The Fed’s Interest Rate Hikes Aren’t Bearish for the Stock Market

Stock-Markets / Stock Markets 2018 Mar 24, 2018 - 04:56 PM GMTBy: Troy_Bombardia

The Fed hiked interest rates this Wednesday. This is far from being the last rate hike in this rate hike cycle.

The Fed hiked interest rates this Wednesday. This is far from being the last rate hike in this rate hike cycle.

We’ve already shown that rising interest rates aren’t consistently bearish for the stock market. We can look at this idea from another angle.

If rising interest rates are bearish for the stock market, then the stock market should fall after the last rate hike in a rate hike cycle (i.e. the economy and stock market should tank after the Fed has increased interest rates by “too much”).

This isn’t the case historically. Sometimes the stock market goes up for months/years without a significant correction or bear market after the Fed stops hiking interest rates.

Here’s what happened to the S&P 500 after the last rate hike in each cycle.

- June 29, 2006

- May 16, 2000

- February 1, 1995

- February 26, 1989

- August 9, 1984

- January 1981

- March 1980

Let’s look at the S&P 500 during each of these historical cases.

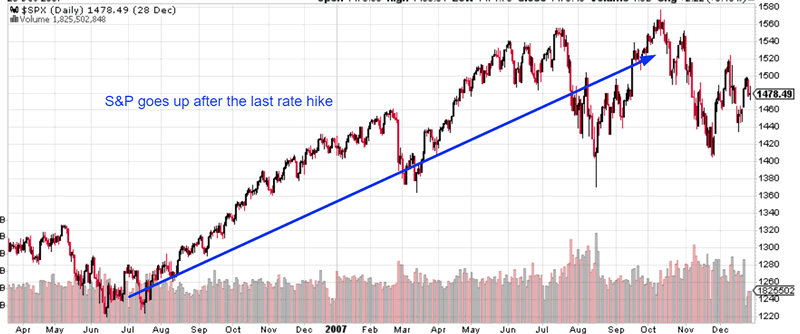

June 29, 2006

The Federal Reserve stopped hiking interest rates after June 2006. The S&P rallied over the next 1 year. The next bear market began 16 months later in October 2007.

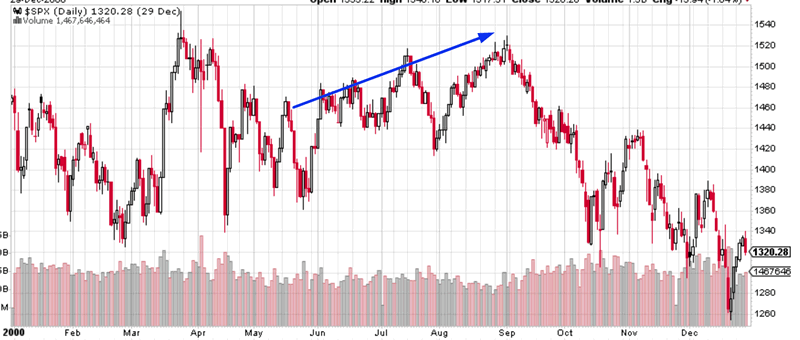

May 16, 2000

The Federal Reserve stopped hiking interest rates after May 2000. The S&P swung higher over the next 3 months before starting its bear market downleg in September 2000.

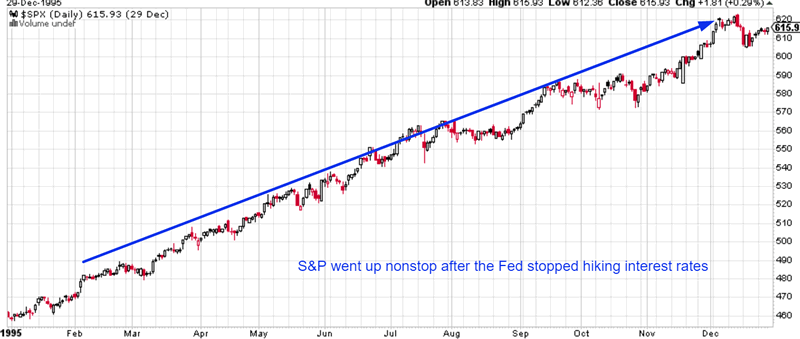

February 1, 1995

The Federal Reserve stopped hiking interest rates after February 1995. The S&P soared nonstop throughout the rest of 1995. The next “significant correction” began 3.5 years later in 1998.

