Stock Market Elevated Risk Premia Suggests the Worst Yet to Come

Stock-Markets / Financial Crisis 2018 Mar 28, 2018 - 01:56 PM GMTBy: Builderadv

Stock markets ended very weak yesterday. Any ounces of bounce is sold as we saw yesterday. The economy per se is doing just about fine.

Stock markets ended very weak yesterday. Any ounces of bounce is sold as we saw yesterday. The economy per se is doing just about fine.

Home Prices: Rising at its fastest

The S&P CoreLogic Case-Shiller National Home Price Index, which measures the price of a typical single-family home in major metropolitan areas across the country, rose 6.2% in January, down slightly from a 6.3% year-over-year increase reported in December. The 10-city index gained 6% over the year, unchanged from the prior month. The 20-city index gained 6.4%, up slightly from 6.3% the previous month.

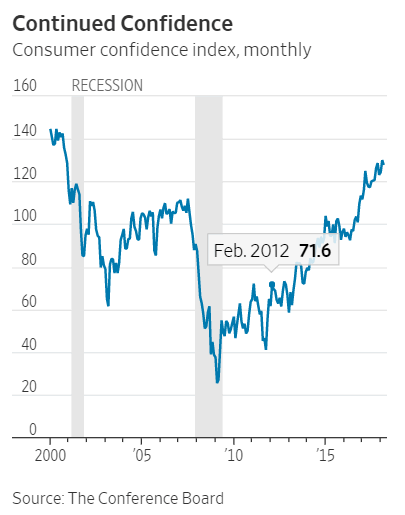

However, consumer Confidence declined

U.S. consumer confidence fell in March, dragged down by consumers’ perception of current and future economic conditions in light of recent stock-market gyrations. The Conference Board said Tuesday its measure of U.S. consumer confidence decreased to 127.7 in March from an 18-year high of 130.0 in February. Consumer confidence will decline dramatically over the next few months if S&P falls down below 2600.

The yield on the 10-year US Treasury rose 1 basis point to 2.784 per cent, still hovering at seven-week lows, while that on Japanese 10-year government bonds was virtually unchanged, at 0.029 per cent.

Stumbling blocks for Markets

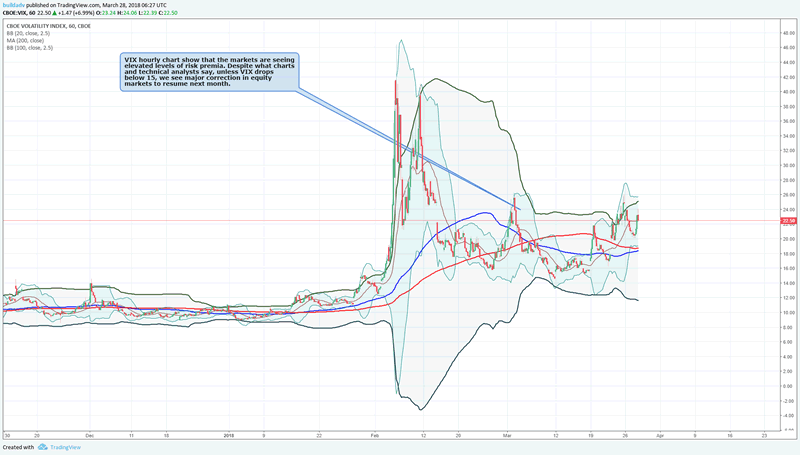

VIX : Elevated risk premia

VIX hourly chart show that the markets are seeing elevated levels of risk premia. Despite what charts and technical analysts say, unless VIX drops below 15, we see major correction in equity markets to resume next month.

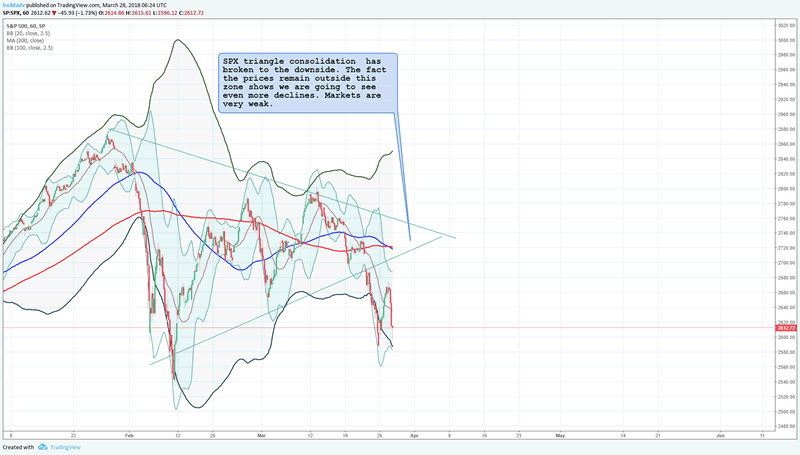

SPX : Weak (Very)

SPX triangle consolidation has broken to the downside. The fact the prices remain outside this zone shows we are going to see even more declines. Markets are very weak.

