Has the Stock Market Rally Run Out of Steam?

Stock-Markets / Stock Markets 2018 Mar 12, 2018 - 03:02 PM GMTGood Morning!

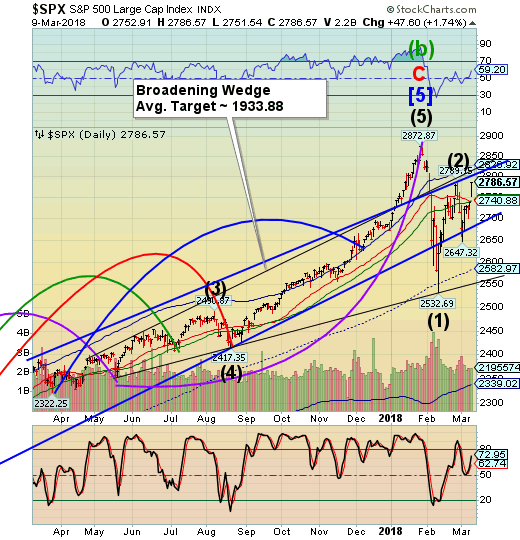

On Friday, SPX closed short of the upper Diagonal trendline near 2800.00. weekend, SPX futures rose to 2805.00, then backed away. It is possible that the futures completed the task of testing that trendline over the weekend.

ZeroHedge remarked, “The "goldilocks" mood that was unleashed after Friday's jobs report (high growth, low inflation) has spread around the globe, sending Asian and European markets higher as trade-war concerns took a back seat to economic optimism. The dollar slipped and Treasuries held strady even as the US Treasury prepares to sell $145 billion in debt today (including both 3Y and 10Y Paper), while most commodities fell.”

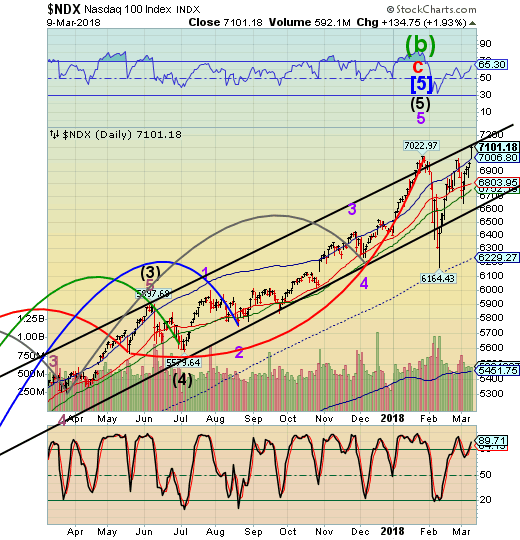

NDX futures also rose to 7175.25, but have fallen back as well. There appears to be trendline resistance near 7150.00. We shall see if it holds.

NorthmanTrader has some observations to help us this morning. “It was a good week to be bullish and the buying was ferocious and on the surface it appears that bulls won a major victory and bears look to have flailed again. Correction over. New highs on Nasdaq with $SPX recapturing all key moving averages including the 50MA, the 21MA, the weekly 5EMA and all is looking rosy again. Next week bullish OPEX, a sheepishly dovish Fed again the week after and then mark-ups for the month and quarter end. One can firmly smell the standard bullish seasonal script.

Or is it all a big lie? And if so, who is lying? After all, nothing is more ferocious than bear market rallies. Bear market are you nuts? Just look at $AMZN. To the moon Alice, to the moon.

Let’s have a look at the larger picture shall we?

First off, was the bullish outlook this week a surprise? No, it wasn’t if you paid attention to the signals and charts.”

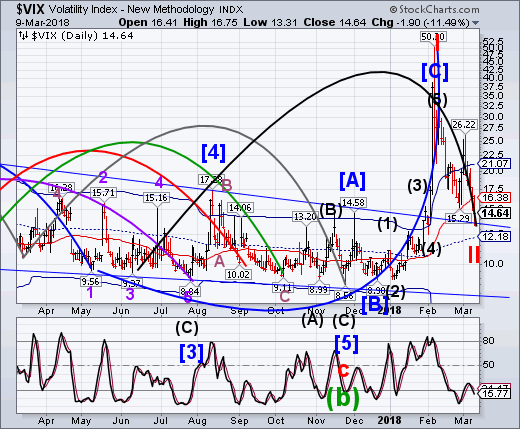

The glaring non-confirmation comes from the VIX futures which have just climbed to a high of 15.57. The 50-day Moving Average is at 16.38, which is an actionable buy signal.

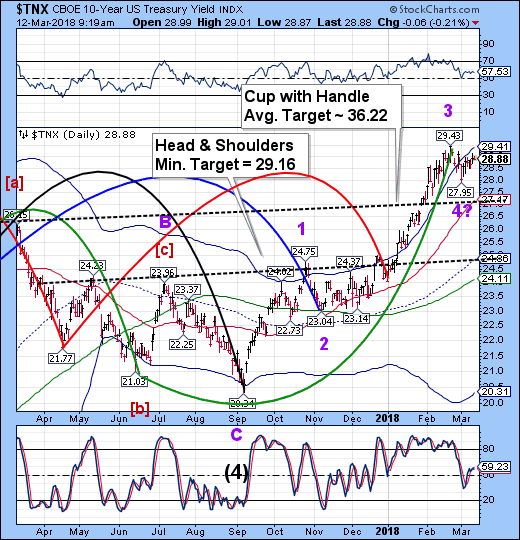

TNX futures are still hovering near the high. The Fed is preparing to sell $145 billion of 3-year and 10-year paper. That may be the canary in the coalmine.

Bloomberg reports, “Add one more thing to the list of worries for the world’s most indebted nation: weakening demand at its bond auctions.

While there’s no danger of the U.S. being unable to borrow as much as it needs, over the past two years, the drop-off has been unmistakable. Based on the number of bids that investors submitted versus the amount sold, average demand for 10-year notes has fallen to the lowest since October 2009.”

As usual, I will be posting more on my website.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.