Stock Market Volatility Attributed to 'Shenanigans'

Stock-Markets / Volatility Feb 24, 2018 - 01:26 PM GMTBy: The_Gold_Report

Technical expert Michael Ballanger explores the maneuvering he believes underlies current market fluctuations.

Technical expert Michael Ballanger explores the maneuvering he believes underlies current market fluctuations.

Back in January, I discussed the likelihood that global equity markets were approaching simultaneous tipping points beyond which legions upon legions of GenX-ers and Millennials would be thrown to the wolves by failing to recognize the financial mania engulfing them. I alluded to it being "Time for the Beast to Exhale," and within a few days, my volatility trade (UVXY) exploded to the upside as the "beast," better known as the global stock market ascent, finally exhaled and fell 3,300 Dow Jones points in a week.

I took a double-and-a-half profit on the UVXY and am now comfortably to the sidelines holding only a modest position in the JNUG, most of which I exited over a month ago when RSI readings exceeded 70. I am now long a very modest 20% position in JNUG from $13.35 and looking to add, while I am avoiding volatility and/or S&P shorts like the bubonic plague for one very simple reason—shenanigans.

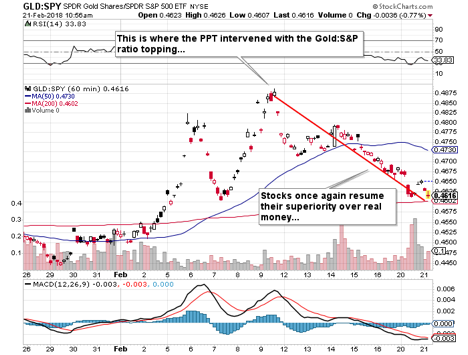

The term "shenanigans" is allegedly from the mid-nineteenth century, and while the Irish are generally credited with its origin, most web searches result in "origin unknown." However, two definitions that most tickle my fancy are as follows: "secret or dishonest activity or maneuvering," as in "the bullion banks control gold prices with sophisticated shenanigans"; and "silly or high-spirited behavior; mischief," as in "the shenanigans carried out by the Plunge Protection Team is a violation of the entire concept of free markets." Whatever the definition, there is absolutely no other rational explanation for the absurdity we just witnessed in the past couple of weeks. Total, unabashed, shameless shenanigans.

Shortly after New Year, I postulated that for a whole pile of reasons, stocks were ripe for a drop and quite possibly a big drop. Well, with fixed income yields soaring and the USD crashing, I had a sense that a granddaddy "bear" was about to arrive and devour everyone and everything in its path, leaving ravaged financial carcasses on the both sides of all roads leading to "financial freedom." And arrive he did, hungrier than ever from a long hibernation, and did indeed strike with unimaginable ferocity, until the park rangers of Wall Street showed up with a "tranquilizer bazooka" and subdued the gorging beast precisely at the 200-daily moving average (dma) for the S&P 500, around 2,539. And on that Friday, a cleverly orchestrated intervention by the price managers saved the markets from the dreaded "weekly breakdown." The sighs of relief from the CNBC anchors could be heard in Nome, Alaska, as plans for winter vacations were taken off hold and Maserati purchases were resumed, with nary a bead of sweat nor blink of an eye. While we have all seen this movie before, it was shenanigans, pure and simple.

At the same time that bitcoin and weed and lithium and zinc stocks were all finding their "buy the dip!" footings, gold and silver were doing everything in their power to behave in their rightful manner as safe havens. That is, until the same day the 200-dma for the S&P was protected. After trading north of $1,360 resistance on numerous occasions, the interventionalists finally forced gold to buckle on Tuesday, Feb. 20, with a $23 smash that ironically coincided with a 250-point drop in the Dow—proving once again that the inverse correlation of gold to stocks is quite easily negated through a liberal dose of shenanigans. "Secret or dishonest activity or maneuvering" . . . if it weren't so melodious it might be deemed humorous. But it's not funny.

So now that the stock roaches are back in control of the asylum, the S&P has clawed back approximately 57% of the 333 points it surrendered during the bear's brief foray from its cave. But I have the totally ad hoc sense that all Grampa Bear did two weeks ago was enjoy a shrimp cocktail and a few paté foie gras canapes, and that he remains in full anticipation of an Edwardian feast of the highest and most consumptive fashion. I see entire sectors of stocks being vaporized in the upcoming months, for all of the same reasons I suggested in mid-January that the "beast" had been holding its breath for too long.

We are now in a reflex rally off the sharp panic of two weeks ago. These of retest-of-the-highs rallies always set up the longer-term top, one where Grampa Bear arrives in ill humor but with renewed energy taken from the hors d'oeuvres of early February and ready to feast, in earnest.

