Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

Stock-Markets / Stock Markets 2018 Mar 13, 2018 - 03:32 AM GMTBy: GoldCore

– Recent stock market selloff showed gold can deliver returns and reduce portfolio risk

– Recent stock market selloff showed gold can deliver returns and reduce portfolio risk

– Gold’s performance during stock market selloff was consistent with historical behaviour

– Gold up nearly 10% in last year but performance during recent selloff was short-lived

– The stronger the market pullback, the stronger gold’s rally

– WGC: ‘a good time for investors to consider including or adding gold as a strategic component to their portfolios.’

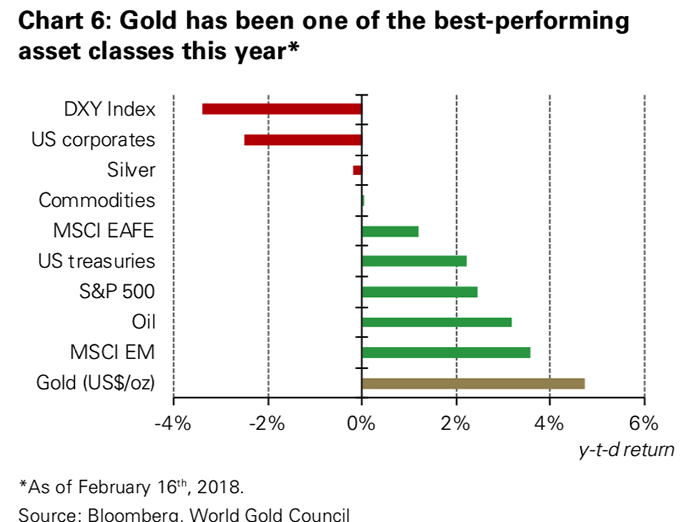

– Gold remains one of the best assets outperforming treasuries and corporate bonds

