Petroyuan and Gold - The Single Biggest Change in Capital Markets of All Time

Commodities / Crude Oil Mar 28, 2018 - 06:31 AM GMT“China’s launch on Monday of its crude futures exchange will improve the clout of the yuan in financial markets and could threaten the international primacy of the dollar, argues a new report by Hayden Briscoe, APAC head of fixed income at UBS Asset Management. ‘This is the single biggest change in capital markets, maybe of all time,’ Briscoe said in a follow-up telephone interview.” – Kate Duguid, Reuters, 3-26-2018

Let’s just assume for a moment that an oil contract denominated and settled in Chinese yuan for whatever reasons becomes more attractive to oil traders than one denominated and settled in U.S. dollars. To the degree that decision is shared among market participants, demand will lessen for dollars and increase for yuan – strengthening one and weakening the other. Instead of all oil purchases being routed through the dollar, some level of the international oil trade will be routed through the yuan instead, including among American companies. “This,” says UBS’ Hayden Briscoe, “helps cement the exchange’s viability and challenges the petro-dollar system, in which oil deals are executed in dollars. This would decrease demand for the greenback and boost U.S. inflation.”

At this time, it is impossible to gauge the impact except to say that such a change in oil market dynamics goes far beyond ordinary commerce to the very heart of the monetary and financial system simply because oil is such a huge chunk of the daily international commerce. That is why Briscoe says it is “the biggest single change in capital markets, maybe of all time.”

In order for the yuan to openly challenge the U.S. dollar, petroyuan volumes will need to be large enough to attract the attention of speculators and investors globally. OilPrice.com reports that on the first day of trading, a respectable 15.4 million barrels of crude (about $1 billion worth) were traded in the September contract with Glencore, Trafigura and Freepoint Commodities among the first to take positions. Jeff Brown, president of FGE, an energy consultant, told Reuters that “The government (in Beijing) seems determined to support it, and I hear a number of firms are being asked or pressured to trade on it, which could help.”

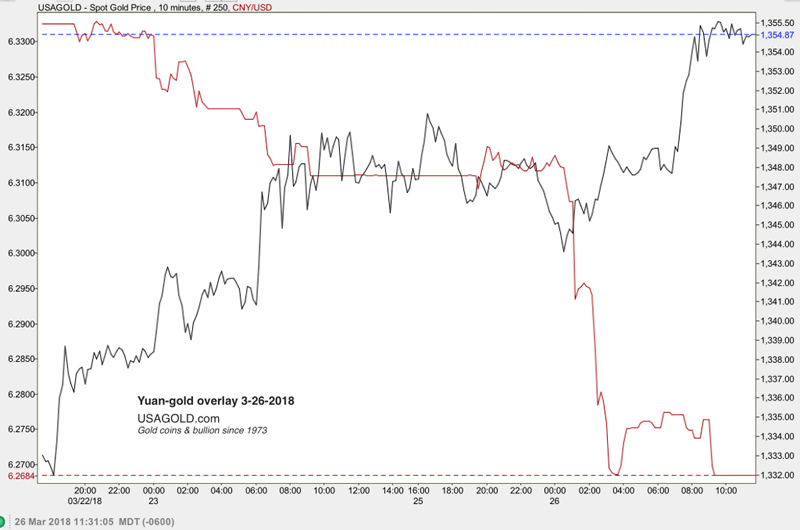

One day does not a market make, but it is interesting to note that on March 26th, the yuan appreciated sharply against the U.S. dollar reaching its highest level in 31 months. Gold, it is worth noting, followed it higher along the exact same timeline. Whether or not the petroyuan establishes itself as a tour de force that openly and effectively challenges the petrodollar, its journey is something that warrants our close attention. Needless to say with everything else that is going on in the financial markets these days, the petroyuan is one component that has not been even modestly factored into the equation.

The Reuters article by Kate Duguid, China oil futures launch may threaten primacy of U.S. dollar quoted at the top of this post is an excellent starting point – a must read. Though the word “gold” is never mentioned, it offers one of the most persuasive arguments in favor of acquiring the precious metal to surface in a very long time.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.