You might wonder why I believe that the oncoming bear will shrug aside the shenanigans brought about by the interventionalists. Here is why:

If I were to recount the multitude of market corrections, crashes and bears that I have endured over forty some years of toil, I can safely say that there has never been a period when I have seen weakness in the U.S. dollar during a period of credit tightening or market turmoil. As the chart above depicts, the 10-year yield has advanced over 30% since last June, while the dollar has given up nearly 7.5%. The theory behind this is that money is drawn to where it is treated "the best," be it by way of conservative fiscal policies or by implied rate of return or both.

In countries where fiscal conservatism is a way of life (like the "old" Switzerland or the U.S. post-WWII), wealthy individuals salted their savings away in Swiss banks or U.S. Treasuries, knowing their money was safe from dramatic currency fiascos such as those that occurred in Weimar Germany, or Zimbabwe, or more recently, Venezuela. Raw demand for safe haven currency positions exerted upward pressure, and therein lies the thesis for historical favoritism toward the USD.

However, beginning in June 2017, a glaring divergence began, wherein the Fed's jawboning about higher interest rates actually manifested itself into actual reactions in the form of rising yields. Instead of capital flowing toward the USD, it actually began to flee it. What could be different today than in other eras and with other regimes? The answer is debt. The U.S. now has a sitting president that cares not about fiscal responsibility nor economic sanity; he will build the Wall, create jobs, fortify the military, solve poverty and unify the nation, all while balancing his budget by way of renewed growth. And all in the face of cuts in government revenue through passage of the recent tax bill.

The well-documented legacy issues surrounding debt ceiling, Social Security and Medicare have been well covered by the financial media, but are now real concerns, as those issues can no longer be talked over or explained away. The term "fiat" finds, at its core definition, the term "decree," meaning that the only reason a currency can be considered a unit of monetary exchange is that its issuer (government) deems it so as an edict or order. It would seem that when markets diverge from historical behaviors, a significant change is probably underway and therein lies my rationale for extreme caution. When the masses reject a "decree," there is trouble a-brewing. That, I believe, is where we are today.

I have been asked a great many times what event would need to transpire in order for gold to move through $5,000/ounce. I have long held that it is only when the USS Nimitz pulls into Gibraltar for a refit and they refuse the credit card. Think about it. The British pound was the world's dominant reserve currency as long as Britannia Ruled the Waves. But once the British were bailed out by the Allies (led by the massive American industrial war machine during WWII), the American currency took the throne of "reserve currency status," because the world currency owners finally recognized that the cost of maintaining the empire had bankrupted Britain.

Here we are a mere seventy-three years later, and the American Empire is now on the verge of that same insolvency-bred disintegration that arrives without notice but with swift precision. The great author Ernest Hemingway best described it when asked how he went bankrupt with the brilliant and very accurate retort: "Gradually, then suddenly."

So, as I try desperately to ascertain whether the volatility trade (UVXY) or the Gold Miners (JNUG/NUGT) could be reestablished with a reasonable prospect of renewed windfalls, I must confess that I currently possess a hard-to-describe sense of foreboding that we might be entering a period where liquidity demands circumvent the investment merits of any and all asset classes. I could liken it to opening a hatch in a space capsule while deep in outer space. The vacuum of space sucks everything from the capsule regardless of its weight or how it is attached. The vacuum of debt in today's world carries that same potential—to suck any and all liquidity from everywhere as demands for added collateral are issued to governments, corporations and private (leveraged) investors.

With the Fed minutes just out, stocks are screaming higher because the language sounded "dovish," with only 2.83 rates hikes being factored in versus the 4.0 hikes discussed last week. Nevertheless, litmus-test-reaction to this central bank mumbo-jumbo remains the USD index, which proceeded to drop like a rock, from 89.91 to 89.49 within seconds of the release. USD weakness is going to be a recurring theme in this publication because with imported goods more expensive, the deflationary effect of the "strong dollar policy" has been reversed.

Additionally, if higher rates cannot throw a bid into the USD, imagine what happens to King Dollar when the Fed panics because the S&P 500 finally breaks support. Just as we learned last week how gold stocks are more stocks than gold during a crisis, ownership of the physical metal is a far safer place to be than trying to avoid margin calls with your favorite gold producer in a careening stock market collapse. No matter how well run or how much gold they produce, they are getting thrown overboard along with Netflix, Google and Amazon.

Late on Wednesday, the Dow gave back over 465 points from the daily highs in what was a breathtaking reversal of fortune. Just as it appeared the Fed was going to ease up on the quantitative tightening campaign, bond yields suddenly spiked back to 2.95% from 2.88%, and the USD Index to 90.05 from 89.49, taking stocks, bonds and gold to session lows. This is the type of action that gives me that ad hoc premonition of impending doom, and why I am keeping my investment powder extremely dry and the urgency to trade very much in check.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.