Probable Stock Market Pop-n-Drop

Stock-Markets / Stock Markets 2018 Feb 26, 2018 - 03:54 PM GMT Good Morning!

Good Morning!

SPX futures are up enough to complete a fifth Wave of C. The 61.8% Fibonacci level and Intermediate-term resistance at 2754.93 are still key to this retracement, although the SPX may briefly go as high as 2763.59 in a pop-n-drop to clean out any short positions with stops. This market is being vicious to those who shorted late and making it difficult to keep their positons. It may be a good time to layer in any short positons you may wish to have.

The market especially “has it in” for Dennis Gartman who got stopped out this morning.

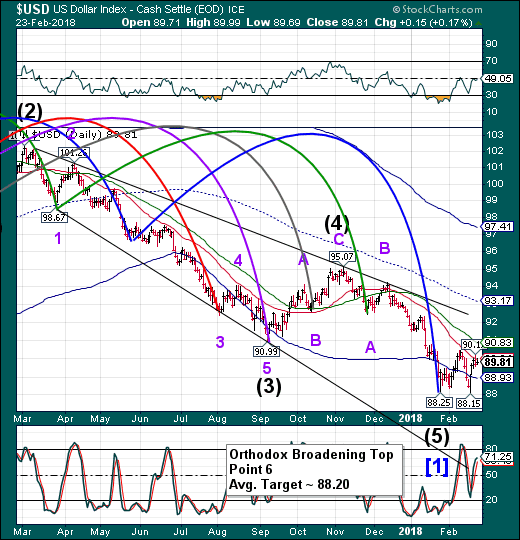

USD futures are down as much as 89.43 this morning. While this move is striking fear in the market, it may be merely testing the Cycle Bottom support at 88.93. Today may be a half-Trading Cycle low. According to the Cycles Model it should strengthen shortly and go as high as the Cycle Top at 97.41 over the next two weeks.

ZeroHedge comments, “Any hopes that the dollar may have halted its recent tumble have been, for now, dashed, when the greenback resumed its slide overnight, the DXY falling below 90 again and down for a third day against all G-10 peers ahead of Fed Chair Jerome Powell’s first Congressional testimony in which investors bet the new head of the Federal Reserve will steer a steady course on policy.”

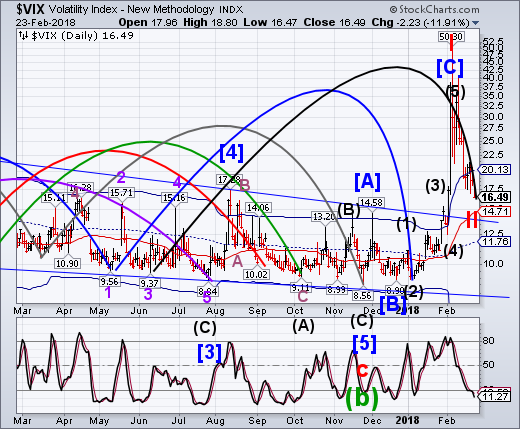

VIX futures are making new lows this morning, suggesting the Master Cycle low may be today (day 262) instead of Friday (day 259). We’ll know after the open. The decline may be short-lived, as it is now 4 days beyond the average length of a Master Cycle.

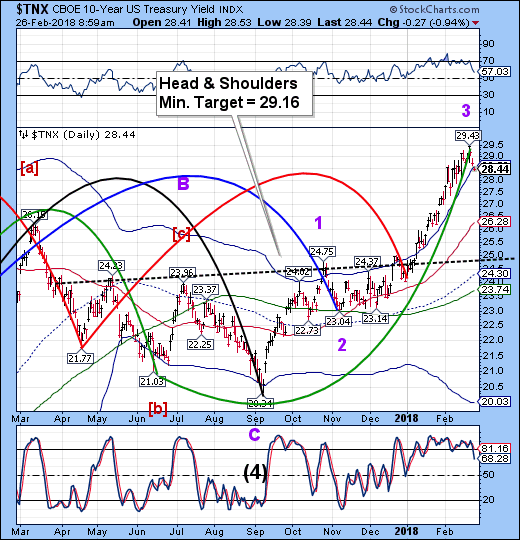

TNX has tumbled beneath its Cycle Top support/resistance line at 28.58, giving an aggressive sell on TNX and the first buy signal on UST since last July. Considering all the Treasury debt added last week, this move has significance. It may be the first sign that the smart money is moving out of equities and into treasuries as a safe haven.

Bloomberg observes, “Morgan Stanley says it’s time to get bullish on bonds -- even as Goldman Sachs Group Inc. and Warren Buffett issue warnings.

The sell-off in Treasuries, that began in earnest in September and ramped up in January, is ending, according to Morgan Stanley strategists. Not so for Goldman Sachs Group Inc., which is running its models through a scenario in which yields on 10-year notes hit 4.5 percent -- though it expects that number to be closer to 3.25 percent by the end of this year. Warren Buffett cautioned over the weekend that bonds can lift risk levels in portfolios as inflation eats away at returns.”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.