US Goldilocks Economy is DEAD!

Economics / US Economy Feb 27, 2018 - 06:07 AM GMTBy: James_Quinn

“Once you strip out the effects of the debt binge, the artificial stimulus via currency depreciation, and the fabled ‘wealth effect’ from the equity market runup, real GDP growth stripped-down to its core was the grand total of 0.7% last year. Potemkin would be proud.” – David Rosenberg

“Once you strip out the effects of the debt binge, the artificial stimulus via currency depreciation, and the fabled ‘wealth effect’ from the equity market runup, real GDP growth stripped-down to its core was the grand total of 0.7% last year. Potemkin would be proud.” – David Rosenberg

appears every president finds the religion of false economic narrative once they ascend to power. Trump never stops babbling and tweeting about the fantastic economy and raging jobs market since his election. He has embraced the stock market bubble as proof of his brilliant leadership, rather than the tens of trillions in debt propping up the most overvalued market in world history. Every president takes credit for any good news, spins bad news as good news, or blames the previous president for bad news that can’t be denied. The president has absolutely zero impact on the economy or stock market over the short term. It’s like taking credit for the sun rising in the east each morning.

The Big Lie method works wonders when you have a willfully ignorant, mathematically challenged, easily manipulated populace. I spent the entire Obama presidency obliterating the fake economic data perpetuated by his BLS, BEA and every other government agency trying to paint a rosy economic picture. I voted for Trump because the thought of Crooked Hillary as the president made me ill. Despite disagreeing with many of his economic, budgetary, and military policies during his first year in office, I’d vote for him again over Hillary in an instant. The thought of having that evil shrew running the country gives me chills.

But that doesn’t mean I will stand idly by, cheerlead and ignore the facts to provide cover for Trump. I despise false narratives, whether they are spun by Democrats or Republicans. The Deep State still runs the show on a day to day basis, and it is in their best interest to mislead the public, keep them sedated, unaware of how bad things have become, and oblivious to the coming debt shitstorm destined to destroy this country. Every remedy prescribed by the Deep State players within the government, Federal Reserve, and Wall Street since 2008 not only did not cure the disease infecting this country, but exacerbated the disease and insured the inevitability of our demise.

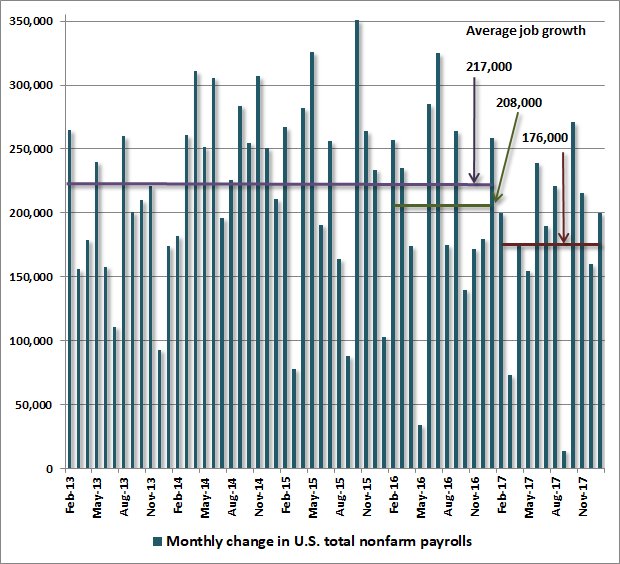

It is particularly irritating to hear Trump and his minions bloviating about the tremendous job growth since he was elected. U.S. job growth has averaged 176,000 jobs per month over the past year. That’s down from an average of 208,000 in the prior year, and 217,000 over the prior 4 years. But why let facts get in the way of a good story. The number of new jobs being added per month is on a declining slope. We are eight years into a fake recovery built on trillions in debt, with the ensuing bubbles in the stock market, bond market and real estate market. I don’t need politicians pissing down my back and telling me its raining.

The other false narrative flogged relentlessly by politicians, Wall Street shysters, CNBC bimbos, and a myriad of highly paid MSM talking heads is the record stock market highs are a reflection of a strong robust economy. What a load of crap. The stock market went up 360% over the last nine years as real wages stagnated and even the highly manipulated GDP barely grew at a 2% rate. The Dow hit a record 26,616 on January 26, proceeded to collapse by 2,800 points in less than two weeks, and has since soared by 1,700 points in the next two weeks. None of these moves had anything to do with the economy, corporate earnings or cash on the sidelines.

