What Happens After the Stock Market Crashes on Thursday and Friday

Stock-Markets / Stock Markets 2018 Mar 25, 2018 - 05:54 PM GMTBy: Troy_Bombardia

The stock market tanked on Thursday (-2.5%) and Friday (-2%). This is rare. Most of the “down on Thursday and Friday” historical cases saw the S&P fall a little on Thursday and accelerate the decline in Friday.

The stock market tanked on Thursday (-2.5%) and Friday (-2%). This is rare. Most of the “down on Thursday and Friday” historical cases saw the S&P fall a little on Thursday and accelerate the decline in Friday.

Nevertheless, this is a bearish sign for next Monday but a short-medium term bullish signal for the stock market. Here’s what happens next when the stock market falls more than 2% on Thursday and on Friday.

Here are the historical cases.

- March 23, 2018 (current case)

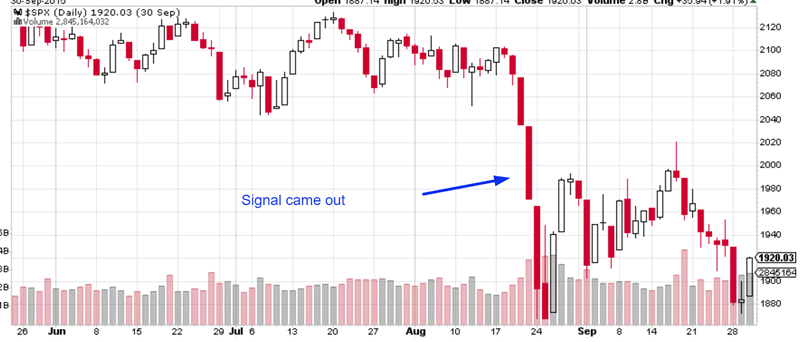

- August 21, 2015

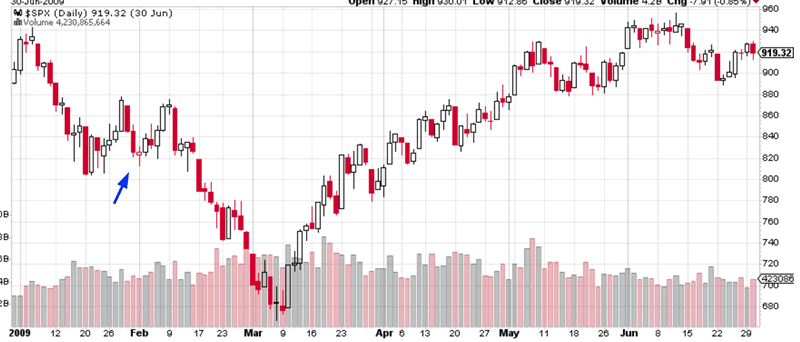

- January 30, 2009

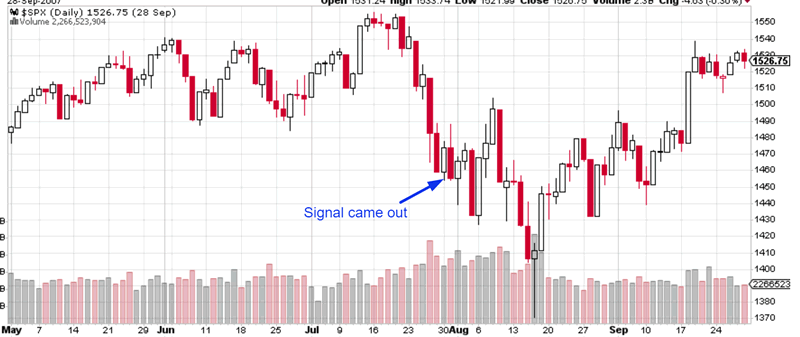

- July 19, 2007

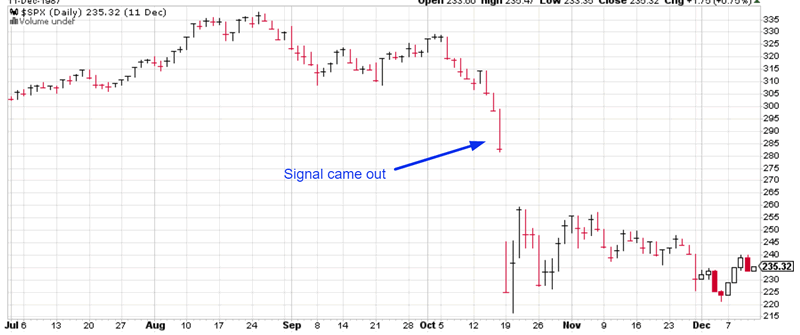

- October 16, 1987

- September 13, 1974

Let’s look at these cases in detail.

August 21, 2015

This occurred in a “significant correction”. The S&P crashed the following Monday, which marked the 1st low in the “significant correction”.

January 30, 2009

The S&P made a marginal new low the next Monday. It then bounced for a week before making new lows over the next 4 weeks.

This case doesn’t apply to today because we are not in a bear market or a recession.

July 19, 2007

The S&P 500 made a marginal new low on Monday. It then rallied for 1 week before making marginal new lows over the next week. That marked the bottom of this “small correction”.

October 16, 1987

This occurred on the Friday before the infamous October 19, 1987 crash. That crashed marked the bottom of the S&P 500’s “significant correction”.

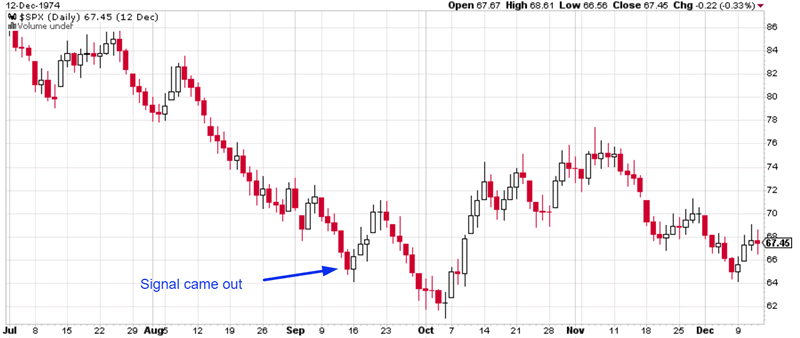

September 13, 1974

