

Interest-Rates / Eurozone Debt Crisis Mar 28, 2018 - 02:21 PM GMTBy: GoldCore

– Eurozone threatened by trade wars, Italy and major political and economic instability

– Eurozone threatened by trade wars, Italy and major political and economic instability

– Trade war holds a clear and present danger to stability and economic prospects

– Italy represents major source of potential disruption for the currency union

– Financial markets fail to reflect the “eurozone time-bomb” in Italy

– Financial volatility concerns in Brussels & warning of ‘sharp correction’ on horizon

– Euro and global currency debasement and bank bail-in risks

Editor: Mark O’Byrne

Donald Trump believes trade wars are easy to win. Winning depends on who your opponent is. At the moment Trump’s target is seemingly China but it is becoming increasingly clear that the Eurozone (and wider EU) is very much also at the top of his protectionist agenda.

This is a problem for the single market. It is not in a strong position when it comes to facing off the strong arm tactics of the President of the United States. Germany is the powerhouse of the EU when it comes to successful trade and industry, but its exporting machine is also vulnerable to US trade tariffs.

The Eurozone (and EU) are facing some major political and financial threats. This was already the case without Trump’s nationalist agenda, but trade tariffs combined with Italy’s political instability and increased market volatility risk now have the single market facing a precarious future.

Italy is a serious political and financial threat

As outlined in the introduction, Trump’s trade wars have brought a number of problems to the fore for the Eurozone but it is Italy that is the most foreseeable threat to economic instability at this moment.

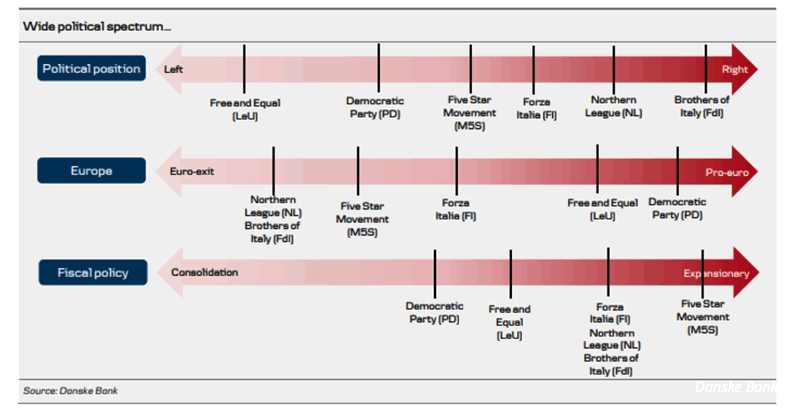

The election in early March and its uncertain result spooked markets somewhat but not enough to offer a real reflection of the risks posed. The result (which is still to be decided, overall) will pose major difficulties for the Eurozone that requires an Italian government focused on economic reforms and fiscal austerity.

Neither party brokering a deal to enter the leadership will be offering this on a silver platter.

Not only are the Five Star Movement and League yet another threat to the ‘one vision’ federal aims of the Eurozone elites but they have also shown very little interest in fiscal restraint. This is the only pathway for the Italian economy to returning to a sustainable footing according to the ECB.

This coming Autumn the (new) government (if appointed) will pass a new budget. Whilst this is pivotal for any new government, it will be more important to watch the politics surrounding the budget.

Considering over 60% of the parliament is made up of populist politicians the chances of an austerity budget being passed are beyond slim.

The two leading parties likely to form a government, The Five Star Movement and League, have made promises they cannot afford to break but are in direct contradiction with EU demands.

Five Star has promised a universal basic income, League has been elected on the promise of a flat income tax. Further inconsistencies with EU reforms are both parties’ promises to reverse pension changes.

At the moment markets do not seem too upset by the political situation in Italy. This is both short-sighted and naive.

Spending policies of both parties challenge EU rules. Whilst Mario Draghi in the ECB has previously been able to keep the country in line, this was with the help of Europhile Mario Monti. Monti is no more and Italians have shown their eagerness to elect more radical politicians who are reacting to the backlash of two punishing decades in which young people were out of work and the elderly lost their savings.

This backlash is something which is being felt throughout Europe. Astonishingly markets and commentators believed Eurosceptisim was on the back burner (despite various election results in 2017).

Italy’s own political outcome should serve as a much needed wakeup call that the euroscepticism within the bloc remain and will likely be reawakened. It may even bring back the existential threat to eurozone stability so many had long thought diminished. In turn, this will reduce the support the euro is currently enjoying.

As is becoming increasingly apparent, Italy is quite the dilemma for the Eurozone, they cannot afford to let it fail but equally it is seemingly too big to save.

This is very much the calm before the storm, as another economic crisis no doubt looms on the horizon.

Is the euro-area as strong as they think?

The ‘shock’ of the Italian election outcome has caused dementia within commentary circles regarding eurozone strength. To hear them talk about the eurozone one would think it was the epitome of health prior to the 4th March Italian election.

