Stocks are Gapping Beneath the Trendline Support

Stock-Markets / Stock Markets 2018 Mar 22, 2018 - 02:09 PM GMT SPX futures appear to be gapping down beneath the trendline at 2700.00. This may be yet another big down day.

SPX futures appear to be gapping down beneath the trendline at 2700.00. This may be yet another big down day.

ZeroHedge reports, “Yesterday, we showed that according to Wall Street, the biggest tail risk facing investors right now is a "trade war"...

... and that should trade tensions escalate, lower stock prices would be the immediate result (and that managers would sell stocks in advance).

Well so far this morning, they are being proven right (or simply selling), because a jittery overnight session for stock futures which saw the S&P close at session lows after yesterday's Fed rate hike (due to the "snowstorm" according to a dead serious Marko Kolanovic), turned increasingly volatile just before dawn in New York, as investors prepared for today's China trade war announcement from President Trump that could levy tariffs on more than 100 types of Chinese goods, and is due just after noon ET.”

NDX futures have crossed the Rubicon as the morning session has collapsed 100 points.

ZeroHedge reports, “Facebook advertisers have threatened to abandon the platform in the wake of a massive data harvesting scandal which began after it was revealed that an app created by two psychologists - one of whom Facebook employs - gathered data on over 50 million Americans and then sold it to political data firm Cambridge Analytics and several others, who used it without consent.

Mark Zuckerberg, co-founder and CEO of the social media giant gave several interviews Wednesday after spending three days in hiding, ostensibly with a crisis management team which advised him not give wholly unsatisfactory answers to one of the largest data breaches in history.“

VIX futures are pressing the 20 handle as awareness of “all is not well” emerges. We may see the Cycle Top surpassed in this session.

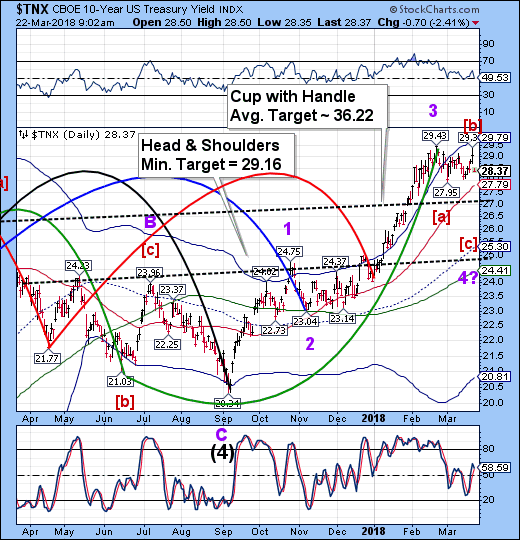

TNX appears to have reversed from its high this morning, as indicated yesterday. The Cycles Model suggests about two weeks of decline that may go as far as the Head & Shoulders neckline.

Bloomberg observes, “Several developments last week indicated that the recent panic in the market for U.S. Treasury bonds was a false alarm. The increase in average hourly earnings has slowed appreciably, reducing the risk of aggressive monetary tightening by the Federal Reserve. Inflation moderated from levels recorded at the beginning of the year. Retail sales dropped for a third month, belying expectations of an increase. Finally, data released March 16 showed that February housing starts fell more than expected, providing another indication of slower economic growth.”

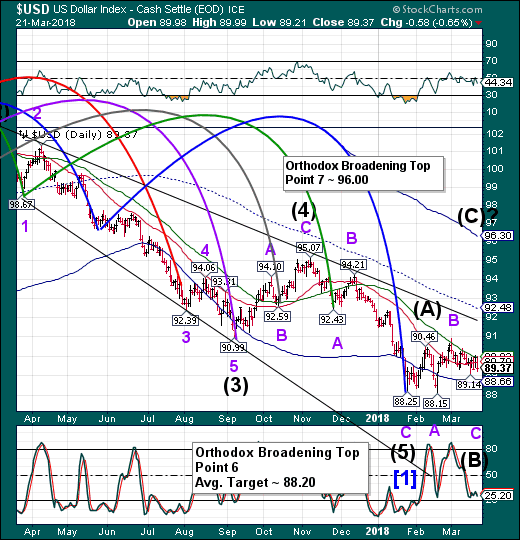

USD futures fell to 89.00 in the overnight session, then have recovered since then. This may also be the reversal that I have anticipated over the past two weeks. Should stocks go down in a panic, the USD may have no trouble at all rising to the Cycle Top resistnce at 96.30.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.