Will Powell’s Actions Pop Stock Market Perfection

Stock-Markets / Stock Markets 2018 Mar 21, 2018 - 12:58 PM GMTBy: Doug_Wakefield

March 21st will be the first FOMC release under Chairman Powell. 3-month Treasury yields have risen 80-basis points since October 1st when the Fed started reducing its balance sheet for the first time since QE 1 launched in 2009. Chairman Powell has stated future hikes are in store for the rest of 2018. Based on these patterns, we should see the 6th rate hike from the Fed since December 2015 on March 21st.

March 21st will be the first FOMC release under Chairman Powell. 3-month Treasury yields have risen 80-basis points since October 1st when the Fed started reducing its balance sheet for the first time since QE 1 launched in 2009. Chairman Powell has stated future hikes are in store for the rest of 2018. Based on these patterns, we should see the 6th rate hike from the Fed since December 2015 on March 21st.

Yet as markets closed on March 20th, US stock indices gave stock investors the view of “still rising, all is calm”.

What lessons could we learn by looking back at major March turning points in US markets over the last 2 decades?

In March 2000 the NASDAQ and S&P 500 topped. The bull market from 1982 to 2000 was complete. By October 2002 the NASDAQ 100 had declined 83% (4021 points) and the S&P 500 50% (768 points).

In March 2009 the NASDAQ 100 closed at 1,043 and the S&P 500 at 676. Since Q4 2007 the NASDAQ 100 had fallen 53% (1,196 points), and the S&P 500 57% (900 points). The first ever global QE was now underway.

When the longest recession since the Great Depression ended in 2009, investors worldwide had seen two devastating bear markets in less than ten years. Global loss estimates topped $60 trillion from the Great Recession.

It is now March 2018. The NASDAQ 100’s current record close is on Monday, March 12th (7131) and the S&P 500’s is on Friday, January 26th (2872).

Adding the 2000 and 2007 peaks in the S&P 500 we get 3,129.

Adding the 2000 and 2007 peaks in the NDX 100 we get 7,055.

Adding the 2000 and 2007 peaks in the Dow Industrials we get 25,948.

Compare those numbers to the ones next.

As of March 19, 2018, the Dow’s current all-time high is 26,616 (1/26/18), the S&P 500’s is 2,872 (1/26/18), and the NASDAQ 100’s is 7,186 (3/12/18).

Should these extremes in stock prices alongside sharply rising rates concern everyone? Certainly.

Yet as the next headline shows, investors, after watching a 12% decline in the Dow and S&P 500 between January 26th and February 9th, went right back in full bore, trusting in the "perfect bull" supported by the chief "rescuer", the Federal Reserve.

Investors Just Pumped the Most Money Ever Into Stock Funds for a Single Week, CNBC, March 16, 2018

When I began my research for public writing in 2004, I learned that the largest monthly inflow into stock funds to date was February 2000, and the largest outflow from stock funds was in July 2002. As we know in hindsight, March 2000 was a major top, US stocks declining 30 months into a major bottom in October 2002.

If there was ever a time for investors to stop chasing a bubble, it is now, although I doubt the fervor of this mania will diminish until we are far away from current all-time highs.

Stop listening to pundits seeking to explain how “investors” responded positively or negatively to news events. We could all give a list of powerful negative events from the last few years that had absolutely no impact at all on market prices more than a day or two if that. Humans are not making investment decisions at the speed of light, computers are!

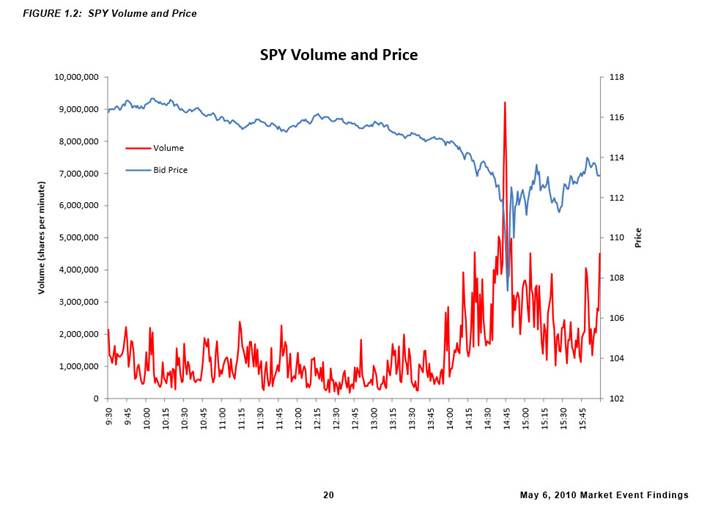

The Findings Regarding The Market Events of May 6, 2010, released by the SEC and the CFTC on September 30, 2010, is important to anyone wanting to understand how fast things can change, especially after months and months of watching the herd into the same trades and strategies over and over again.