It was not. For example, not only is Brexit still threatening a major existential crisis on the single market but 2017 brought in the destruction of the French two-tier political system and the total wipeout of the centrist majority in German parliament – two things Europhiles thought they could be sure of.

Instead there are a number of looming issues that will no doubt create further divisions and anti-EU sentiments. This is despite markets remaining optimistic.

By all accounts, the forecasts for eurozone growth are pretty optimistic. The European Commission has recently revised upwards its expectations for growth in 2018 and 2019, having been surprised by the performance in 2017.

However, they also warn of a potential ‘sharp correction in financial markets’ . In a 44-page forecast the EC warned of asset price vulnerability to ‘a reassessment of fundamentals and risks [that] could expose debt overhand in a number of Member States.’

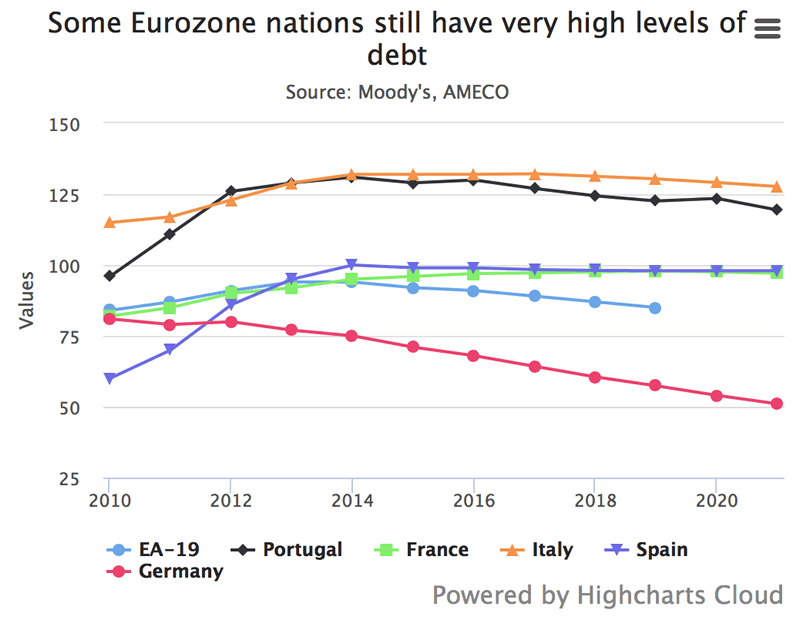

Ratings agency Moody have also put a dampener on any self-congratulatory moves, a recent report finds that high-national debt is a long-term threat to the single currency union’s prosperity:

“As the economic cycle inevitably turns and growth slows, high public debt will become an increasingly important constraint on sovereign credit profiles.” A downturn could hit national finances hard, “rendering them vulnerable.”

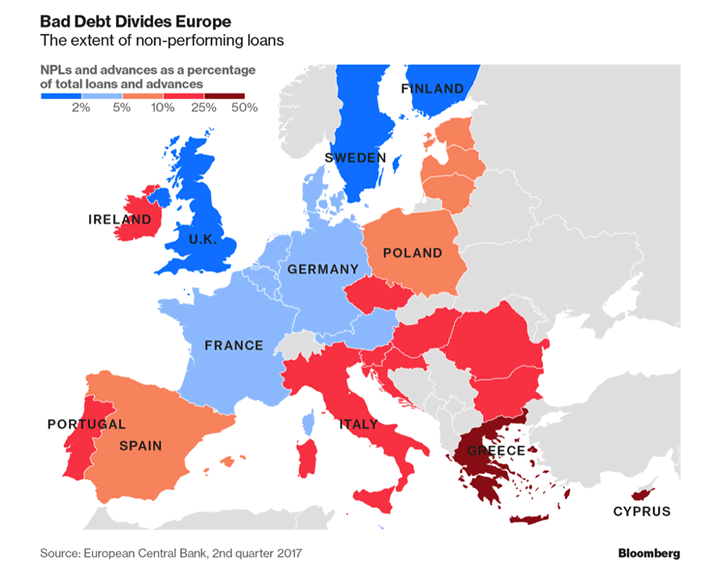

Brexit is not going to send the single currency market spinning out of control but there are major unresolved issues and looming ones which may well do this. Both French and German parties put forward major Eurozone reforms in 2017, no one has agreed on anything. The main issue politicians and bureaucrats are working to resolve is the never-ending interdependence between sovereigns and banks.

The solution that will no doubt be agreed upon will be a banking union. The chances of this being at all fully functioning are extremely slim given the different economic and political interests of each eurozone member. Needless to say the union will not be perfect and therefore the main problems in the single currency market will remain – there will be overdependent financial systems, highly leverage banks, increasingly unimaginable imbalances between member states and more booms and shocks.

All in all, there will not be the tools to deal with ‘shocks’, pushing the ECB further into the red and further away from reform.

America first, consequences second

The EU’s lack of financial reforms, growing euroskepticism and growing debt levels are nothing new. All that was required was a catalyst to cause them to tip the financial union into crisis.

