The Bond Market is SCREAMING Inflation, But Stock Investors are Clueless

Interest-Rates / US Bonds Mar 13, 2018 - 03:43 AM GMTBy: Graham_Summers

Inflation is now reaching a crescendo.

The fact is that inflation develops in stages in the economy. The first stage concerns the price of items being bought and sold by wholesalers. We saw this begin to surge starting in the middle of last year. And it was a global phenomenon.

Paying more for something is manageable for a while. However, at some point the increase in prices is passed on into the economy in the form of more expensive goods and services. This is when inflation truly begins to become a problem.

And the tell tale sign that things are beginning to get out of control is when workers begin demanding higher wages to deal with increased cost of living.

We are now officially there.

Last week’s jobs data revealed that average hourly earnings for some 80% of workers rose at an annualized pace of 3% over the last three months. Again, this was over three months so it’s not a single data point, workers are DEMANDING higher wages to deal with higher costs of living/inflation.

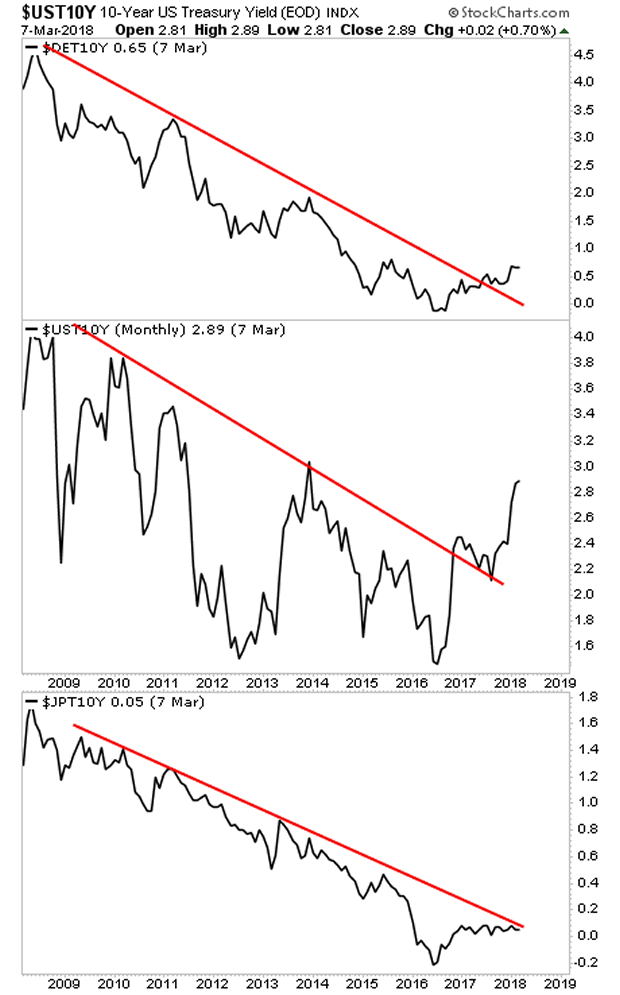

We get confirmation of this from the bond market, where bond yields are spiking higher to accommodate higher inflation. Already we are seeing yields on US Treasuries, German Bunds, and even Japanese Government Bonds spike higher to test if not BREAK their long-term downward trendlines.

This is a truly global problem for global Central Banks which are all WAY behind the curve. And this is going to present investors with one of the great money-making opportunities of 2018 if they’re positioned correctly.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.