“In the four-and-one-half minutes from 2:41 p.m. through 2:47:27 p.m. prices of the (S&P500 futures contract the) E-Mini had fallen by more than 5% and prices of the SPY (ETF) suffered a decline of over 6%.” [pg 4]

Anyone who dismisses the lessons from the May 6, 2010 Flash Crash as having no application to investors in 2018, is refusing to consider the 1,000-point drops in the Dow on February 5th and 8th, this coming after the only 11,000 point rise in a 2 year period in the history of the index.

Investors, advisors, and money managers can place their hopes in more intervention by central bankers to stop their stock holdings or funds from declining, but after the largest intervention by central banks in world markets in history, do we not realize that this mindset has placed us all in a very precarious position?

Global Central Banks Redouble Cash Offer to Quell Brexit Panic, Financial Post, June 24, 2016

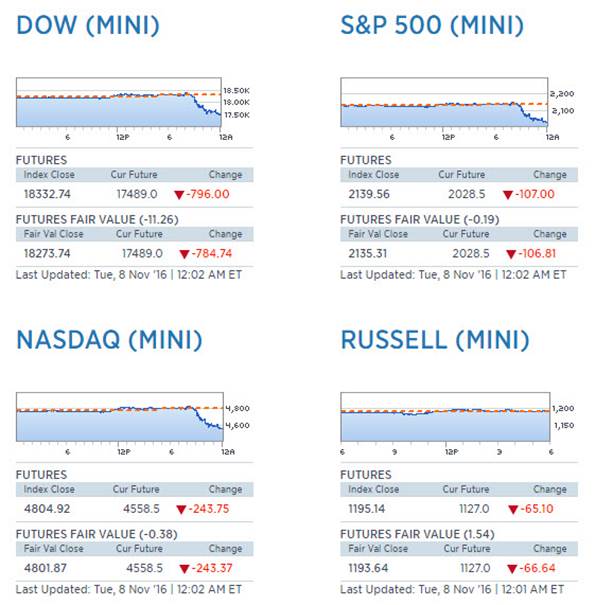

Dow Futures Plunge 750 Points as Trump Takes Key Battleground States, MarketWatch, Nov 8, 2016

Dow Closes Up 250 Points; Financials Surge After Trump Election Upset, CNBC, Nov 9, 2016

When the Dow fell 5% in two days after the Brexit, we were told that global central banks “stopped the panic”.

Most individuals never knew of the 900-point drop in Dow futures the evening of the US elections on November 8th since the following morning the entire 900-point drop had recovered BEFORE stocks opened in New York on November 9th.

Now I ask you, do you know of any “investors” who dumped stock futures in the middle of that night before buying stock futures, all in a few hours?

So why didn’t the big banks and global central banks take credit for “saving the stock rally” then?

Final Call for Stall, Bear Train Will Leave the Station

Soon the most complex system in the world, the global financial markets, will no longer stall on the mother of all “corrections”. When they break under various key levels in the sand that have once again stalled the decline since February 9th, the entire world will need to remember these words from the SEC and CFTC about the May 2010 Flash Crash.

One key lesson is that under stressed market conditions, the automated execution of a large sell order can trigger extreme price movements, especially if the automated execution algorithm does not take prices into account. Moreover, the interaction between automated execution programs and algorithmic trading strategies can quickly erode liquidity and result in disorderly markets. [pg 6]

The “perfect bull” seen in 2017 has been challenged in Q1 2018. When the next major line in the sand is broken as we saw in August 2015, there will be no easy options.

With the US national debt going from 5.7 trillion to 9 trillion between the 2000 and 2007 US stock tops, and 9 trillion and 21 trillion between the 2007 and current 2018 all-time highs, we can not turn to the same dollar-centered world, and a group of central bankers to “save the markets” by doubling or tripling current debt levels.

Historic changes are coming.

The Golden Petro-Yuan and the Chinese Bride in the Arabian Desert, Law Today, Dec 13, 2017

Was January 26th the Dow’s Final Peak?

The Great Recession turned bulls to bears. Was January 26th the peak of this 9 year stock bull? Booms have repeatedly been followed by busts in history. This will come. Time to consider mega contrarian trend changes and trades? Join the readers of The Investor’s Mind as history and QT changes the global landscape.

Click here for a 90-day subscription.

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.