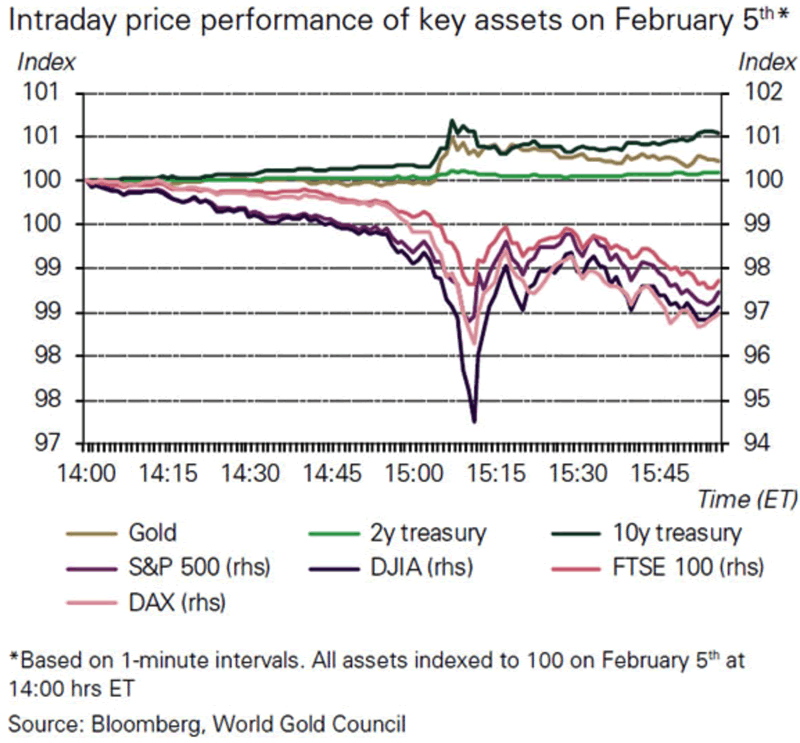

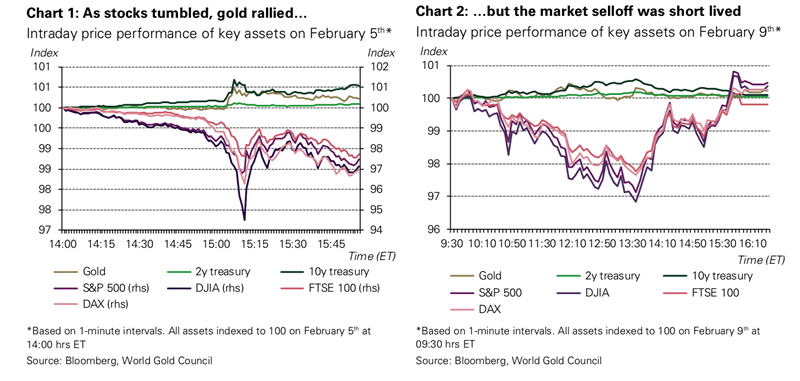

A recent World Gold Council (WGC) study has concluded that the market selloff on February 5th made the case for gold as both a diversifier and an asset that protects portfolios during market downturns.

The stock market selloff of early February saw stocks tumble. But, whilst it was sharp it was also short-lived. Many watching the gold price were disappointed to see gold lose around 0.8% of its USD price between February 5th and February 12th, when both the Dow Jones and European stocks and begun to recover losses.

Yet to judge gold on its price performance alone is to misunderstand gold (or, in fact any asset’s) role in a portfolio. In order to appreciate it’s performance one must compare it to other assets as well as it’s long-term behaviour.

Gold’s protection was stronger than you realise

Whilst gold did drop by nearly 1% in USD terms it was a different story for other currencies (which account for 90% of gold demand). This was particularly the case in Europe where currencies weakened against the dollar, increasing gold prices. In euro terms old rallied by 0.9% and 1.8% in sterling, between Friday February 2nd and Monday February 12th.

The 0.8% overall drop in the gold price over the beginning and end of the stock market selloff was not reflective of gold’s performance during the period:

‘[Gold] still outperformed most assets on the week (other than treasuries) and reduced portfolio losses, providing liquidity to investors as market volatility rose.’

“Gold’s effectiveness as a hedge increases with systemic risks”

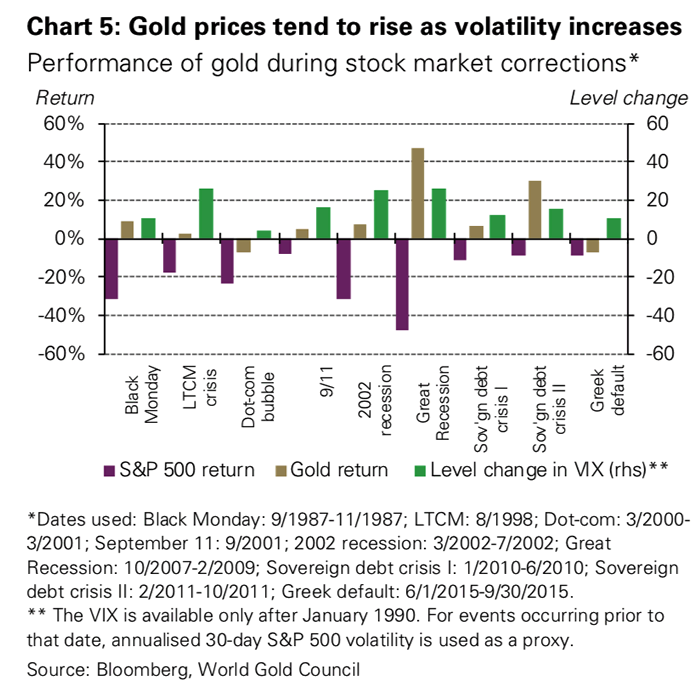

Gold and stocks are inversely correlated in market downturns. This is thanks to the behaviour of investors who typically show a ‘flight-to-quality’ behaviour.