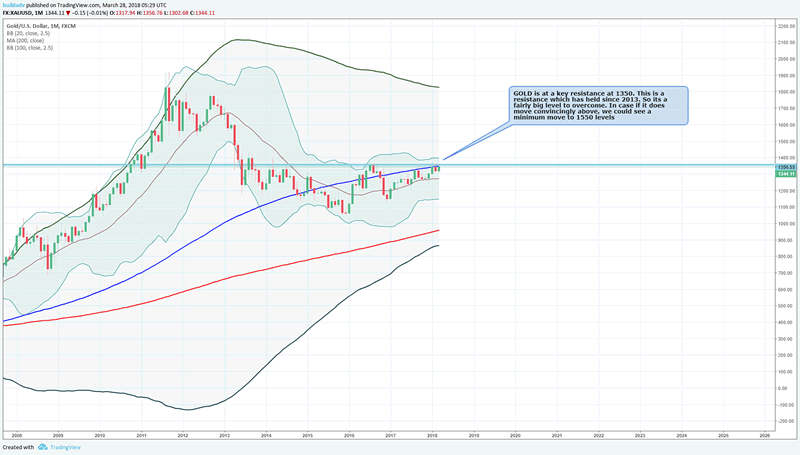

GOLD: Breakout is nearing but NOT yet broken out!

GOLD is at a key resistance at 1350. This is a resistance which has held since 2013. So its a fairly big level to overcome. In case if it does move convincingly above, we could see a minimum move to 1550 levels

CRUDE: Bullish but resistance near

Brent crude, the international benchmark, slipped 0.7 per cent to $69.65 a barrel, pulling back further from the one-month high of $71.05 it notched on Monday. West Texas Intermediate, the US marker, fell 0.8 per cent to $64.74 a barrel after US crude inventories rose by 5.3m barrels last week, coming in higher than expected. Opec and Russian officials are considering creating a longer-term oil alliance to keep prices in check, according to Saudi Arabia’s crown prince Mohammed bin Salman.

Forex Markets:

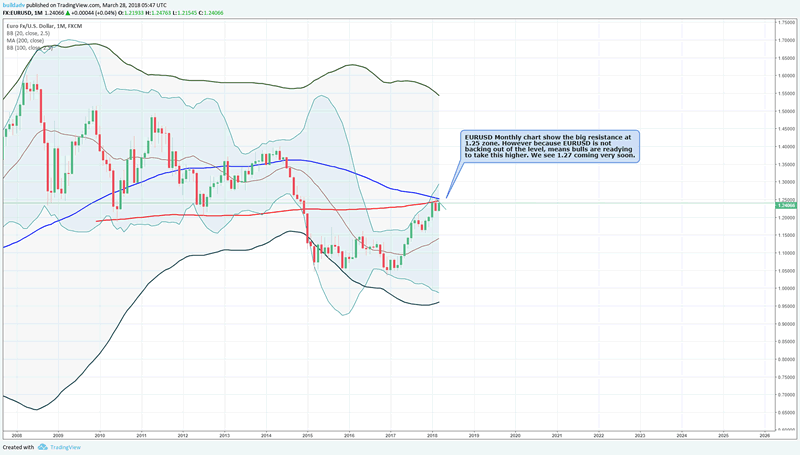

EURUSD Monthly: Heavy resistance

EURUSD Monthly chart show the big resistance at 1.25 zone. However because EURUSD is not backing out of the level, means bulls are readying to take this higher. We see 1.27 coming very soon.

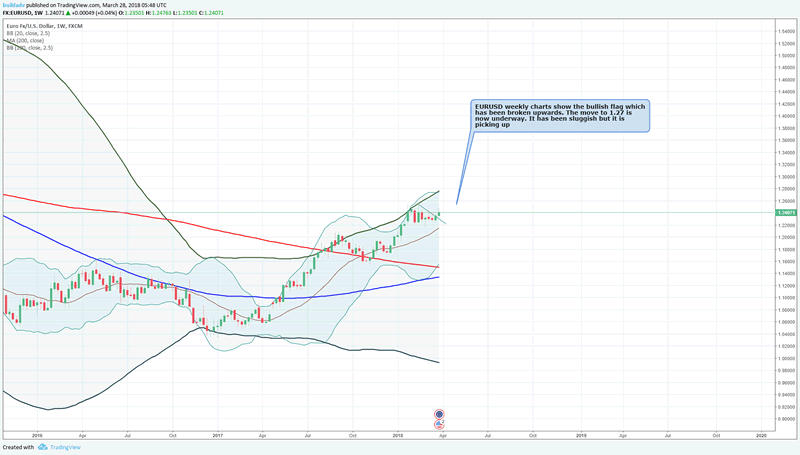

EURUSD Weekly

EURUSD weekly charts show the bullish flag which has been broken upwards. The move to 1.27 is now underway. It has been sluggish but it is picking up

We send a lot of detailed trade setups and trend directions for all major forex pairs like EURJPY, GBPJPY, USDJPY, EURAUD, AUDUSD, GBPUSD, USDCAD, CADJPY, AUDJPY and so on....Detailed trade setups are shared via our premium posts at buildadv.com You need to be Platinum subscriber at buildadv.com to read these trade setups: Platinum Membership at buildadv.com