President Donald Trump may well be that catalyst. The US is the only country to have trade featured in the first article of its constitution. This explains why protectionism fits in so nicely with Trump’s ‘America First’ agenda.

Since the end of the Second World War European countries have taken the approach that trade is a means by which nations can find common ground so the risks of going to war are far more costly than just military. Paradoxically the US see trade as a means of exerting ones force and independence on the world – it is a demonstration of sovereignty. This has come at a bit of a shock to the EU.

For years the EU has sailed along arrogantly assuming that current account surpluses from the likes of Germany are not going to be an issue. They are an issue, but one that is usually taken up with the G20, or even the WTO (with who the US wins more than 85% of the dispute-settlement cases). Instead, Trump has taken matters into his own hand and now the eurozone’s own bastion of stability – Germany is in the firing line.

Currently Germany has an 8% current account surplus, whilst the eurozone also runs at a huge 3.5%. This makes them both vulnerable to trade wars. This is a swift lesson in why the ECB’s strategy to prevent a crisis since 2012 has been short-sighted and costly. It has resulted on a current account surplus and now (inevitably) other nations don’t want to take it. The single currency market has opened itself up to protectionist measures.

Should Trump follow through with his threats and put a 35% tariff on European cars then it will lose the economy an estimated €17bn a year. Add to this the ongoing problems in the diesel car market and Germany are in a real bind when it comes to strategic industries.

Of course, the EU can respond to US measures but they are very much on the backfoot. They rely on the US for security support and (until now) to turn a blind eye to their current account surplus. Now, Trump has realised that he has a double-edged sword – his trade tariffs will not only influence the EU’s trade policies but also the defence spending of NATO allies.

The US can get away with protectionist measures as it is far less reliant on foreign trade than the likes of the EU plus it has a relatively insignificant social welfare system. This means there is a significantly lower risk to the economy by engaging in protectionism.

In contrast, the EU is far more reliant on foreign trade particularly due to the impact an increase in protectionism will have on its developed welfare system. The costs are too great to let these measures get the better of them, but with Trump hanging military spending and support over their heads what can the EU do in this new Cold War era?

Should Italy, Tariffs and Trump worry our portfolios?

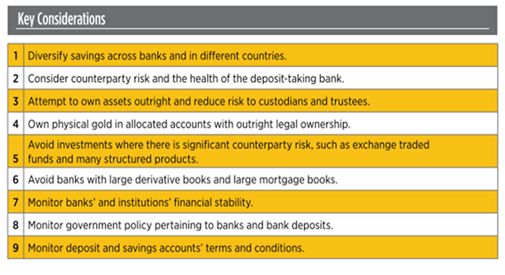

Anything that impacts the financial situation of a country will have an effect on your savings and investment portfolio. This may just be in terms of currency risk or stock market performance. Alternatively it could be worse than that and it could result in bail-ins confiscating money straight from your savings account.

Two years ago, the ECB approved the bail-in tool. In simple terms it gave them the right to remove money from individuals’ and companies deposit accounts in times of financial crisis.

It is now not difficult to see the looming threats to the stability of the European financial system.

Investors would be wise to redirect their attention from the politicking around Italian elections and trade war disagreements, instead fusing their energies on securing their wealth.

Savers should be looking for means in which they can keep their money within instant reach and their reach only. Gold and silver bullion, if owned in the safest manner, remain one of the best options in this regard.

Physical, allocated and segregated bullion coin and bars ownership gives you outright legal ownership and total liquidity. There are no counter parties who can claim it is legally theirs (unlike with cash in the bank or shares) or legislation that rules that deposits can be confiscated to bail out failing banks.

Gold and silver are the financial insurance against bail-ins, political mismanagement, and overreaching government and financial institutions.

To read more about how you can protect your savings in the bail-in era then read our free bail-in guide here.

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

28 Mar: USD 1,341.05, GBP 946.24 & EUR 1,082.23 per ounce

27 Mar: USD 1,350.65, GBP 954.64 & EUR 1,087.41 per ounce

26 Mar: USD 1,348.40, GBP 949.27 & EUR 1,086.95 per ounce

23 Mar: USD 1,342.35, GBP 952.80 & EUR 1,088.65 per ounce

22 Mar: USD 1,328.85, GBP 939.36 & EUR 1,078.10 per ounce

21 Mar: USD 1,316.35, GBP 935.53 & EUR 1,071.64 per ounce

20 Mar: USD 1,312.75, GBP 935.60 & EUR 1,066.22 per ounce

Silver Prices (LBMA)

28 Mar: USD 16.46, GBP 11.63 & EUR 13.28 per ounce

27 Mar: USD 16.64, GBP 11.79 & EUR 13.41 per ounce

26 Mar: USD 16.61, GBP 11.67 & EUR 13.39 per ounce

23 Mar: USD 16.53, GBP 11.70 & EUR 13.39 per ounce

22 Mar: USD 16.52, GBP 11.64 & EUR 13.41 per ounce

21 Mar: USD 16.25, GBP 11.56 & EUR 13.23 per ounce

20 Mar: USD 16.25, GBP 11.60 & EUR 13.22 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.