This benefit of gold is better seen when market crises are broader or last longer than the stock market correction we saw in February.

Examples include Black Monday, the 2008–2009 financial crisis and the European sovereign debt crisis (Chart 5). But there are exceptions.

Gold has been more effective as a hedge when a market correction has been broader (i.e. affects more than one sector or region) or lasted longer.

During the 2001 dot-com bubble burst, the risk was mainly centred around tech stocks and was not enough to elicit a strong reaction from gold; it was not until the broader US economy fell into recession that the gold price responded more sharply. Similarly, investors outside of Europe discounted the possibility of a spill-over from the 2015 Greek default. In recent pullback, as stocks quickly rebounded, gold’s reaction was more muted.

However, taking a longer, more strategic view, is quite relevant.

Looking beyond the short-term stock market selloff

As we often discussed, mainstream media and market commentary have a strong bias towards short-term views. This leads to a very blinkered approach and often an all-too-easy dismissal of gold as a worthy investment.

There has been talk of a stock-market correction for a long-while. Frothy asset prices, pumped-up valuations and the ongoing uptick in stock market prices appeared to be just asking for a market selloff. We finally saw a selloff last month when the DJIA had it’s biggest drop in history. Was this the end of the bubble? Prices did recover but that doesn’t mean it wasn’t the final bell in what has been a long run.

An environment is now forming where a number of corrections are becoming more likely in the near-future. Interest rates are slowly being hiked up, how markets and economies will cope with this after a record-long period of ultra-low interest rates is something we are just beginning to get a taste of.

Trade wars are looming, inflation levels are climbing and political sabre-rattling is growing stronger. With this in mind the World Gold Council reminds us of gold’s ‘four key roles in a portfolio’:

– delivering positive long-term returns

– improving diversification

– providing liquidity, especially in downturns

– enhancing portfolio performance through higher risk-adjusted returns

So far, 2018 has been a good case in point of gold’s role as a strategic asset. It has been one of the best-performing asset classes year-to-date, besting treasuries and corporate bonds (Chart 6). It has served as a diversifier and liquidity source as stock markets tumbled. Thus, gold helped investors improve their portfolios’ performance.

‘Consider including or adding gold as a strategic component to portfolios.’

The World Gold Council notes that there has been an increase in bullish positioning in gold options. ‘In our view, this type of bullish positioning suggests that investors may be increasing their portfolio protection against further market downturns…this is as good a time as any for investors to consider including or adding gold as a strategic component to their portfolios.’

You can find out more about investing in gold as part of a diversified portfolio in our Comprehensive Guide to Investing in Gold.

All quotes and charts taken from the World Gold Council.

Gold Prices (LBMA AM)

12 Mar: USD 1,317.25, GBP 950.66 & EUR 1,069.87 per ounce

09 Mar: USD 1,319.35, GBP 955.21 & EUR 1,072.50 per ounce

08 Mar: USD 1,325.40, GBP 955.08 & EUR 1,070.39 per ounce

07 Mar: USD 1,332.50, GBP 960.07 & EUR 1,071.86 per ounce

06 Mar: USD 1,324.95, GBP 957.01 & EUR 1,074.00 per ounce

05 Mar: USD 1,326.30, GBP 958.78 & EUR 1,075.63 per ounce

Silver Prices (LBMA)

12 Mar: USD 16.46, GBP 11.88 & EUR 13.39 per ounce

09 Mar: USD 16.49, GBP 11.92 & EUR 13.40 per ounce

08 Mar: USD 16.48, GBP 11.89 & EUR 13.31 per ounce

07 Mar: USD 16.65, GBP 12.01 & EUR 13.42 per ounce

06 Mar: USD 16.62, GBP 11.96 & EUR 13.41 per ounce

05 Mar: USD 16.51, GBP 11.95 & EUR 13.42 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.