We also a run a automated Trade copier for forex trading. It has done well with positive returns every single month since 2010 to 2018. If you would like a automated trading solution and you have a MT4 trading account, please reach out to us at contact us

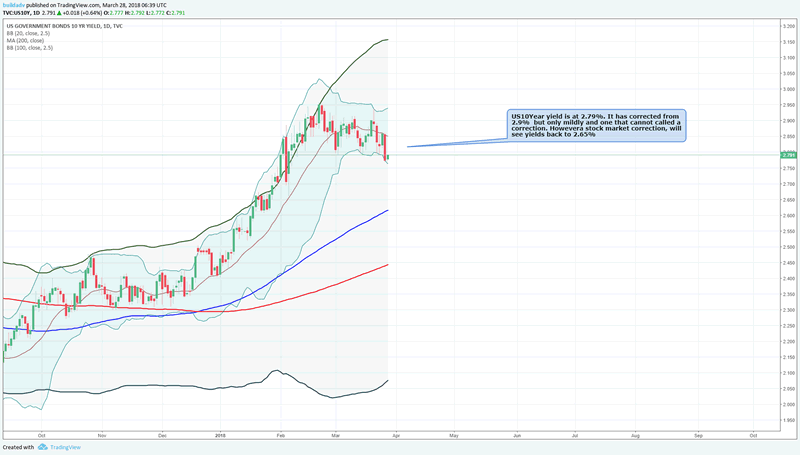

Bond Markets: Yield is flirting higher

US10Year yield is at 2.79%. It has corrected from 2.9% but only mildly and one that cannot called a correction. Howevera stock market correction, will see yields back to 2.65%

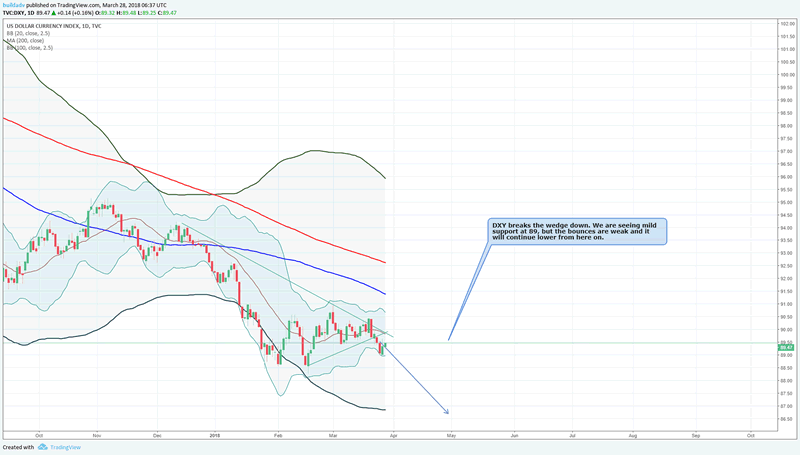

Dollar Index: Break and Bounce

DXY breaks the wedge down. We are seeing mild support at 89, but the bounces are weak and it will continue lower from here on.

Summary: We see no reason to become neutral on risk. As long as VIX stays elevated, we see extreme pain coming in US equity markets and then world wide.

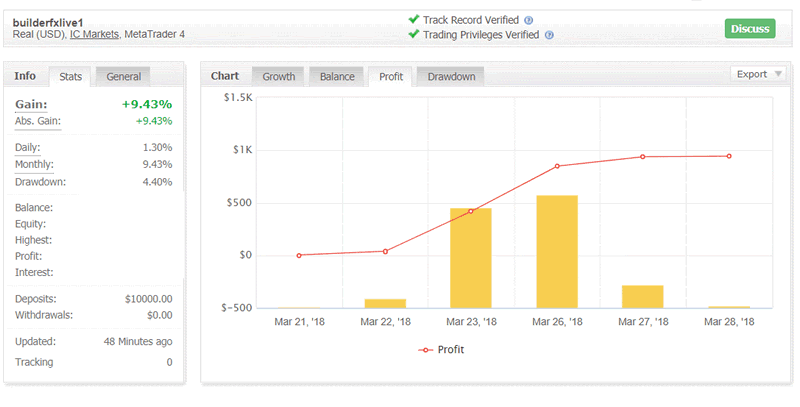

Trade Copier updates

The Trade copier has made over 9% this month for clients. Our long term equity curve continues to rise. The system has seen all markets since 2010 and has made returns every single month. If you would like to copy these signals to your MT4 trading account, please contact us here: Contact us

By Buildadv

About Buildadv:

Buildadv is a investment management firm. We specialize in premium trading research, chart setups, trading insights and a forex trade copier which generates returns for MT4 trading clients. We operate the BUILDFX Trading system which has a rich history of over 8 years of trading history generating an average return of over 15% a month.

Email: adminsupport@buildadv.com

Website: http://buildadv.com/contact/

Copyright 2018 © Buildadv - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.