Do Stocks Bull Market Tops Need Breadth Divergences?

Stock-Markets / Stock Markets 2018 Mar 19, 2018 - 07:30 AM GMTBy: Troy_Bombardia

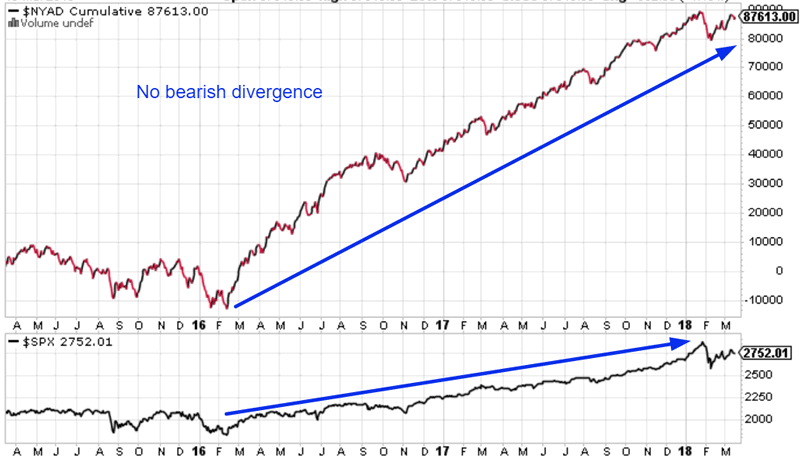

Despite what some bearish investors might say, the U.S. stock market’s breadth is IMPROVING right now. Here’s the NYSE’s Advance-Decline Cumulative Line. It is leading the S&P 500 higher.

Bull market tops are accompanied by bearish breadth divergences. (I.e. more stocks fall than rise in the last leg of a bull market.) These divergences last months if not years. Here are the historical cases:

- 2007

- 2000

- 1973

- 1968

Let’s look at these cases in detail.

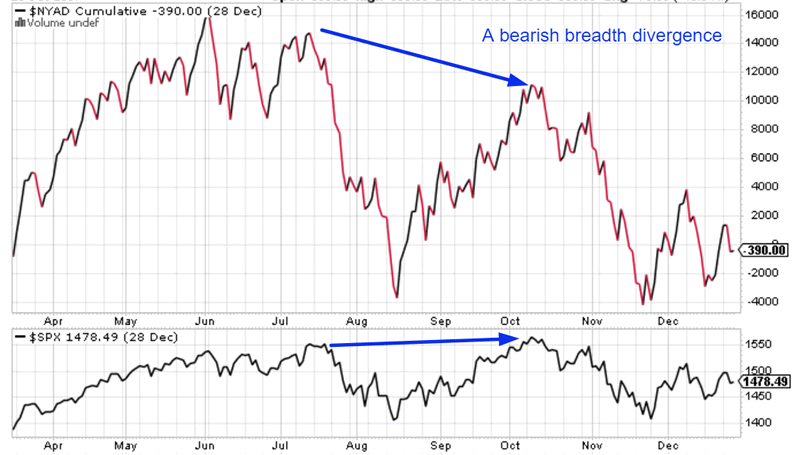

2007

The U.S. stock market peaked in October 2007. The Advance-Decline line peaked in June 2007 and made a multi-month bearish divergence.

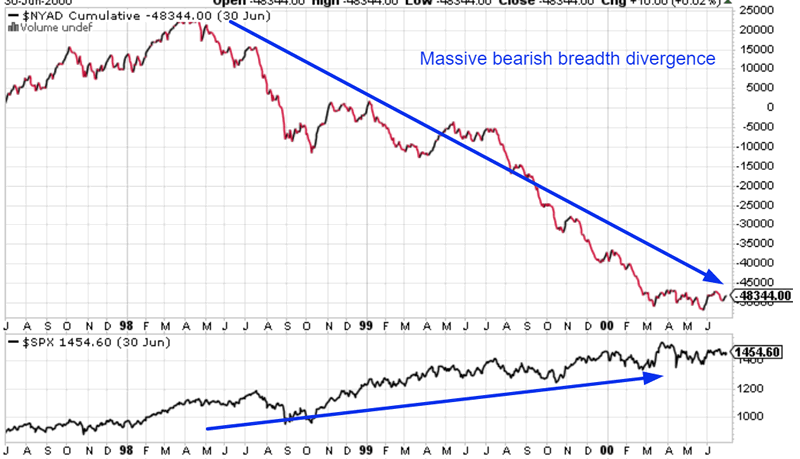

2000

The U.S. stock market peaked in March 2000. The Advance-Decline line peaked in April 1998 and made a bearish divergence that lasted 2 years.