The stock market bubble has been driven solely by the Federal Reserve providing free money to Wall Street, with a guaranteed put by Bernanke and then Yellen. QE, ZIRP, and an unspoken agreement between the central bankers at the Fed, ECB, Bank of Japan and the Swiss National Bank to buy stocks has effectively elevated stocks around the world to absurd valuations. These highly educated intellectual-yet-idiots now cannot unwind their debt house of cards without blowing up the world financial system. With total public and private U.S. debt of $67 trillion and over $200 trillion of unfunded liabilities, this powder keg of debt awaits the inevitable spark.

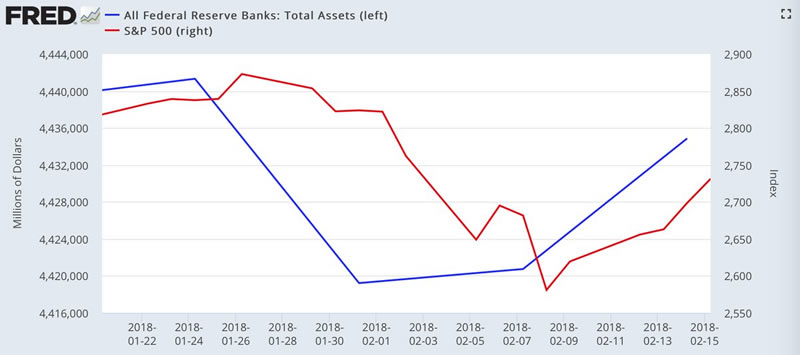

The Fed announced the unwinding of their $4.4 trillion balance sheet of dodgy mortgages, treasuries, and other Wall Street created dreck, many months ago. They had been all talk until the last week of January when they reduced their balance sheet by a measly .5%. Do you think it was just a coincidence the stock market imploded by 10% in an instant? Shockingly, the Fed increased their balance sheet by $15 billion over the next two weeks and the stock market rebounded dramatically. Weakening the dollar at the same time didn’t hurt either.

The other excuse for the stock market correction was the CPI hysterically coming in too high at 2.1% and resulting in the 10 year Treasury surpassing 2.9%. It is hysterical the government expects the plebs to believe health care costs are only rising by 2%, auto prices are falling, food prices are increasing less than 2%, and shelter expenses are only rising by 3%. Anyone living in the real world knows their living expenses are rising at an above 5% clip, while their wages are barely growing. It is absolutely essential for the Deep State to disguise the true level of inflation or panic and retribution would ensue.

Proof the fake employment numbers are nothing but a propaganda ruse can be seen in the real average hourly earnings chart. Real earnings have not budged in over two years when the economy was supposedly adding 200,000 jobs per month. And this is using the patently false CPI as the measure of inflation. In reality, real wages have been in steady decline since 1999. If millions of jobs have been added over the last two years, they must be the shittiest paying jobs possible to not budge wages up one iota. Fries with that Coke?

This is exactly what the Deep State controllers want. They don’t want real wages for real people in the real world to go up. The true purpose of the actions taken since 2008 has been to enrich Wall Street while impoverishing Main Street. Mission accomplished. Record corporate profits and stock market gains have not “trickled down” to the plebs. The over-class has reaped all the benefits. If they allowed real wages to increase by more than 2%, their low interest rate scheme would become untenable. Look what has happened when 10 Year Treasuries approached 3% – financial panic.

A critical thinking individual might ponder why a 3% interest rate would be fatal to the US economy if we truly have 4% unemployment, GDP is really growing at 3%, and consumer confidence is at all-time highs. In 2007 the 10 Year Treasury was 5% and savers could get a 5% in a money market account. Today, with the 10 Year around 2.85%, the average money market pays .12%. The Too Big To Trust Wall Street cabal reaped all the ZIRP benefits and continue to screw the little guy. While they borrowed from the Fed for free, they continued to charge 15% or higher on their credit cards to the ignorant indebted masses.