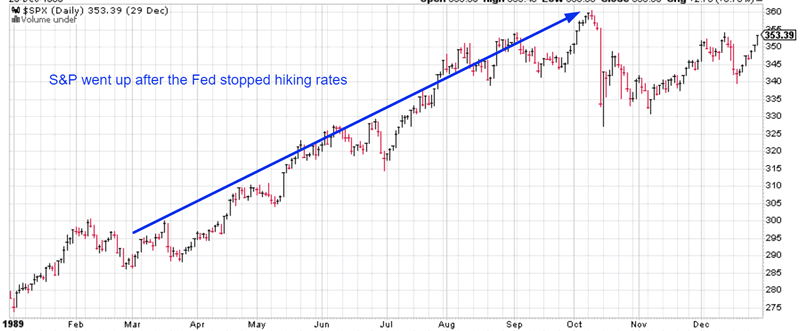

February 26, 1989

The Federal Reserve stopped hiking interest rates after February 1989. The S&P rallied nonstop after the Fed stopped hiking rates. The next “significant correction” began 1.5 years later in July 1990.

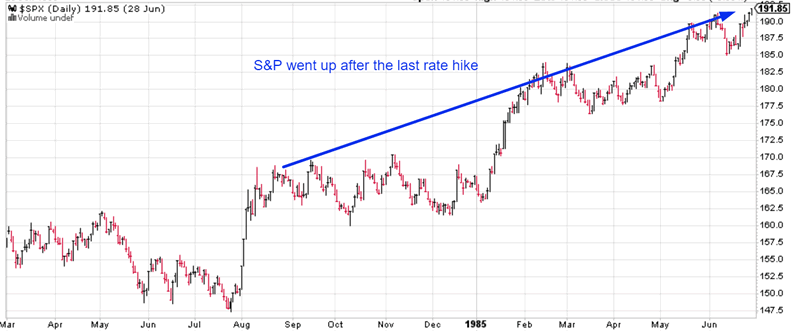

August 9, 1984

The Federal Reserve stopped hiking interest rates after August 1984. The S&P rallied over the next year. Its next “significant correction” began 3 years later in 1987.

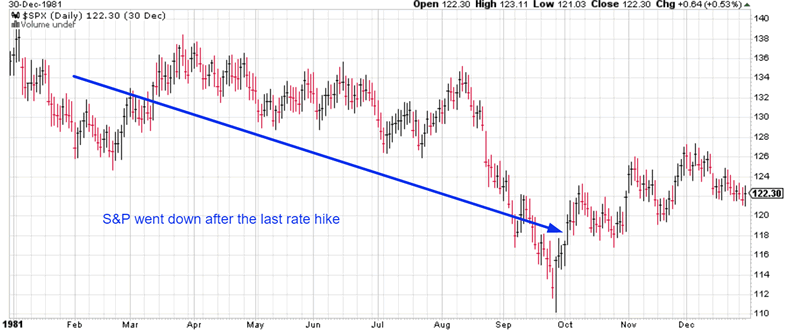

January 1981

The Federal Reserve stopped hiking interest rates after January 1981. This was the start of a “significant correction”.

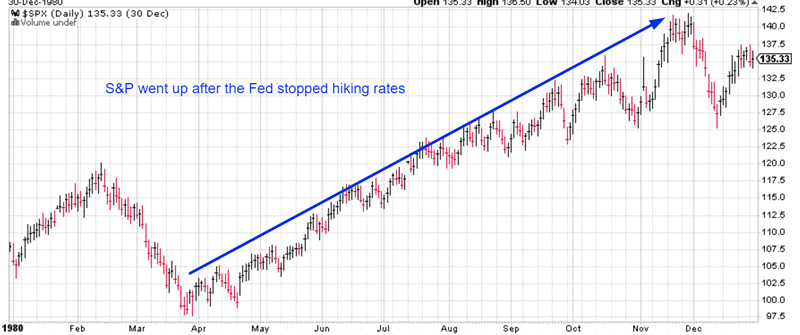

March 1980

The Federal Reserve stopped hiking interest rates after March 1980. The S&P rallied over the next 8 months before beginning a “significant correction”.

Conclusion

The correlation between Fed rate hikes and the S&P 500’s future performance is very weak. When the Fed stops hiking interest rates because the economy has “weakened” the stock market tends to go up over the next few months more often than it goes down.

The Fed is hiking interest rates right now, and this isn’t consistently bearish for the stock market. Focus on the economic data and not the Fed’s actions.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.