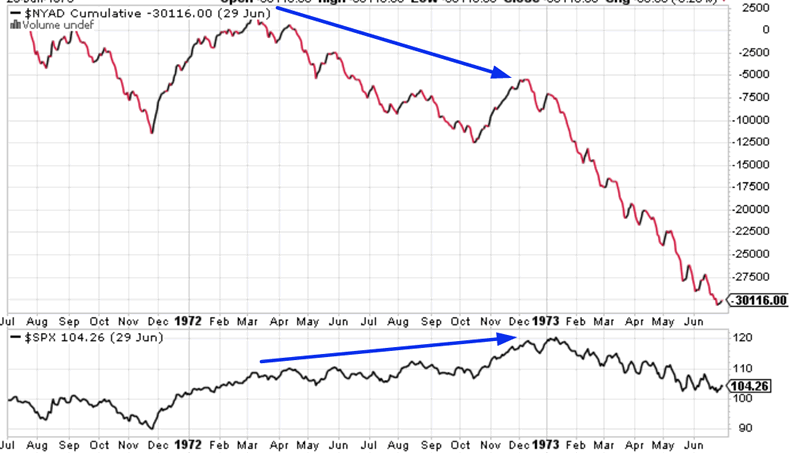

1973

The U.S. stock market peaked in January 1972. The Advance-Decline line peaked in March 1972 and made a bearish divergence that lasted 10 months.

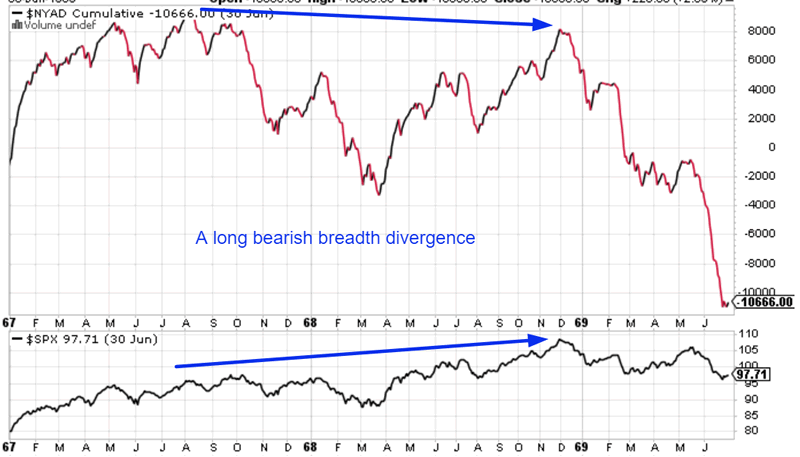

1968

The U.S. stock market peaked in December 1968. The Advance-Decline line peaked in April 1967 and made a bearish divergence that lasted for 1.5 years.

Conclusion

There has been no multi-month bearish breadth divergence today. This implies that the current equities bull market is not over and will last AT LEAST a few more months. This thesis is supported by other studies (Study: strong earnings growth is bullish for stocks).

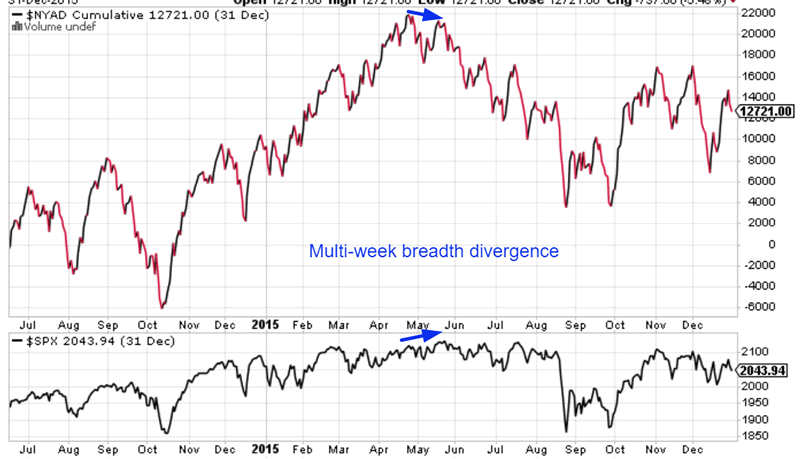

It’s also worth noting that multi-week bearish breadth divergences were common before historical “significant corrections” began. Here’s an example featuring the 2015 “significant correction”.

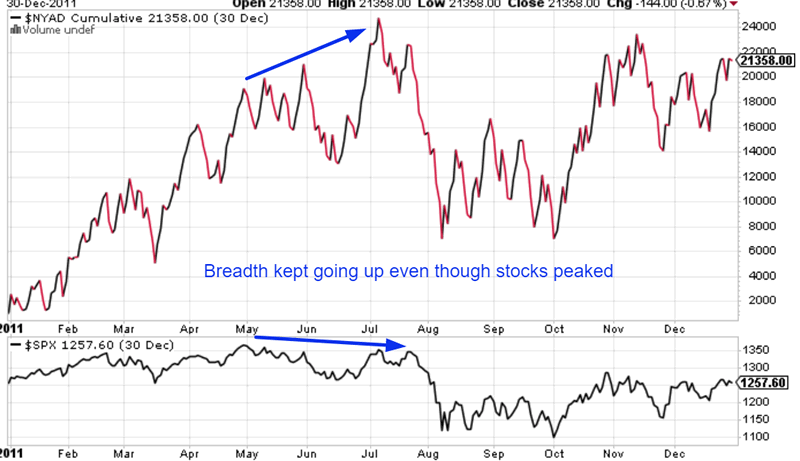

Here’s an example showing that not all “significant corrections” are preceded by bearish breadth divergences. We cannot use breadth divergences to consistently and accurately predict “significant corrections”.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.