Are Stocks Ready for a Profound Failure?

Stock-Markets / Stock Markets 2018 Mar 27, 2018 - 04:34 PM GMT SPX futures made an overnight high of 2679.75 before pulling back. The 38.2% Fib retracement level is 2702.27, which it has not achieved. As the formation stands right now, it would make an a-b-c zigzag. However, a further pullback may lead to yet another push to the trendline and 38.2% retracement. A failure to retrace that level would be profound.

SPX futures made an overnight high of 2679.75 before pulling back. The 38.2% Fib retracement level is 2702.27, which it has not achieved. As the formation stands right now, it would make an a-b-c zigzag. However, a further pullback may lead to yet another push to the trendline and 38.2% retracement. A failure to retrace that level would be profound.

The story line for this rally is Trump’s “Happy Tweet.” ZeroHedge comments, “Just as Trump sent stocks into a tailspin last week with his bellicose trade overtures against China, so the near record (point) rebound in the Dow on Monday is being attributed to a much more diplomatic tone out of the Trump administration, when first Mnuchin, then Peter Navarro played down the threat of a trade war and instead said that the administration is “actively” involved in talks with China to resolve the recent trade tensions between the two nations. Various unconfirmed media reports then also suggested that trade war with China may never materialize (of course, as Mark Cudmore explained this morning, it very well still may). It culminated with a "happy" tweet from Trump himself on Monday night, in which the stock-picking president, hours after confirming his delight with the spike in the market, tweeted "trade talks going on with numerous countries that, for many years, have not treated the United States fairly. In the end, all will be happy!"

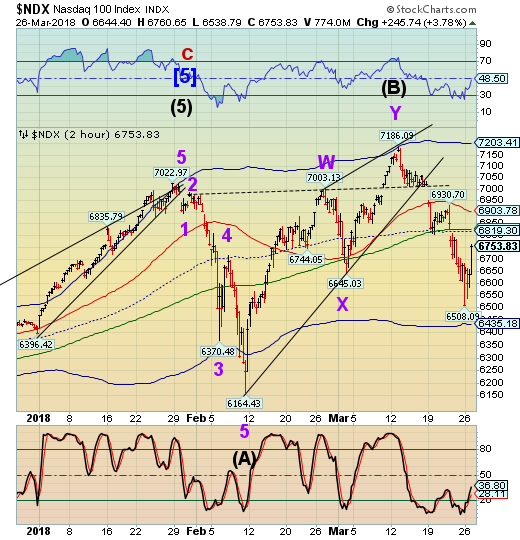

NDX futures overshot the double resistance levels at the mid-Cycle (6819.30) and the 50-day at 6826.78. However, it has pulled back beneath the 50-day at this juncture. It bears watching, since it may lead the SPX in a reversal.

ZeroHedge mentions, “Mint - Blain’s Morning Porridge – 27th March 2018

“You don’t need a weather man to know which way the wind blows...”

The headlines are all about yesterday’s “extraordinary” bear-rally in stocks – upside buoyed by expectations the US/China trade discussions will de-escalate trade war tensions. I’m unconvinced by the narrative: the volume was tiny and a look at the charts suggests global stocks have still got problems ahead.”

Whiole stocks were going higher yesterday, the NYSE Hi-Lo stalled at the 50-day Moving Average and has receded the rest of the day. This action does not bode well for the strength of the equities market. It rmains solidly on a sell signa.

VIX futures are on the decline this morning, but within the parameters of a retracement. The 50-day Moving Average at 18.01 plays an important role of keeping the VIX on a buy signal.

ZeroHedge observes, “From former Lehman trader and macro commentator Mark Cudmore, who unlike the algos that have jumped from one extreme of the ship to the other, refuses to accept that yesterday's market surge is indicative of a change in market direction and/or sentiment, or as he writes in his latest Macro Wrap...

One Strong Bounce Does Not a Bull Market Make

Equities haven’t bottomed just yet.

Some commentators have been swift to say Monday’s U.S. stock bounce shows the bull market is firmly back on track. But, as Aristotle once observed, "one swallow does not a summer make, nor one fine day."

U.S. equity futures haven’t even regained last Thursday’s opening price. The tenuously optimistic spin conveys a sense of desperation from equity longs. Volatility is now much higher than two months ago. This means larger price moves. In both directions.”

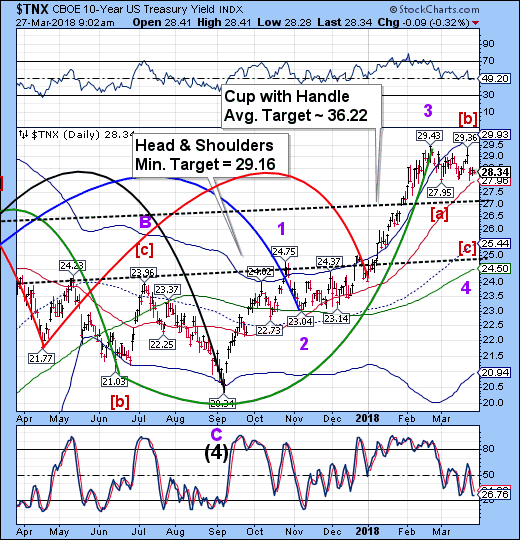

TNX may be ready to descend beneath the Intermediate-term support at 27.90 as the decline may be ready to ‘lock in.” As if the last commitment of traders report, the speculators are still heavily short the 10-year. Last week’s low at 27.99 did not break down beneath the prior low at 27.95. When the breakdown occurs, there will be a rush to cover their shorts.

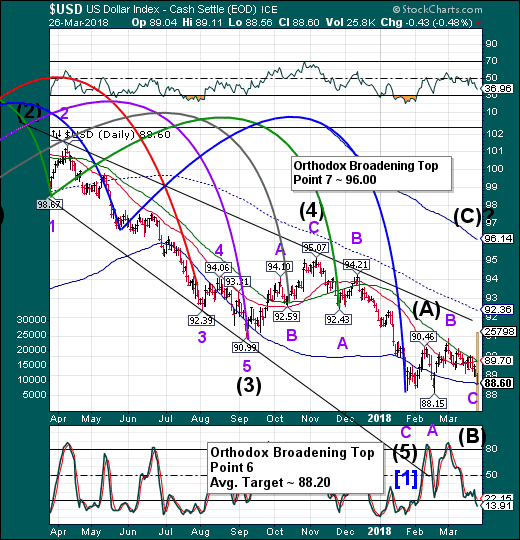

USD futures are bouncing after testing Cycle Bottom support at 88.57. USD shorts will also have to cover as the dollar vaults toward Point 7 at 96.00. The Cycles Model suggests the rally may last about a week, but it will appear to be vicious for the shorts.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.