Is the Bitcoin Bull Market Dead or Just Taking a Breather?

Currencies / Bitcoin Mar 08, 2018 - 02:46 PM GMTBy: Sol_Palha

For at least another hundred years we must pretend to ourselves and to every one that fair is foul and foul is fair; for foul is useful and fair is not. Avarice and usury and precaution must be our gods for a little longer still.

For at least another hundred years we must pretend to ourselves and to every one that fair is foul and foul is fair; for foul is useful and fair is not. Avarice and usury and precaution must be our gods for a little longer still.

John Maynard Keynes

Despite the heavy beating Bitcoin has taken, the sentiment has not turned bearish, and Bitcoin experts are still enthusiastically issuing wild targets of $100K and beyond.

Do these experts ever bother to look at the charts before issuing such targets or do they do so after ingesting some toxic substance? We will never know the answer to that question, but what we do know is that in most cases they have no idea of how high or low the market is going to go. They issue lofty targets that have a very low probability of being hit because if the market trades to these levels, they become instant heroes if they miss they can push some convoluted theory, for example, market manipulation to justify the bad call. The fact that Bitcoin is trading over 50% below its highs does not seem to faze these experts; they are quite resilient and continue to push for targets that border on the fantastic.

We published two articles on bitcoin since Dec of 2017, one on the 4th of December, and in that article, we made the following claim

Bitcoin, on the other hand, is now in the feeding frenzy stage, so this market is ripe for a correction

The second article on the 24th of January, and in that article, we issued price targets

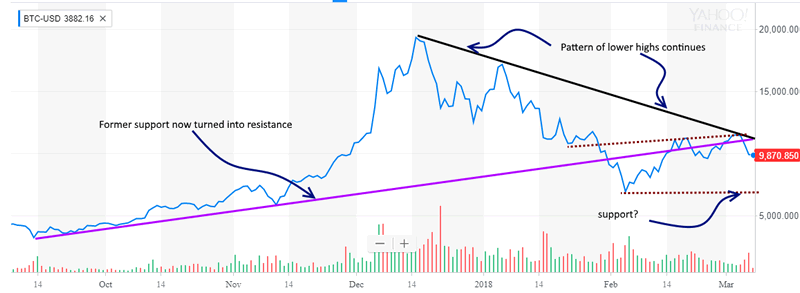

The bloodletting will continue until the trend of lower highs that started after Dec 14, 2017, comes to an end. On the conservative side, we think Bitcoin could drop down to the 8,800-9,200 ranges, but this market is far from your typical market, and there is a good chance that Bitcoin could drop down to the $5000-$5600 ranges before the dust settles.

On the 4th of February, Bitcoin prices dropped down to $6, 627, that’s within striking distance of the low-end targets ($5000-$5600) we issued. So is the correction over and is this market ready to trend higher.

The first thing that stands out is that Bitcoin is trading below the main uptrend line and until that obstacle is cleared the path of least resistance is down. Based on this one observation we can state that the probability of it testing the $5000 ranges is significantly higher than of it surging to new highs. It could trade lower, but that will depend on how it behaves when it tests that level, so there is no point in discussing targets below that mark. Experts expecting Bitcoin to surge to new highs could be in for a shock this year.

Secondly, there are still too many bullish articles on bitcoin; here is a small sampling of the articles published over the past four weeks

- Bitcoin price: Cryptocurrency to soar above $30,000 in 2018

- Bitcoin price to 'double' in 2018 cryptocurrency boom

- Struggling bitcoin will double by mid-year, Wall Street's Tom Lee says

- Bitcoin Will Stabilize, Hit $50K by 2019: Neu-Ner

- Cryptocurrencies Forecast to Resume Surge According to Expert

- Bitcoin Bull Tom Lee Goes Hyperbolic on Latest Price Forecast

- Bitcoin Price Will Double by End of 2018

- Bitcoin price 'to double' in 2018 – so what about Ethereum and Ripple

Third; the trend of lower highs shows no sign of abating. A series of lower highs is usually a bearish signal and signifies lower prices. The first positive sign would be for Bitcoin prices to surge above its downtrend line.

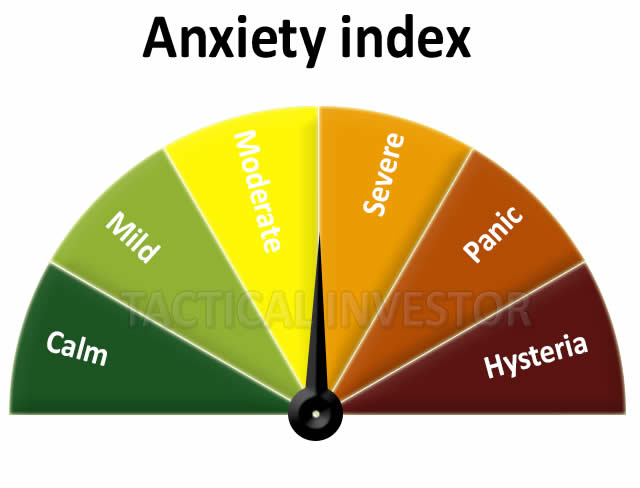

Lastly, if you look at the above image, you can see that the Bitcoin camp is still not in disarray. One of the things we pay very close to attention is investor sentiment, and until the Bitcoin camp is in gripped by hysteria, we feel that it’s unlikely to surge to new highs until this gauge is in the hysteria zone.

Conclusion

Bitcoin had a fantastic run; in fact, the run-up was so spectacular that it makes dot.com mania of the 90’s seem sane in comparison. Any market that has experienced such a spectacular run must also experience a back-breaking correction. While it appears that the drop from $20K to the $6600 ranges might qualify as backbreaking, one has to remember that Bitcoin surged over 11,000%, so the current pullback is only backbreaking for the latecomers. Usually, when a market experiences such a strong move, the 1st few breakout attempts tend to fail.

The prudent course of action would be to wait until there is a surge in the number of articles calling for the demise of Bitcoin and investor sentiment sours, before committing new capital.

Greed is a bottomless pit which exhausts the person in an endless effort to satisfy the need without ever reaching satisfaction. Erich Fromm

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2018 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.