British Pound Slides Deeper Against US Dollar

Currencies / British Pound Sep 08, 2008 - 01:38 AM GMTBy: Regent_Markets

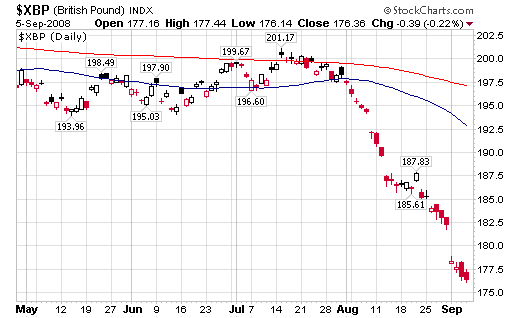

It was a good week for European equity markets with the FTSE100 finishing the week at 5636, its highest level for nearly two months. US markets didn’t have such a good time of it, with the Dow Jones and S&P500 finishing largely flat on the week and the Nasdaq closing well down after a sell off on Friday. There was better news for the Greenback though, as the Pound fell to its lowest level for two years against the US Dollar. Although the Dollar has undoubtedly been strong over the last month, last week’s move on Cable (USD/ GBP) was largely a factor of the weakening pound. It made a record weekly low against the Euro and fell to its lowest levels since spring against the Japanese Yen.

It was a good week for European equity markets with the FTSE100 finishing the week at 5636, its highest level for nearly two months. US markets didn’t have such a good time of it, with the Dow Jones and S&P500 finishing largely flat on the week and the Nasdaq closing well down after a sell off on Friday. There was better news for the Greenback though, as the Pound fell to its lowest level for two years against the US Dollar. Although the Dollar has undoubtedly been strong over the last month, last week’s move on Cable (USD/ GBP) was largely a factor of the weakening pound. It made a record weekly low against the Euro and fell to its lowest levels since spring against the Japanese Yen.

With stream of bad news coming last week, you didn’t need to look too hard for reasons why the Pound was taking such a beating. Fears of recession increased after a CBI report showed the weakest high street activity in 25 years. In addition, Nationwide housing figures showed that the current UK housing slump was the worst for nearly two decades. There was however, some relatively good news from house builder Taylor Wimpey. Despite the dramatic headlines about its write down in land value, Taylor Wimpey closed up on the week. The huge write down on the value of its land bank was largely expected for once.

The FTSE enjoyed a good week in spite of this data thanks to higher oil prices and improved sentiment in financials. This two sectors alone account for a large proportion of the UK’s benchmark index. Oil traders were on hurricane watch as tropical storm Gustav headed for Louisiana. WTI crude finished the week up around $3.00 as a consequence. US Monoline insurer MBIA indicated that it is continuing to win new business despite a reduced credit rating. MBIA’s strong numbers have helped push the financial sectors higher on both sides of the Atlantic, with Barclays and RBS both enjoying gains approaching 10% on the week.

Better than expected US GDP numbers also sparked a mini rally in the middle of last week. US GDP numbers came in well above estimates with a 3.3% annual rate of increase. In addition to this, jobless claims came in lower than expected. Although the GDP numbers implied a growing US economy, they also revealed a deeply divided one. On the one hand, exports are shooting up thanks to the weak Dollar, on the other hand consumer spending; the lifeblood of the US economy is still looking dire, once you strip out the effects of the stimulus package. Bush’s rescue plan and the Fed’s demolition of the Dollar may have stopped the overall economy going into recession, but it is still a close run thing. Next quarter there will be no tax breaks for US consumers and if oil continues to pull back, the Dollar is likely to rise further, thus hurting exports.

The S&P Case-Schiller house price index fell less than expected for the second quarter, but US house prices are still down 15.9% year on year. On a more positive note, housing futures based on the Case-Schiller index bottomed at the end of June, and have been rising since. Expectations are for lower levels still, but these levels are now thought to be better than those predicted a few months ago. However, it is too early to say for sure that this heralds the start of the start of the much vaunted turnaround in US house prices. Interest-rate futures are currently implying that banks are again becoming hesitant to lend to each other, on fears that credit losses will increase as the feared global recession kicks in. Increased lending rates will hardly be manna from heaven for home owners on either side of the Atlantic.

This week brings a whole raft of top tier economic announcements. Topping the bill on Thursday are the MPC and ECB interest rate announcements and accompanying statements. Both are widely expected to produce ‘no change’ verdicts, but as ever, it is the forward looking statements that will cause the most excitement. Sterling traders are speculating on a rate cut from the MPC before the year is out. On Friday, the week’s biggest announcement is the US Non Farm Payroll figures which will ensure the week doesn’t end quietly. Aside from this, this week brings UK manufacturing data on Monday and US Manufacturing data on Tuesday. On Wednesday we get UK PMI data. US markets are closed on Monday for Labor Day.

Traders ar BetOnMarkets predicts that next week’s data has the potential to make or break the tentative rally off the July lows. Analysis from Jason Goepfert of SentimenTrader, showed that the ISE sentiment index reached extreme levels of bullishness on a short term basis. This index has been a reasonable contrarian indicator over the last few years and with lots of potentially damaging data out next week, the risk is arguably to the downside. A No Touch Trade on the S&P 500 not to revisit the August highs of 1315 could return 62% over the next 16 days.

By Mike Wright

Tel: +448003762737

Email: editor@my.regentmarkets.com

Url: Betonmarkets.com & Betonmarkets.co.uk

About Regent Markets Group: Regent Markets is the world's leading fixed odds financial trading group. Through its main multi-awarding winning websites, BetOnMarkets.com and BetOnMarkets.co.uk, it has established itself as the leading global provider of a unique, powerful way to trade the world's major financial markets. The number, length and variety of trades available to our clients exists nowhere else in the world. editor@my.regentmarkets.com Tel (+44) 08000 326 279

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Regent Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.