The S&P made a marginal new low the next Monday. It then bounced for a week and then fell for 2 weeks, which marked the bottom of the S&P 500’s bear market.

This historical case doesn’t apply to today. It happened within the context of a bear market and recession. We are neither in a bear market nor recession today.

Conclusion

When the stock market crashes more than 2% on Thursday and Friday:

- It makes AT LEAST a marginal intraday new low on Monday. This makes sense. When the market crashes, some of that residual fear carries over the weekend and creeps in on Monday. That causes the market to fall from the OPEN on Monday.

- The stock market is higher next Friday vs this Friday in 4 out of 5 historical cases. This wasn’t true of October 16, 1987: it crashed the following Monday. But the Medium-Long Term Model predicted that “significant correction”, whereas it has yielded no such SELL signal this time.

- The stock market was very close to a medium term bottom AS LONG AS there wasn’t a bear market and recession. The bear market cases are irrelevant today: there is no recession today. And most of those bear market cases happened near the bottom of the bear market, after the market had fallen 50%+.

The Medium-Long Term Model predicted all bear markets and all but 3 historical “significant corrections”. Could this be the 4th failure?

I don’t think so, but we’ll wait and see. This is still a “small correction”, but it’s on the big side of “small corrections”.

Regardless, I plan on sticking to the model. It’s good to avoid significant corrections when you’re using 2x or 3x leveraged ETFs (I’m using 2x leveraged S&P 500 ETF right now). But it’s the bear markets that you MUST avoid. And there are no bear market signals right now.

You have to focus on risk:reward during times like this. The market’s downside risk is limited while its upside is much higher.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.