Stocks Recovering from a "deep dive" Overnight

Stock-Markets / Stock Markets 2018 Mar 23, 2018 - 02:17 PM GMT SPX futures challenged the Cycle Bottom support by declining overnight to 2718.50. It is now in bounce mode and may challenge the trendline today. The 38.2% retracement is almost precisely at the trendline at 2702.83 while the 50% retracement is at 2721.74. Mid-Cycle resistance at 2714.10 is a common retracement point. There is central bank intervention. The question is, how far can they retrace lost ground?

SPX futures challenged the Cycle Bottom support by declining overnight to 2718.50. It is now in bounce mode and may challenge the trendline today. The 38.2% retracement is almost precisely at the trendline at 2702.83 while the 50% retracement is at 2721.74. Mid-Cycle resistance at 2714.10 is a common retracement point. There is central bank intervention. The question is, how far can they retrace lost ground?

ZeroHedge reports, “After the carnage in Japanese, Chinese stocks overnight, US equity futures are staging their standard pre-open bounce this morning along with offshore yuan (which has nearly erased all post-tariff losses)...

Ugly night in Asia...

But a notable late-day bounce as Bloomberg reports China intervened to support its stock market on Friday, people familiar with the matter said, after fears of a trade war with the U.S. sparked the steepest intraday selloff in six weeks.”

NDX futures sold off to 6594.75 in the overnight before recovering its (overnight) losses. It, too is likely to bounce back to the combination mid-Cycle and 52 day resistance at 6816.16. That constitutes a 2% bounce likely to happen today.

The interesting thing is that the 38.2% retracement is at 6872.92.

ZeroHedge passes this on from Richard Breslow, “Don’t mistake this as a trade recommendation, but it is all right to do nothing. Trading when you believe you have an edge is when it is time to step in. If you are there, then go for it. But trading merely because things are moving around is a day-trading concept, not an investment thesis.

It’s important to match trading style, objectives and realistic liquidity assumptions to how you view volatility vs risk. They are very much not the same thing. Made even more so if you think the Fed equity put has been eliminated. It hasn’t, just moved some.

I guess I would be more excited about jumping in if I could construct a more coherent explanation for precisely what is going on. And if I can’t come up with some half-baked theory I’m willing to run with, I’m willing to bet neither can a lot of other people. Even if they are more than willing to be adamant that it all boils down to one thing. It doesn’t.”

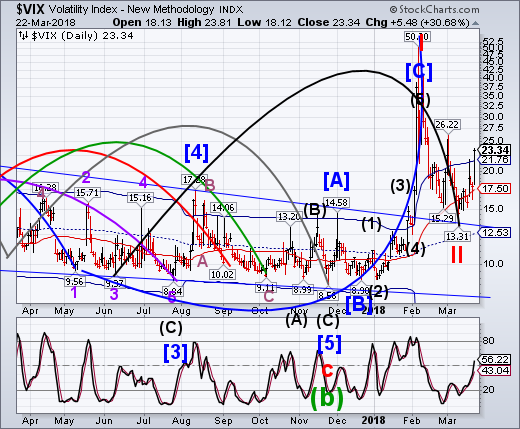

VIX futures have pulled back from an overnight high of 25.27. It appears to have completed a Leading Diagonal Wave (1). It may decline back to the 52-day Moving Average at 17.50, which is near the 61.8% retracement level (17.32).

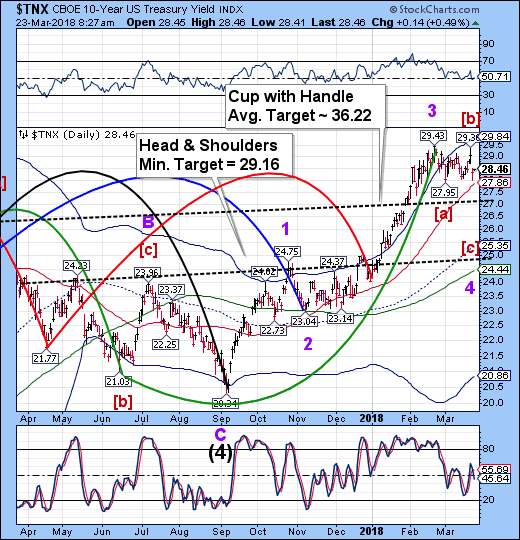

TNX bounced to 28.52 in the overnight session, but the bounce may be over. If so, the decline may resume. The normal target for this decline appears to be mid-Cycle support at 25.35.

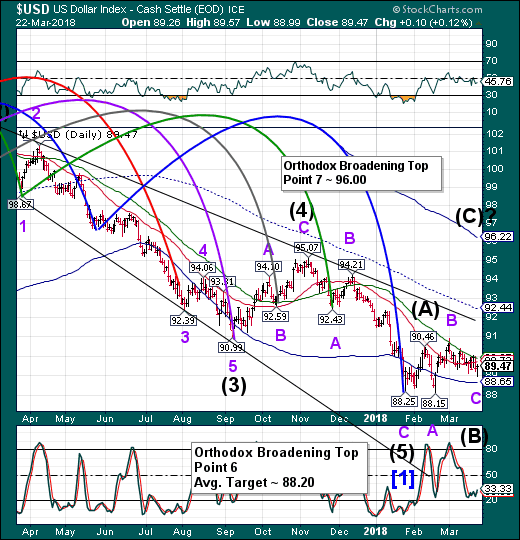

USD appears to have completed Wave C of (B) yesterday at 88.99 and is likely to begin its rally to the Point 7 target.

PoundSterlingLive reports, “The US Dollar could be set to rally against "risk" currencies in the coming weeks, according to Morgan Stanley, as markets respond to a decline in global risk appetite and a rise in short term market interest rates.

Strategists at the bank are watching the latest developments on the international trade front keenly, as well as events in interest rate markets, and have flagged both the Australian Dollar, Pound Sterling and New Zealand Dollar as among those likely to suffer the most in the current environment.”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.