More Stock Market Selling in the Offing?

Stock-Markets / Stock Markets 2018 Mar 04, 2018 - 02:52 PM GMTBy: Brad_Gudgeon

Last week, I wrote about the looming bull trap. On Feb 27th, the stock market topped and the SPX fell 142 points or about 5% in 3 days. My observation was based on time cycles, Elliott Wave and Mars conjunct Vesta. Most of the decline was blamed on the Trump announcement of tariffs on Aluminum and Steel, with fears igniting about a coming trade war.

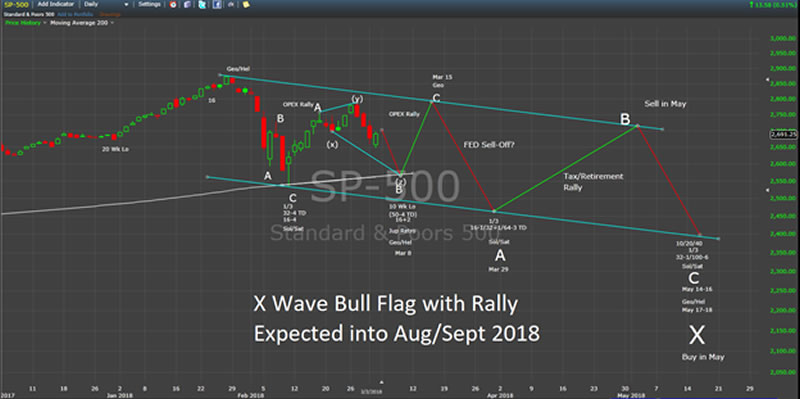

The astro trines I had mentioned did little to hold the market up under those conditions other than what appears to be a coming B Wave rally into early next week (followed by Wave C down). This suggests more selling ahead. The SPX chart below explains what I now expect given the new market information. My original expectation was to see new lows directly ahead. I now believe all we see would likely be a test of the 200 day moving average down near to 2565 by around March 8th or 9th and then a strong rally to new recovery highs above 2789 by March 15th or 16th.

The current count looks like an ABC X ABC type A Wave (a double three) move down into late March, with X expected near March Option Expiration. The 10/20/40 week low is not due until sometime in middle/late May. The trend is still down and wild up moves may still be expected out of exhausted selling. The May low (expected to be near 2400) should launch a new rally to above 2900 by sometime this summer, which should form a Y Wave double top and more severe selling (Wave Z) as we go into the fall and early winter of 2019. My best guess is we see a 20-25% bear market by then. This should end Wave 4 since 2009, with Wave 5 of V of (V) expected by early 2020.

Gold is doing better than the miners and I expect that trend to continue. I do see a nice low developing soon that should launch the miners up into March expiration, but it should be nothing more than a trading opportunity, IMO. Right now the trend in the precious metals (and especially the miners) is at best a sideways one with expected selling later in the year along with the stock market.

I know that a lot of commentators are bullish the precious metals market, but I am not one of those, at least not yet.

I am shorting any stock market strength in the next day (2703?) or two expecting another leg down into either Thursday or Friday. The mining shares look good for a short term move up into the middle of month, and I am just waiting for some weakness to develop into week’s end to go long NUGT.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look atwww.blustarmarkettimer.com

Copyright 2018, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.