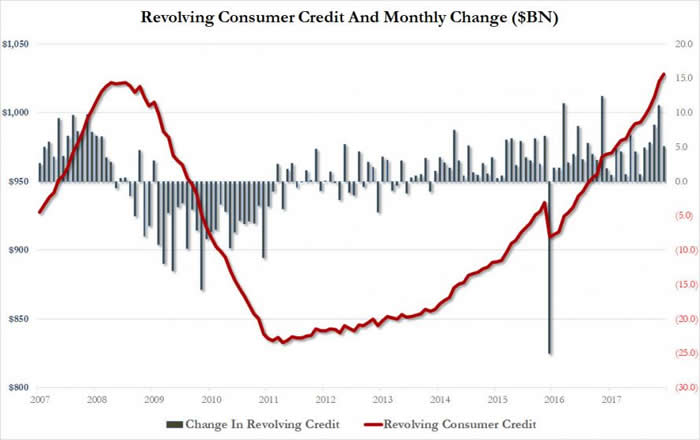

Let’s face the facts. Your overlords have doubled down on debt to keep this crumbling empire alive, so their looting and pillaging operation could continue. The fractional decline in debt during the 2008/2009 Fed created financial crisis virtually destroyed the global financial system. The solution to this debt problem has been to add tens of trillions in debt while artificially suppressing interest rates by rigging markets. The U.S. alone has added $13 trillion of debt since 2009 – a 25% increase in eight years. The corporate media and Wall Street cheer, as consumer debt surpassed its previous high and stands at over $13 trillion, with revolving credit card debt soaring.

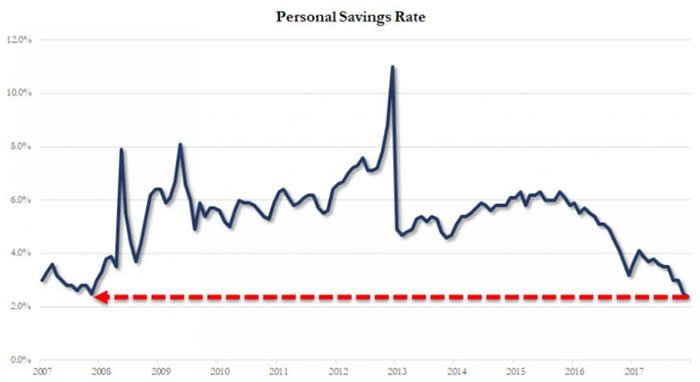

With only 4% unemployment and nothing but rosy economic indicators for as far as the eye can see, one might ask why revolving credit card debt is at all-time highs and the personal savings rate is at all-time lows. Are these two indicators a positive economic sign or a sign of desperation for the average working class family? If the bottom 80% have not had any real wage gains in over a decade, are paying through the nose for healthcare, rent, education, energy, and food, maybe their only choice is depleting their savings and surviving on their credit cards. Does that sound like a Goldilocks scenario for Main Street?

