The Tertiary Bubbles Have Blown Up… Can the Fed Manage the Secondary Ones?

Stock-Markets / Liquidity Bubble Mar 22, 2018 - 06:18 PM GMTBy: Graham_Summers

The big questions being tossed around Wall Street today are: why are markets such a mess? Why are we getting these wild swings?

The big questions being tossed around Wall Street today are: why are markets such a mess? Why are we getting these wild swings?

The reality is that the markets are NOT a mess. These are actually normal healthy markets. Healthy markets move, sometimes a lot in a small span of time.

The real issue is that from ’09 until recently, the market was completely artificial because Central Banks cornered ALL risk by cornering the sovereign bond market.

Remember we are in a debt-based financial system today. Sovereign bonds are the bedrock of that system. They define the “risk free rate of return” against which ALL risk is priced. They’re also the senior most collateral owned by the banks to backstop their trading/ derivatives portfolios.

When Fed and other Central Banks cornered sovereign bonds via ZIRP (front end of bond market) and QE (long end of bond market) they forced EVERYTHING to reprice to ridiculously low levels of risk. This is why I coined the term the Everything Bubble in 2014. It’s also why I wrote the book on this subject.

This bubble is unlike any other bubble in history in that it is truly systemic, affecting every asset class Today you have a primary bubble (sovereign bonds) creating secondary bubbles (corporate debt, housing, stocks) and even tertiary bubbles (short vol/ risk parity fund/ passive investing).

It truly is the Everything Bubble.

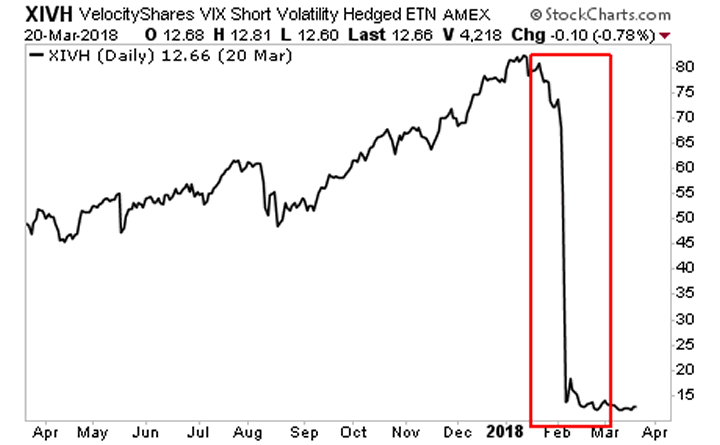

As Central Banks begin to attempt to normalize policy, all of these will start blowing up in reverse order. The tertiary bubbles blew up in February when the short-volatility trade destroyed over 97% of its value in a matter of days.

Central Banks are now trying to manage to deflate secondary bubbles, particularly that of stocks, without causing a crisis.

Big picture: you’re going to see a LOT of volatility going forward. And we’re going to see absolute insanity in asset prices. The reason? Every historic correlation/ relationship has been messed up by Central Bank interventions.

Imagine a person who was a raging heroine addict and who contracted major illnesses during his addiction. Now imagine that person getting clean. Throughout the detox process all kinds of issues/ organ problems would develop as the body attempts to adjust to drug being removed.

THAT is the market today. This time is truly different but not in a good way. We’ve never had a coordinate Central Bank policy of creating bubbles in the bedrock of the financial system before. Given how badly Central Banks managed the Tech stock bubble and Housing Bubble, the outcome won’t be pretty.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.