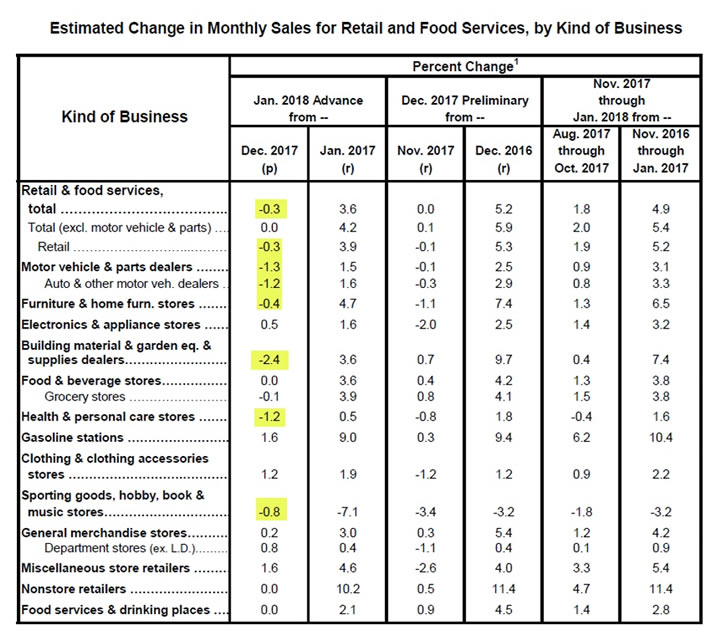

Do you remember the strident mainstream media narrative about the best holiday retail season in years? It seems the Big Lie narrative has been revealed to be false by actual data. Retail sales were flat in December and down substantially in January. The trend is down. Retail sales in the discretionary categories are negative. But at least gasoline sales are robust, due to soaring prices. The debt based auto sale (rental) scheme is unraveling as defaults soar among the millions of subprime borrowers comes home to roost. The average family is barely scrapping by and retail sales will continue to stagnate, while thousands more retail stores are shuttered. Ghost Malls R Us.

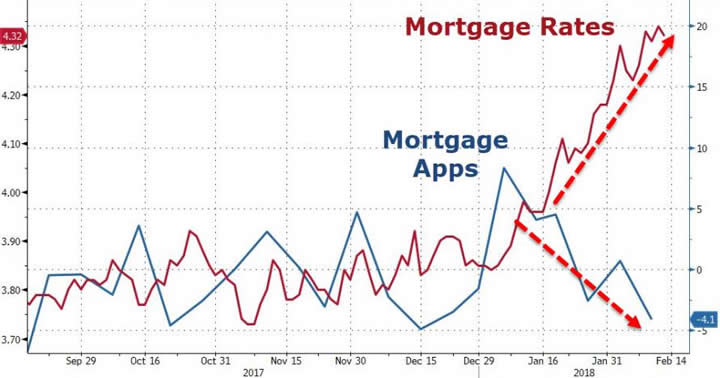

The precarious fragile nature of our entire debt dependent financial house of cards has been revealed by the reaction of the housing market to the slightest blip up in mortgage rates over the last two months. A lousy 37 basis point increase in mortgage rates resulted in mortgage applications plunging. And we all know what happened next.

Existing and new home sales both collapsed in a heap. We have home prices at all-time highs, exceeding 2005 bubble highs. We have heavily indebted millennials working shit service jobs who will never be able to afford to buy. We have a new tax law that no longer rewards home ownership. And now we have rising mortgage rates. Get ready for housing collapse part deux. Home prices are poised to fall by at least 30%, again. Thank you sir may I have another. I wonder how much of the $8.9 trillion of mortgage debt will be written off this time and passed to the taxpayers.

The Deep State overlords and their lackeys at the Federal Reserve hit the panic button after the 10% correction two weeks ago. The Fed increased their balance sheet, they’ve managed to push rates back below 2.85%, and they have drastically weakened the dollar to support their Wall Street masters. They can’t keep this up for long. The Fed committed to drastically reducing their balance sheet and weakening the dollar has had zero impact on our worsening trade deficit. Bug is approaching windshield.

Those controlling the strings behind the scenes might believe their brilliant maneuvering, devious schemes, and potent propaganda have successfully navigated the rock shoals of looming financial disaster, but their hubris will end up sinking the ship in the end. Any success they attribute to their intellectual capabilities can also be attributed to just plain dumb luck. The lethargic, plodding, boring economic recovery has been just right for Wall Street and the political class. Not too hot and not too cold. Just right to keep interest rates at emergency level lows while not resulting in workers actually getting wage increases which would create inflation.

It’s truly been a Goldilocks recovery for the stock owning .1%. But, as Ludwig von Mises noted many decades ago, the boom cannot continue indefinitely. Valuations are stretched to the breaking point. Those in power are unwilling or unable to voluntarily renounce further credit expansion. They have laced Goldilock’s porridge with arsenic and it is just a matter of time until she’s dead. A depression is in our future, no matter what actions are taken at this point. Keep calm and prepare yourself.

“The boom cannot continue indefinitely. There are two alternatives. Either the banks continue the credit expansion without restriction and thus cause constantly mounting price increases and an ever-growing orgy of speculation – which, as in all other cases of unlimited inflation, ends in a “crack-up boom” and in a collapse of the money and credit system. Or the banks stop before this point is reached, voluntarily renounce further credit expansion, and thus bring about the crisis. The depression follows in both instances.” – Ludwig von Mises

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2018 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.